For most of 2020, interest rates have been at a real low. The impact of Covid-19 on the economy has been considerable, prompting the Bank of England to lower the base rate to 0.1%.

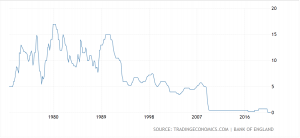

In the 10 or 15 years before the 2008 financial crisis, interest rates were hovering between 4% and 8%, a healthy return on savings sat in extremely low-risk accounts. Since 2008, rates have not once risen above 1%. If you look back even further, as you see in the graph below, the Bank of England’s rate used to fluctuate a lot, only to settle into a low-interest trough since 2008.

The point is, the interest rates that savers are getting from banks are low. At a 0.1% interest rate, you’d have to have £1000 in an account to make £10 over the year. With the inflation rate not far off the rate of interest, money sitting in savings accounts is not, in real terms, growing over time.

Cash has, traditionally, been viewed as a safe bet for preserving wealth. For a long time, it was. Only the specific circumstances of the recent economic moment mean that cash is no longer viable over the long term as a savings tool. This summer, we took a deep dive into the viability of cash and explained why many people are sitting on too much of it.

Best cash ISA rates

Despite the Bank of England’s base rate, you can find a return on an easy access cash ISA of around 0.65%, according to data from Money Saving Expert. Though this may seem like you’re beating the average, this is still lower than the rate of inflation.

Many savers like to keep their savings flexible in case of an emergency. Rainy day funds have only become more popular in the wake of the Covid-19 pandemic and this is a trend we see continuing as the economy recovers. If you’re willing to lock your money up for a minimum of five years and have at least £2,000, say, you can find returns that stretch to 1.4%.

Ultimately, cash ISAs are fine for holding onto wealth if you are sure you won’t need to access that wealth for a number of years. If you want a more flexible approach to your savings, though, you might choose an easy access ISA, in which case you’ll see the purchasing value of that cash dropping over time.

Best inflation-beating ISAs

So, you want to save money but you also want that money to outperform inflation. You’re not alone – savers have been turning to financial markets in an attempt to protect and grow their wealth over the long term.

If done right, investing gives savers the opportunity to outperform inflation on their own terms, while still maintaining access to the cash if that rainy day were to come. Investing in a stocks and shares ISA is, we believe, currently the most effective way to protect and grow your wealth without locking it away for decades.

Before you start investing, it’s important that you’ve cleared any expensive debt and have saved around three months’ worth of outgoings to protect you in the event of a crisis. After all, you never know when the boiler is going to break down in the middle of winter.

Can you move your ISA?

For anyone reading this with money sitting in a cash ISA or a savings account, the good news is that switching is incredibly straightforward. In a time when making smart decisions with your money is so important, it’s vital that people know their money is in the best position possible to see returns.

Whether it’s a lack of consistent returns, sky-high fees or you just want your money to start working more for you, transferring an ISA to another provider is surprisingly easy. To switch to Moneyfarm, for example, all you need to do is fill out a form and send it back to us. We’ll do the rest and we will never charge you a penny for switching a cash ISA over to us. You can transfer stocks and shares ISAs just as easily too.

In just a few minutes, you can find the risk level appropriate for you and build a balanced, diversified stocks and shares portfolio for effective long-term saving. Our team of qualified investment advisers is on hand to help you through the process, too.

Are withdrawals from an ISA taxed?

The short answer to this question is no. Every tax year, the allowance for tax-free earnings on an ISA is £20,000. You can deposit up to this amount across the tax year and any profits from it are free from tax.

With cash and stocks and shares ISAs, you can withdraw money at any time, without losing any of the tax benefits. It’s worth checking your provider to ensure there are no fees for taking withdrawals – with Moneyfarm, there is never a charge.

If you have a flexible ISA, you can withdraw money and put it back in during the same tax year, without reducing your year’s allowance. There are options for anyone looking to save more than £20,000 a year but, if you plan on investing under that amount, you have nothing to worry about.

How to form your investment strategy

All investment carries risk – it’s how you manage this risk that matters. What works for your friends might not be appropriate for you and your particular financial goals. Your investments should reflect what you’re saving for, when you’ll want your money and your financial situation.

Understanding your investor profile and tailoring your portfolio to your tolerance to risk is one of the first steps to achieving your financial goals – it’s the DNA of your investment strategy.

However, the hard work doesn’t stop there. As the markets move, so will the appearance of your portfolio. It’s important you recognise these changes and adjust them back in line with your investor profile.

It’s important you don’t pile all your money into one investment – it’s a risky game to play that rarely pays off. Instead, manage the risk in your portfolio by spreading your money across investments, asset classes and geographies. Any losses should be offset by gains made elsewhere in your portfolio.

Diversification takes time, skill and knowledge to get right – not to mention the extra capital to trade yourself. That’s why many investors prefer experts to do it for them. These funds can come with hefty price tags, however, which can eat into your return and delay you from achieving your goals.

Before you choose an investment, make sure you take the time to understand the fee structure. At Moneyfarm, we keep our fees simple and low. You deserve to know how much you’re paying and keep as much of your money as possible.

Five tips to inflation proof your ISA

- Invest your savings in a stocks and shares ISA

- Invest your way – make sure your portfolio reflect you and your financial goals

- Make sure your portfolio is diversified across investments, asset classes and geographies to manage risk

- Invest a little and often to average the amount you pay for an asset over time

- Keep an eye on investment costs so you can keep more of your money