We’ve seen equity market volatility pick up sharply over the past few days and wanted to put these moves into context.

What’s happening?

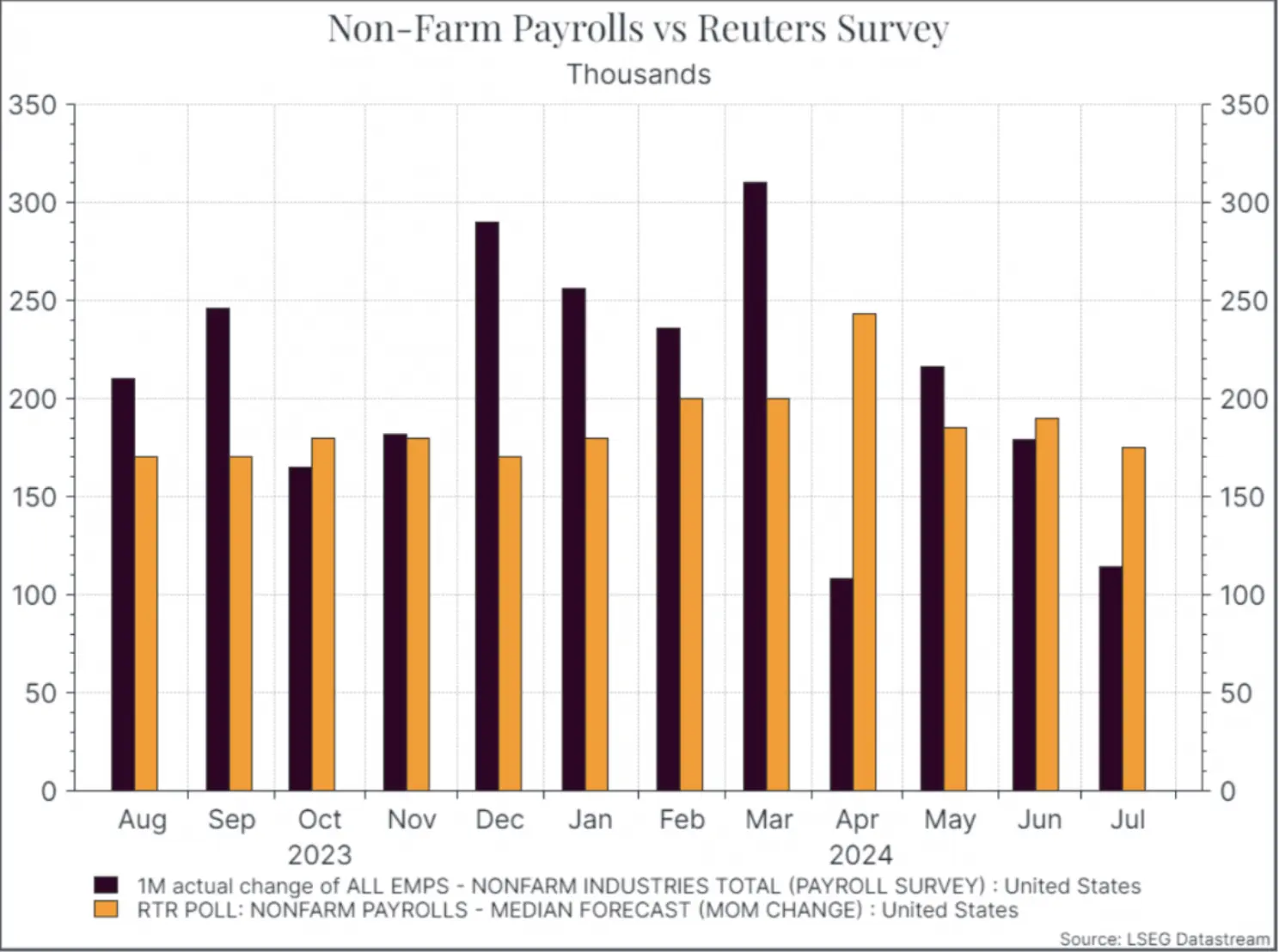

We think that global investors are concerned about the health of the US economy, after a couple of weaker-than-expected data releases. Specifically, last Thursday, we saw the ISM manufacturing survey, and on Friday, the Bureau of Labor Statistics released its monthly employment report. Both indicated that the labour market in the US continues to slow down. The chart below shows the monthly change in payrolls (the dark line), compared to analyst forecasts (the lighter line). After a run of stronger-than-expected figures earlier in the year, we can see weaker-than-expected figures in three of the last four months.

