Analysts and investors are predicting big things from Nvidia’s third-quarter update on Wednesday: namely, a big jump in profits and $32.9 billion in revenue – almost double last year’s $18 billion. They know there are three big trends fueling Nvidia’s rise: surging demand for its AI-optimized chips, booming interest in its networking tech, and strong data centre sales growth.

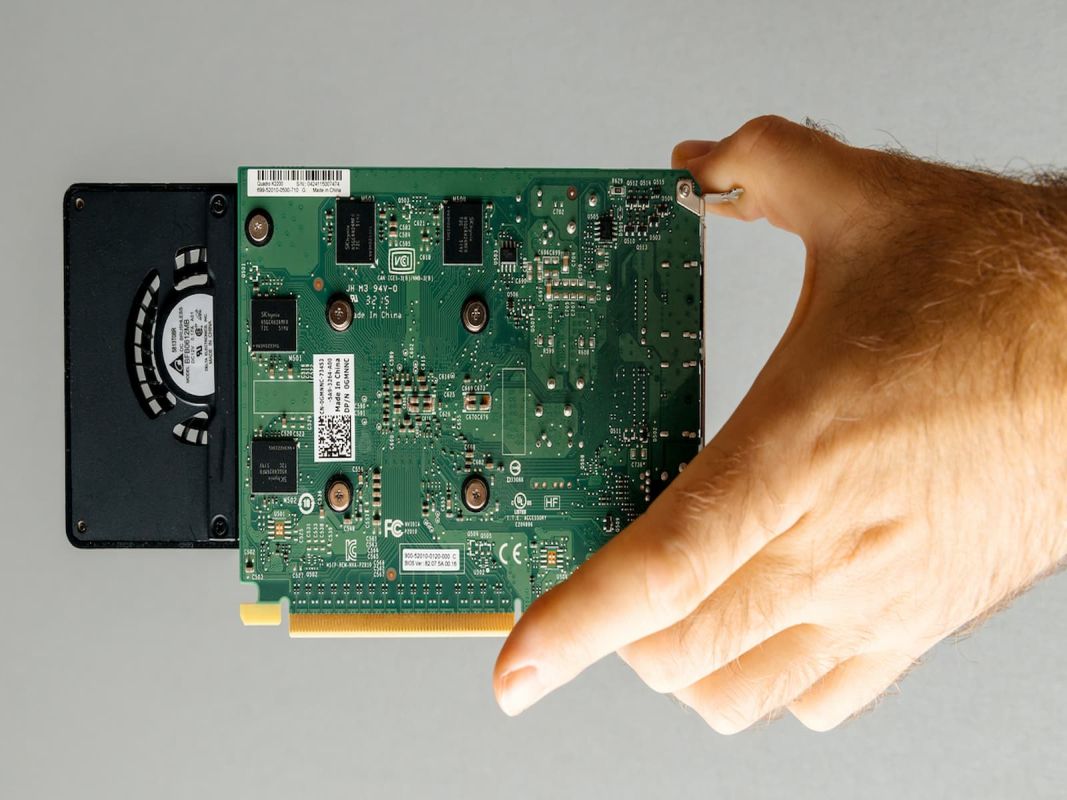

Nvidia’s cutting-edge graphic processing units (GPUs) are, after all, the backbone of the AI boom. Its top-of-the-line Hopper models – like the H100 and H200 – are engineered to handle the most advanced AI tasks, powering everything from chatbots to image generators. They process massive data loads in record time and keep AI applications running smoothly, so it’s no surprise demand is off the charts as more and more industries look to bring the technology under their own roofs.

Meanwhile, Nvidia’s Spectrum-X networking tech – which connects GPUs in data centres – powers lightning-fast data transfers and helps companies make their AI infrastructure faster and more efficient. This technology is in high demand, especially as cloud giants like Amazon, Google, and Microsoft pour their considerable resources into data centres that can handle their heavy processing needs. It’s no wonder Nvidia’s data centre business is making it rain too.

That said, Nvidia’s got its challenges. Supply chain issues leave the chipmaker struggling to keep up with demand, and the ramp-up of Blackwell – Nvidia’s next-gen GPUs – could squeeze margins in the coming quarters, with its steep production costs.

And it’s worth bearing in mind that Nvidia’s stock trades at around 35x its expected 2024 earnings, and potentially above 50x its 2025 earnings. That means there’s not much margin of safety if things don’t quite measure up. Nvidia may continue to exceed expectations, but the stakes remain significant. Any indication of slowing demand could lead to a market adjustment, unsettle some investors, and put pressure on the share price. A case of high reward, high risk.

On the calendar

- Monday: Nothing major.

