‘Volatility’ has, recently, become an increasingly popular term within the sphere of financial markets. Although it might be considered one of the core concepts of not only investing but finance more broadly, its implications and effects are often misunderstood, causing unnecessary economic damage.

For this reason, here we will break down the meaning of volatility and attempt to explain what its main implications are for investors.

What is volatility?

A good starting point is probably its definition.

‘Market volatility’ signals the extent to which the value of an asset can change over time. High volatility means the price of an asset is likely to change dramatically over a short period of time, whereas low volatility indicates that an asset’s price will be relatively stable.

Calculated in percentage points, volatility can be measured either through standard deviation, or by comparing the volatility of an asset’s returns against its relevant benchmark (beta).

Standard deviation is calculated by working out the square root of the difference between an asset’s price and its mean value. The higher the standard deviation, the more volatile the stock.

Does volatility measure risk?

Essentially, volatility indicates the level of risk associated with the value of an asset – the higher the volatility the more likely its value will fluctuate in either direction.

Volatility is often laden with negative connotations, often leading investors to panic-sell their stocks. This, however, all-too-often leads them to sell their assets at a lower price than they initially paid. For this reason, it is important to be aware of the potential losses associated with this kind of knee-jerk reaction, such as diminishing your return potential.

For example, if you’re looking for big returns, you will want to be exposed to volatility, as prices fluctuate in both negative and positive directions. One of the key things for investors to understand is that volatility includes positive swings and by no means negative by definition. However, you will need a long-term time horizon to ride out any short-term losses.

We know that not everyone has the time or the temperament to see their investments rise and fall, which is why it’s important you understand your risk tolerance before you start investing. You can learn about your unique investor profile here.

How can you limit the effects of volatility?

To ensure your portfolio has been built with the right level of volatility exposure to help you achieve your goals, you should take time to outline your financial objectives and time horizon before you start investing.

Although some people try to time the markets, it is a difficult thing to do and often leads to poor results. We believe that adopting a long-term strategy can help you achieve your financial goals by tailoring your portfolio around medium to long-term economic trends.

You can also manage volatility risk through a well-diversified portfolio. By balancing volatile assets with those that have more stable pricing, you’re likely to smooth out any fluctuations in returns.

Ultimately, volatility is neither wholly positive nor wholly negative. By understanding your financial needs, volatility can be sensibly used to reach your financial goals.

At Moneyfarm, we take the time to understand your investor profile and carefully match you with an appropriate investment portfolio that can help you achieve your long-term goals.

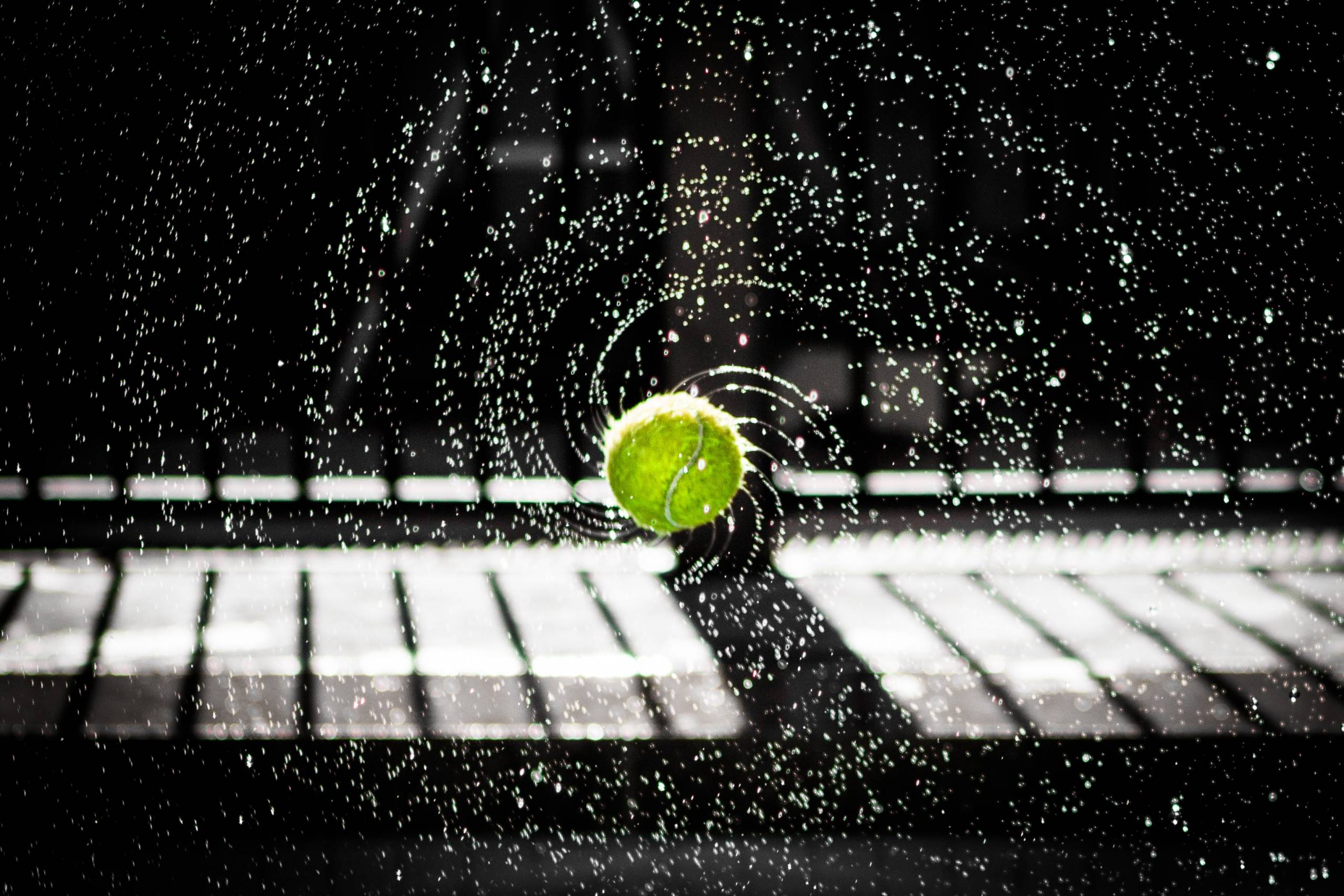

Photo by Josh Calabrese on Unsplash