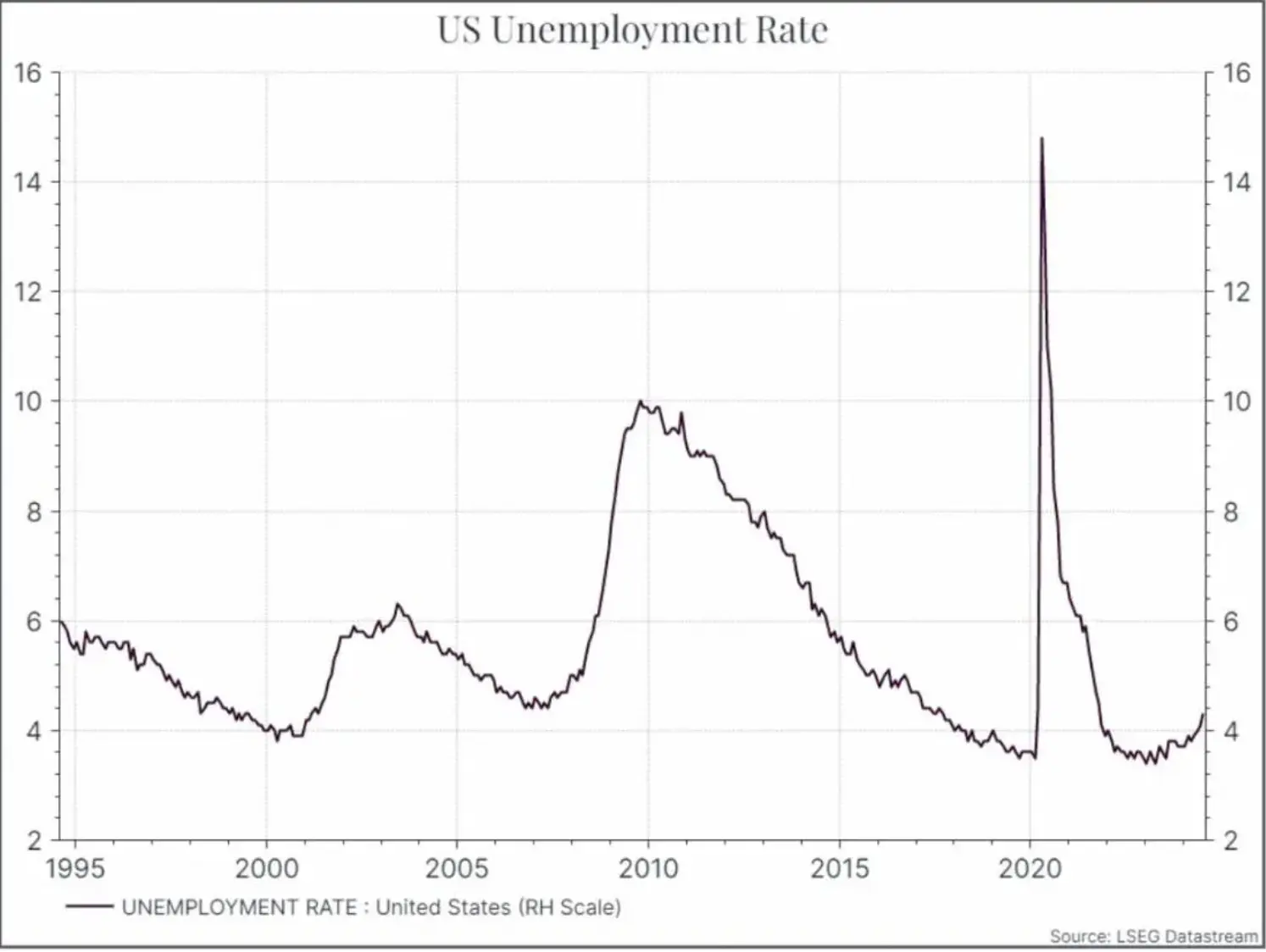

We’ve also seen the US unemployment tick up to 4.3% in July (see chart below) – still low by historical standards, but consistent with a slowdown in the economy.

