2019/20 ISA allowance

ISAs are a simple way to grow your money tax-free, but it’s important you know the basics to ensure you can maximise your returns. The ISA allowance is the maximum amount you can save or invest tax-free in an ISA during one tax year.

When it comes to investing in your ISA you have two options: use it or lose it. If you don’t invest as much of your £20,000 ISA allowance as you can before the new tax year on 6 April 2019, you’ll lose any unused allowance. This can make a real difference over the long-term.

How much can you save in an ISA?

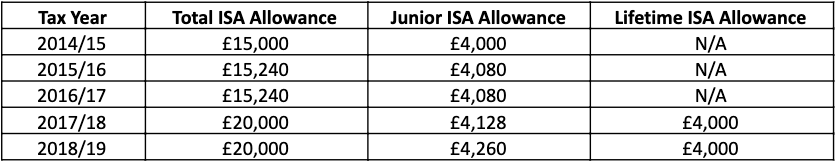

The ISA allowance increased to £20,000 in 2017 from £15,240, and will remain at this level in the 2019/20 financial year.

You can spread your ISA allowance between different types of ISA, so it’s worth checking how many ISAs you can have. You can split your annual allowance between Cash and Stocks and Shares ISAs as you like, however, there are limits on how much of your £20,000 allowance you can deposit in Junior ISAs and Lifetime ISAs:

- The 2019/20 Junior ISA allowance is £4,368

- The 2019/20 Lifetime ISA allowance is £4,000 (this is seen as a portion of your £20,000 ISA limit).

Although the total ISA allowance of £20,000 and the Lifetime ISA allowance of £4,000 have stayed the same this year, the 2019 Junior ISA allowance was increased in line with inflation.

Here’s how the ISA allowance has changed over the past five years:

ISA allowance reset

At the beginning of each tax year, the ISA allowance resets. This means that unused allowance doesn’t roll over into the following year.

The tax year runs from 6 April to 5 April the following year. To be counted in the ISA allowance of a tax year, money must be transferred to your ISAs by midnight on 5 April.

2016 ISA changes

Significant changes to ISAs were introduced in 2016 in a bid to help savers during a period of very low interest rates, and to make ISAs more flexible.

The new ISA rules of 2016 included:

- An increase in the total ISA allowance of over 30% from £15,240 to £20,000, applicable from April 2017.

- Introduction of the Innovative Finance ISA, available from April 2016.

- Introduction of the Lifetime ISA, available from April 2017.

- Ability to withdraw and replace money from an ISA within the same tax year without these transactions counting towards the annual ISA allowance.

These changes have been positive, with an estimated 95% of savers not paying tax on their savings income.

However, this masks a decline in the number of British adults using a portion of their ISA allowance in the 2017/18 financial year, from 11.1 million to 10.8 million, according to the Individual Savings Account Statistics released by the government.

Whilst the number of cash ISAs fell by nearly 700,000, the number of Brits investing in a stocks and shares ISA rose by nearly a quarter of a million (246,000). This meant cash ISAs made up 72% of all ISA subscriptions in 2017/18, down from 77%.

Over £69 billion was saved and invested in adult ISAs in 2017/18 with the £7.8 billion increase being driven by an increase in popularity of the stocks and shares ISA. The average person invested £6,409 of their £20,000 ISA allowance, the government figures show.

Types of ISA

With any ISA, you won’t pay tax on interest earned on cash, or on income and capital gains from investments. A simple and tax-efficient way of investing is with a Stocks and Shares ISA.

Each type of ISA meets different investment needs, so whether you’re saving for the short-term, long-term or for a specific goal, like buying your first home, there’s an ISA to suit you.

Stocks and Shares ISA

If you’re looking for a simple, tax-efficient way to grow your money on the financial markets, a stocks and shares ISA is probably for you. A stocks and shares ISA allows you to invest your money through the ISA wrapper, shielding any returns from tax. Making the most of your annual allowance each year can help you maximise your returns over the long run.

Investing is a popular way to offset the impact of inflation on your money and grow your money over time. You can invest in shares, bonds, funds and other investments through your ISA wrapper.

A Stocks and Shares ISA is generally considered a long-term saving option, and as with any investment, there is risk involved.

Cash ISA

A Cash ISA is like an ordinary savings account, without the tax. There are different Cash ISAs to meet different needs, such as instant access and fixed interest rate. You can open a cash ISA with most high street banks and building societies, but you’re only allowed to put money in one cash ISA each year.

Although cash has traditionally been viewed as a ‘safe’ place to keep your money, the low returns available on easy access cash ISAs mean your money is probably losing value to inflation rather than growing for your future.

This is why more Brits are looking to the financial markets to protect their money from inflation and grow it for the future. However, if you have a short-term horizon or want to take on less risk, this may be the most appropriate for you.

Junior ISA

Parents or guardians can manage a Junior ISA on behalf of their child if they are under 16. Once aged 16, a child can take control of the account or open a Junior ISA themselves. The money always belongs to the child and cannot be withdrawn until they are 18 years old. Junior ISAs are available as cash or stocks and shares variants, and money can be saved in one or both types of account.

Innovative Finance ISA

The money you save is used to fund peer-to-peer lending, corporate loans or crowdfunding. Savings are spread between multiple loans, but as there is always a chance a borrower won’t repay a loan, there is risk.

Lifetime ISA

You can benefit from a government top-up of 25% of your contributions, in addition to any interest earned. A Lifetime ISA can hold cash, stocks and shares or both. A Lifetime ISA must be opened before your 40th birthday and you can only contribute to it until you turn 50. Money can only be withdrawn when you’re buying your first home, when you are aged 60 or over, or if you become terminally ill.

Help to Buy ISA

Suitable for first-time property buyers, savings must be used towards the purchase of a first home. When you are ready to buy your first house, the government tops up your contributions by 25%. Your solicitor or conveyancer must apply for this bonus straight after your offer on a property is accepted. The Help to Buy ISA is available until 30th November 2019, and the government bonus must be claimed by 1st December 2030. The Help to Buy ISA is a special type of Cash ISA, so you can’t contribute to another Cash ISA in the same tax year.