One of Moneyfarm’s key principles is to avoid market timing. This is also the approach we recommend to our clients as the main path to success in their investment journey.

What is market timing?

Market timing is an investment strategy that aims to buy and sell securities to maximise returns. In practice, it involves trying to buy when stock prices are rising and sell when stock prices are falling. However, market timing is not always a wise investment choice. Keeping too much cash in a current account, stopping regular contributions to investments during difficult periods, or disinvesting during a negative market phase are all unconscious forms of market timing (and even less controllable).

Why is it not a good idea?

The main problem with market timing is that it is extremely difficult to execute consistently. This is especially true for more extreme market tactics, such as moving most of your investment assets into cash to avoid a bear market or another significant market correction.

To successfully time the market, you have to be right twice. First, you need to choose the best time to divest, and second, you have to identify the optimal time to re-enter the market. The issue is that an error in timing entry and exit points can be very costly for investors. This is because the best market days often occur during the most challenging downturns, and missing even a single day can have dramatic consequences for long-term capital value.

The cost of market timing

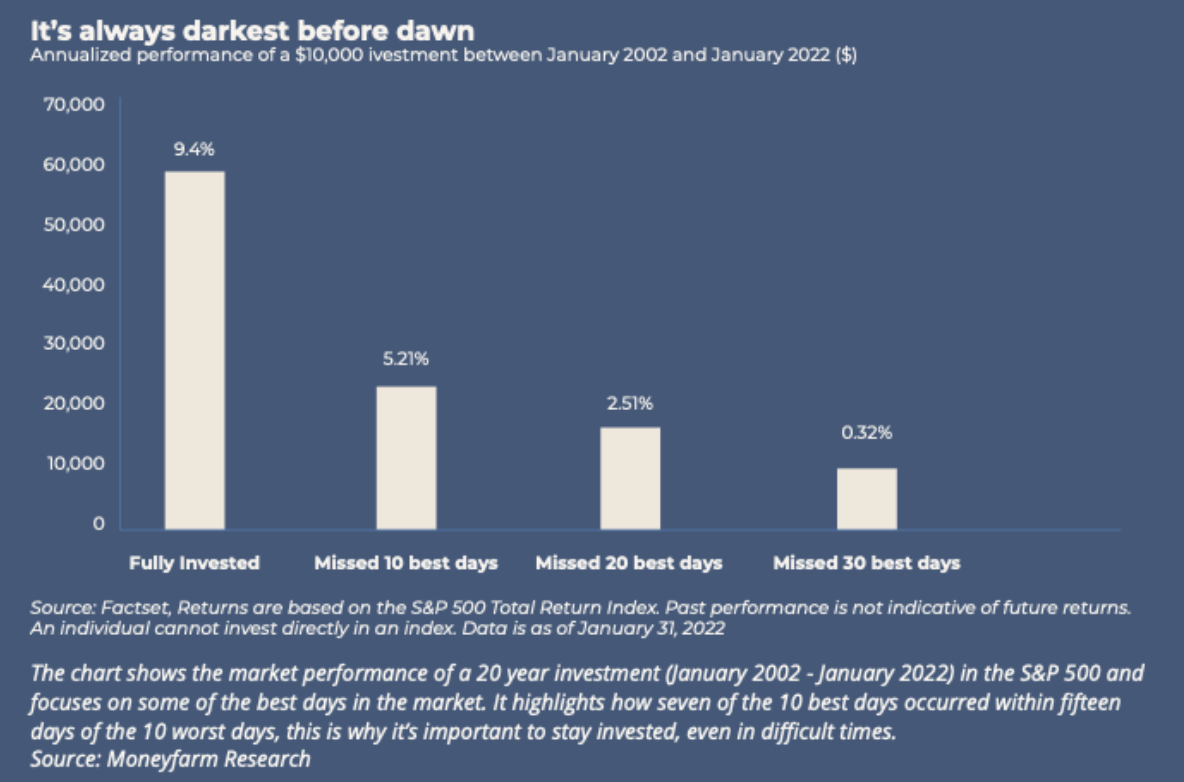

Numerous studies have demonstrated that time in the market beats timing the market. For example, a recent study concluded that even missing just a handful of the best market days can significantly reduce an investor’s average returns over time.

The chart below shows the 10-year performance of the S&P 500 stock index as of January 31, 2022. As you can see, the index had an average annual performance of 9.4%, which is quite attractive.

But what would happen if you missed the 10 best days within those 10 years? The annual performance would drop to 5.21%. This means losing 4% of performance over 10 years. And what if you missed the best 30 market days in 10 years? The performance would decline to 0.32%. This would mean sacrificing approximately 9% of performance per year for over 10 years. This is the risk of market timing.

Many of the best days for investors occur during market downturns or recessions, while some of the worst days happen during bull markets. The 10 best trading days in the last 30 years occurred during a recession, and five of them happened during a bear market.

Staying invested over time, with proper caution and professional risk management, is the best way to ensure success for investors. We are aware of the difficulties in predicting short-term market dynamics, which is why we construct portfolios based on medium and long-term forecasts, which are usually more reliable. Through our advisors, we encourage investors to remain invested in the market even during volatile phases, prioritising the goal of long-term growth.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.