Most analysts had expected the economy to slow in the coming months, after the sharp rise in interest rates we’ve seen, but these figures have raised concerns that the US economy could be heading towards a recession, with negative implications for the global economy. Some of the earnings commentary from consumer businesses in the US over the past couple of weeks suggested that the lower-income consumer in particular was facing some pressure. With that in mind, there was perhaps some disappointment that the US Federal Reserve chose to leave policy rates unchanged last week. With no meeting scheduled for August, the Fed will likely cut rates at its September meeting. We’ll have additional data before then to suggest whether or not the Fed has waited too long to reduce rates.

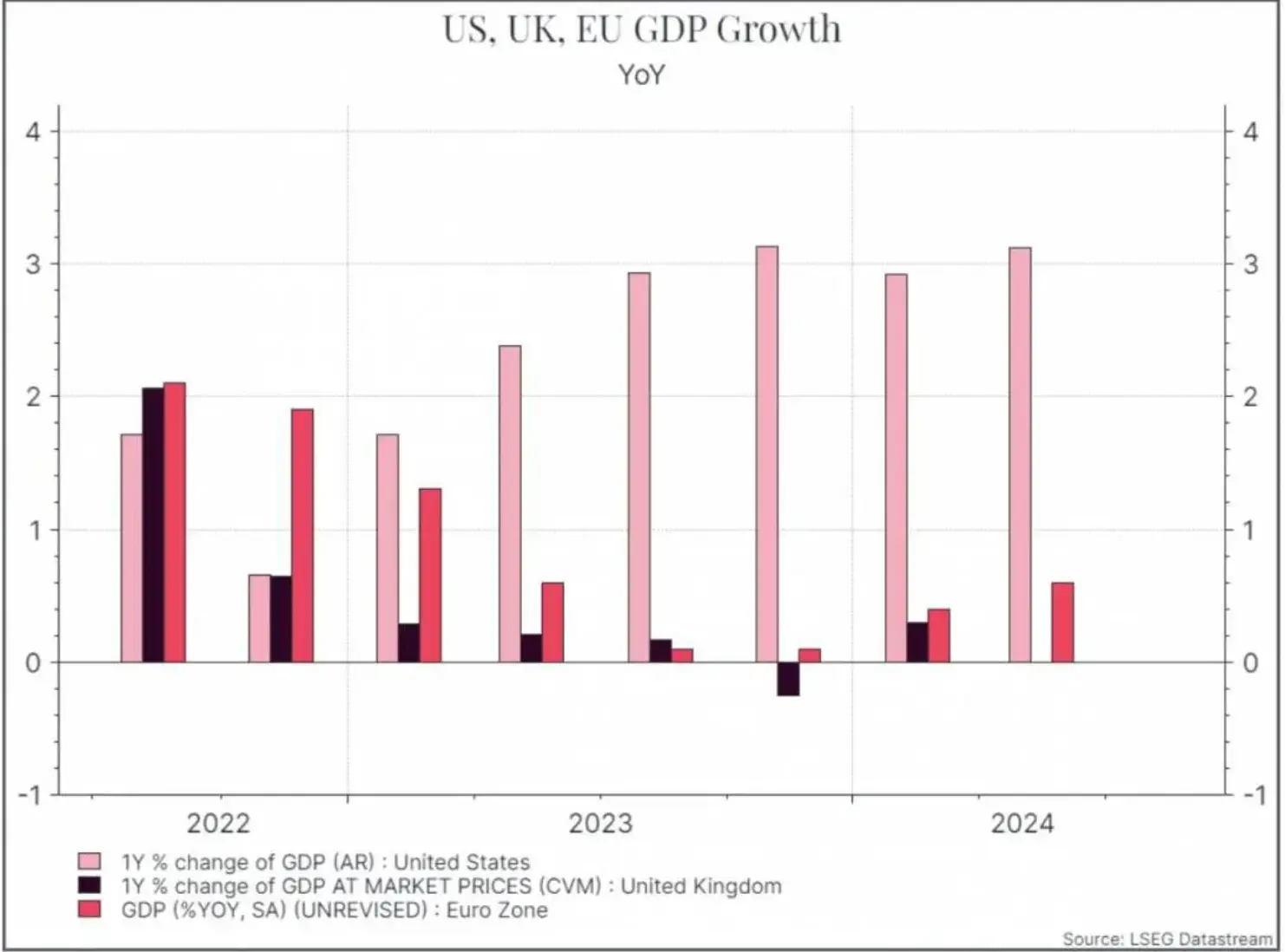

It’s worth bearing in mind that other US macro data suggests that the economy is still in pretty decent shape. The chart below shows annual GDP growth for the US, UK and the Eurozone, with US growth still strong, while the most recent ISM Services report (from August 5th) also suggested decent growth. Nonetheless, we will continue to monitor the incoming data closely to understand whether the US economy is indeed slowing faster than we’d expected.

How are our portfolios positioned?

What about portfolio positioning? Falling equity markets have impacted our portfolios, particularly in the mid-to-high risk. In general, however, we believe that our portfolio positioning is fairly conservative, particularly on the higher-risk lines. In the UK, P1 is a purely fixed-income portfolio and, our highest-risk portfolio, P7 has around 83% equity. We’ve consistently discussed whether we should increase our equity exposure, as our portfolio volatility has generally been at the low end of our long-term targets. We think that the current market volatility could provide us with the opportunity to add to some of our equity positions.

