US

- Big US banks got earnings off to a comfortable start.

Europe

- The European Central Bank cut interest rates again.

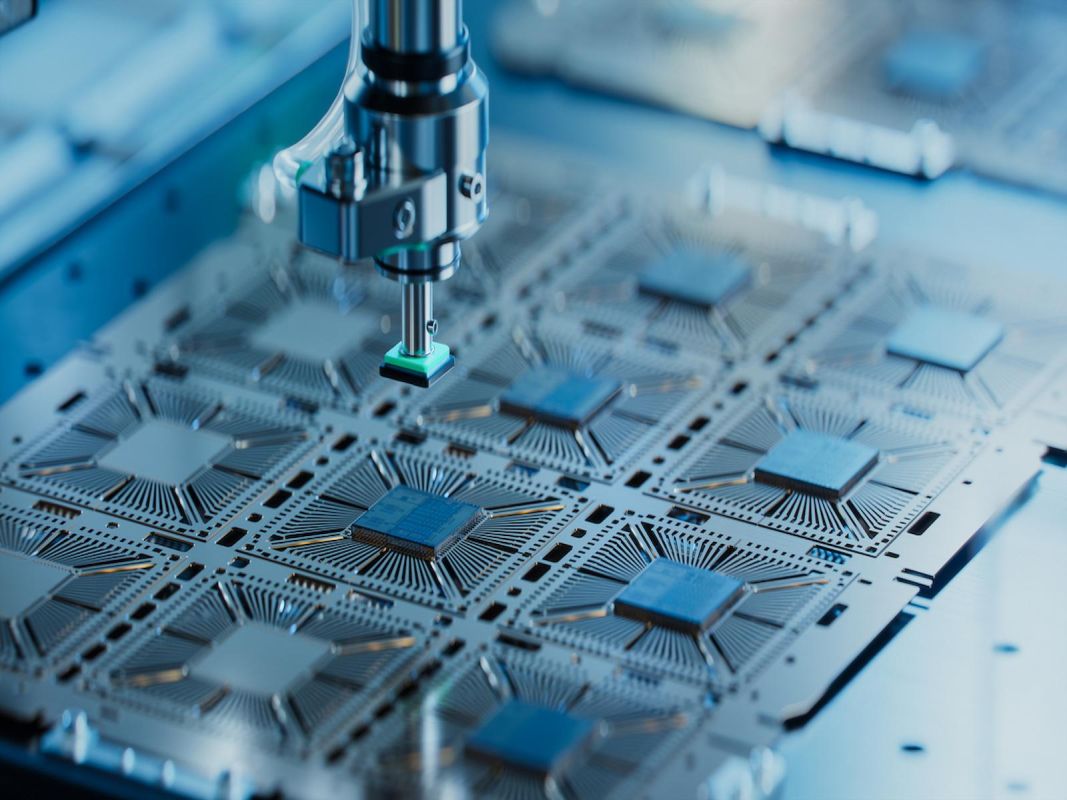

- ASML and LVMH sent shockwaves through markets.

Asia

- Chipmaker TSMC assured investors that AI demand is still booming.

UK

- Chinese online fashion retailer Shein has expanded its team of banks to help organise its potential initial public offering (IPO), which could value the company at £50 billion ($65 billion), and make it one of the largest listings in London in recent years.

- Wage growth in the UK slowed to its lowest level in over two years during the summer.

- UK gambling stocks took a hit after reports suggested the government is considering tax increases of up to £3 billion ($3.9 billion) on the industry.

- Inflation dropped sharply in September, with key indicators monitored by the Bank of England also falling, strengthening expectations for a potential interest rate cut in November.

- The UK government is considering a combination of tax increases and spending cuts totaling around £40 billion ($52 billion) to address the budget deficit.

- Sources indicate that Britain plans to raise capital gains tax on sales of shares and other assets in the October 30th budget statement.

Why it matters

US banks are on a … roll. JPMorgan, Morgan Stanley, Bank of America, and Citigroup kicked off earnings season with one expectation-beating result after another, thanks to some strong stock trading and dealmaking. Morgan Stanley’s wealth management arm continued crushing it. And although Citigroup and Bank of America both saw loan losses jump, it didn’t overshadow their profits.

The European Central Bank (ECB) lowered its key interest rate for a third time this year, as widely expected. The central bank is moving with purpose, aiming to support an economy flanked by troubles. Growth in the region has been subdued, and weaker consumer activity, a manufacturing slowdown in Germany, and government belt-tightening in France suggest it could worsen.

It was a rough week for big acronym companies in Europe: LVMH and ASML surprised markets with negative quarterly updates. The disappointment came as Chinese demand for both luxury goods and semiconductor production equipment slowed.

The news from ASML, Europe’s third-biggest stock, sent shockwaves through global chip shares as investors ratcheted down expectations for 2025. Meanwhile, LVMH, Europe’s number two stock, said Chinese consumers had switched from buying to window shopping, as the country’s economic slowdown continued to bite.

Confidence in AI demand remained buoyant as TSMC, the world’s biggest producer of advanced chips, announced third-quarter revenues and profit margins that beat estimates, and delivered an upward revision to its 2024 forecasts. It now predicts that sales will climb roughly 30% in US dollar terms this year, up from the previous projections in the mid-20% range. Its CEO, speaking to investors, said AI demand is only just beginning. Even ASML, after its bruising result, said AI remained a bright spot for its business. That helped send Nvidia’s stock to a record high.

UK inflation dropped sharply to 1.7% in September, the lowest since April 2021, raising hopes for a Bank of England interest rate cut in November. However, uncertainty persists as wage growth slowed to its weakest level in two years, and job vacancies hit their lowest point since 2021, signalling a cooling labour market that could dampen consumer demand and overall economic growth.

Despite these concerns, the slowdown in both inflation and wage growth strengthens the case for reducing interest rates, which could encourage investment. All eyes are now on the upcoming budget on October 30th, as the government seeks to address a £40 billion fiscal shortfall through a mix of tax hikes and spending cuts. Investors are closely watching how the budget will manage the need for public service investments while maintaining fiscal stability.

Meanwhile, Shein’s potential £50 billion IPO could provide a much-needed boost to London’s financial markets, which have been losing companies to the US. On the downside, potential tax hikes on industries like gambling are already having an impact, with shares in companies like Entain and Flutter Entertainment dropping sharply.

The government’s focus on taxation and spending cuts may hurt business confidence and stall growth in the short term, as industries such as gambling and tech prepare for possible regulatory changes and fiscal tightening.

Important Information

This publication has been produced with Finimize. As with all investing, your capital is at risk. Forecasts are never a perfect predictor of future performance, and are intended as an aid to decision- making, not as a guarantee. This publication does not contain and should not be taken as containing, investment advice, personal recommendation, or an offer of or solicitation to buy or sell any financial instruments. Prospective investors should seek independent financial, tax, legal and other advice before making an investment decision.

Your capital is at risk. If you choose to invest, the price and value of any investments and any income from them can fluctuate and may fall. So you may get back less than the amount you invested. Past performance is not a guide to future performance.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.