As we head into the second round of the French parliamentary elections, a market consensus seems to be coalescing.

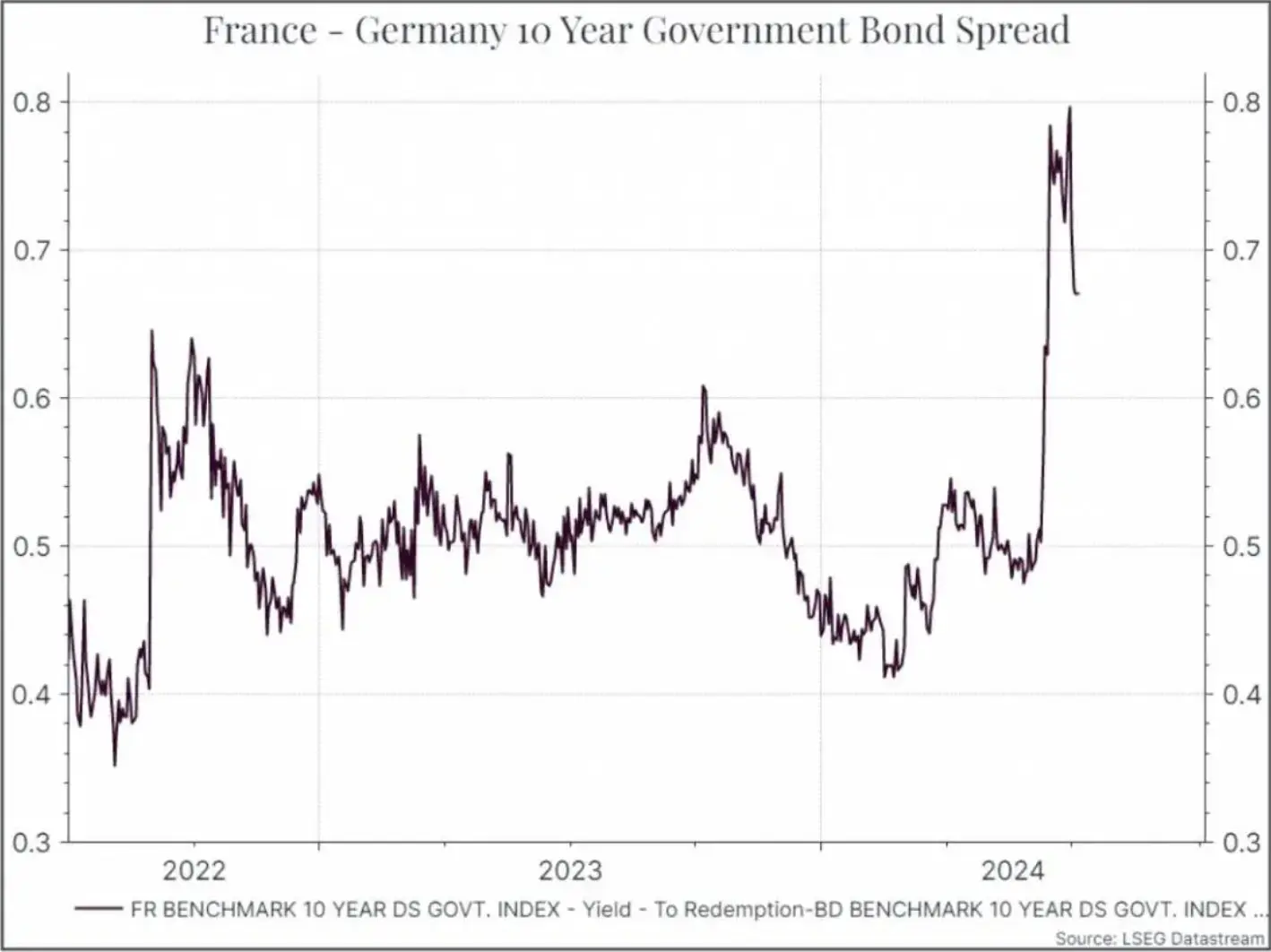

The base case runs something like this. The probability of a far-right National Rally (Rassemblement National) majority seems to have fallen – not least because we have seen other parties try to consolidate the opposition against the RN. The market has taken that news positively, reflected by a drop in the spread between French and German government bonds over the past few days (see chart below). If that’s how the election pans out, then we could see a bit more relief in European markets.

But, at the same time, the medium-term outlook remains cloudy. The RN will likely be the largest party in parliament, even if it doesn’t form a government. That suggests that we won’t see much progress in addressing the French budget deficit. Both the far-left and far-right parties gained a lot of support, with manifestos that would increase the budget deficit. Investors will keep in mind the Presidential elections in 2027. We think that could keep the spread between French and German government bond yields at a higher level than before the election was announced.

In terms of alternative scenarios, if we did see the RN win an absolute majority, we’d expect that to be taken negatively by investors, with French government bonds likely selling off. In that case, we’d expect to see French equities underperforming at least in the short-term even if the largest French companies are quite globally diversified.

So, we think the most likely scenario is some sort of anti-RN coalition – and we think that would be enough to calm investors for now. But even in that scenario, France’s fiscal challenges won’t disappear and the political balance looks quite fragile.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.