At the same time, on the fixed-income side, we can see the benefits of diversification coming through. Bond yields have fallen, as investors have looked for safe havens and this has helped particularly our lower-risk portfolios. That stands in contrast to what we saw in 2022, when rising yields and falling equity markets meant that asset-class diversification didn’t provide the benefits that we see today.

How should you think about this situation?

It’s easy to “stay the course” when things are going well. It’s more of a challenge when markets are volatile and uncertain. But we continue to believe that it has generally been the right approach. As we’ve noted before, deciding to sell long-term investments is a really difficult thing to do successfully. You need to get two key decisions correct – selling at a good time and then remembering to re-invest.

That said, it’s always important to think about your goals and make sure that your portfolio is consistent with your time horizon and your risk tolerance.

How could we be wrong?

So, for now, we think the market’s reaction to concerns about US growth seems quite dramatic. We think the sell-off could provide an opportunity to add to our equity exposure. If that’s our starting view, it’s important to think about how we could be wrong.

One key underlying assumption is that the US economy remains in decent health. We think that it is slowing down, as you might have expected given the sharp rise in interest rates, but that it won’t tip into a recession. We could be too optimistic about the US economy. We are seeing unemployment rising along with other metrics like credit card delinquencies. If that slowdown accelerates, then we’ll look back and likely say that the US central bank moved too slowly to bring down policy rates.