- Tuesday: Canada inflation (October). Earnings: Walmart, Medtronic, XPeng.

- Wednesday: UK inflation (October). Earnings: Nvidia, NIO, Palo Alto Networks, Snowflake.

- Thursday: Eurozone consumer confidence (November). Earnings: Baidu, Deere, Intuit.

- Friday: Japan inflation (October), UK retail sales (October), eurozone PMIs (November), US PMIs (November), US consumer sentiment (November).

What you might’ve missed last week

Global

- Bitcoin’s latest rally pushed it above the $90,000 mark for the first time ever.

US

- Consumer prices rose at a modestly faster pace in October.

Europe

- European stocks lagged behind US ones by the most since 1995.

UK

- House prices surged in October, marking the fastest increase in more than two years.

- British wage growth, excluding bonuses, fell in the third quarter to its lowest level in over two years.

- The government is exploring a plan to consolidate certain pension funds, aiming to boost cost-efficiency and scale to support major projects.

- Energy regulator Ofgem has approved five new subsea power connections linking Great Britain to the European continent and Ireland.

- AstraZeneca is shifting its focus toward the US for growth as its once rapidly expanding business in China faces mounting challenges.

Why it matters

Bitcoin has rocketed more than 30% since the US election, smashing through the $90,000 barrier for the first time last week. A mix of factors is fueling the frenzy. For starters, traders have been betting on pro-crypto changes from the incoming US administration, which has floated ideas like a national bitcoin reserve and looser regulations. Plus, there’s been increased buying from big institutional investors, with some viewing bitcoin as a hedge against inflation and fluctuations in traditional currencies. And then there’s good old FOMO playing a role. But don’t be afraid to be sceptical: DOGE tripled in value after Elon Musk was tapped to lead the “Department Of Government Efficiency” (yes, that’s DOGE), and that suggests hype might be playing more than just a minor role.

US consumer prices rose by 2.6% in October compared to the same time last year – up from 2.4% in September. And the so-called core measure, which excludes the cost of more volatile things like food and energy, held steady at 3.3%. The numbers were still well higher than the Federal Reserve’s 2% target, and already some investors are on edge about what the president-elect’s proposed tariffs and growth-focused policies might mean for the future of inflation. If nothing else, it’s a reminder that the “last mile” in this inflation battle may be tricky

US stocks hit a new milestone, outperforming their European counterparts by a wider-than-ever margin. Specifically, the S&P 500 was up 25% so far this year, compared to the 5% climb seen in Europe. This widening gap comes as Europe’s economy faces challenges, with the prospect of new tariffs and trade tensions adding to the uncertainty. Still, investors are now paying a record 70% valuation premium for US stocks over European ones, with some of them betting on a raft of new market-friendly policies to come. It’s worth keeping in mind though that markets have a habit of surprising folks, and high expectations don’t always match reality.

October saw British house prices rising at their fastest pace in over two years, driven by pre-budget optimism. However, analysts anticipate a slowdown due to slower interest rate cuts and higher inflation from recent government policies. Simultaneously, wage growth, excluding bonuses, has slowed, vindicating the Bank of England’s recent decision to lower interest rates.

To fuel domestic investment, the government announced plans to consolidate various pension schemes into “megafunds” to unlock substantial capital for national infrastructure projects. This reform aims to channel up to £80 billion into UK assets, emulating successful models from Canada and Australia. However, experts caution that over-consolidation might stifle innovation and competition in the pension sector.

Ofgem, the UK’s energy regulator, approved five new subsea power links to Europe and Ireland, aiming to capitalize on the UK’s growing wind capacity. These interconnections are intended to position the UK as a net electricity exporter by 2030, providing grid flexibility and reducing reliance on volatile gas markets.

In the private sector, AstraZeneca is pivoting its growth strategy towards the US, where it anticipates policy-driven economic expansion and substantial investments in research and development. The shift is partly due to regulatory issues and compliance challenges in China, which have dampened its previously robust growth there. While AstraZeneca faces hurdles in China, it remains optimistic about achieving $80 billion in sales by 2030.

Important Information

This publication has been produced with Finimize. As with all investing, your capital is at risk. Forecasts are never a perfect predictor of future performance, and are intended as an aid to decision- making, not as a guarantee. This publication does not contain and should not be taken as containing, investment advice, personal recommendation, or an offer of or solicitation to buy or sell any financial instruments. Prospective investors should seek independent financial, tax, legal and other advice before making an investment decision.

Your capital is at risk. If you choose to invest, the price and value of any investments and any income from them can fluctuate and may fall. So you may get back less than the amount you invested. Past performance is not a guide to future performance.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.