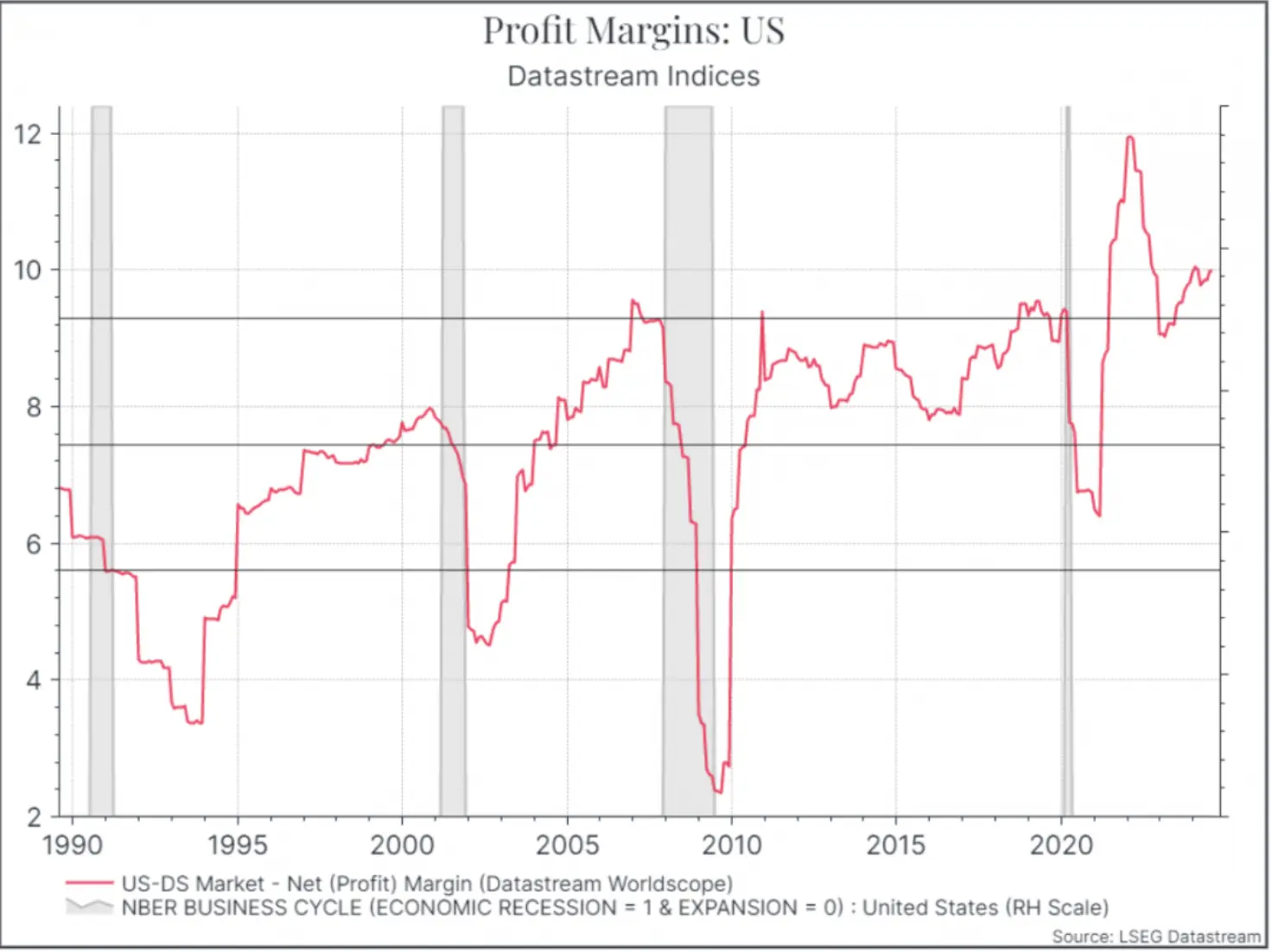

The second key point is that the slowdown won’t have a significant impact on corporate profitability. We’ve had a lot of discussions on this point. The chart below tracks profit margins for US companies over time. There are two things to highlight. First, corporate profit margins have been drifting higher over time. Second, they’re cyclical – during recessions (the grey bars), margins usually fall – which is what you’d expect.

US margins have over the years generally proven more resilient than we had expected. Even during the COVID recession, margins fell only briefly and stayed much higher than during the recession of 2009-10. When it comes to equity markets, if we do see an economic slowdown, a lot will depend on how that’s translated into corporate profitability. For now, we’re assuming that companies can keep their margins intact, but it’s an important metric that we’ll continue to monitor.

In conclusion

It’s a challenging market environment at the moment. The assumption of a soft landing for the US economy is coming into question – raising the question of whether the US Federal Reserve has waited too long to cut interest rates. Our base case is still for a slowdown in the US without a deep recession, but we’ll continue to monitor macroeconomic data closely. The negative returns we’ve seen over the past few days are painful, but a normal part of long-term investing. It’s worth remembering that this downturn comes off the back of an extremely strong period of overall market performance. We think that our portfolios are fairly conservatively positioned and well-diversified, and that there’s scope to add to risky assets like equities, and we’ll continue to assess the best time and way to do that.

At Moneyfarm, we want to help you make informed investment decisions by keeping you abreast of all the latest market-moving news. If you have any questions about the latest market news and what it means for your savings and investments, please don’t hesitate to get in touch with a member of our team by booking an appointment today.

As with all investing, your capital is at risk. The value of your portfolio with Moneyfarm can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance. If you are unsure investing is the right choice for you, please seek financial advice.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.