On Sunday, 28 May, there will be a run-off between Turkish President Recep Tayyip Erdogan, leader of the Justice and Development party, and the challenger for the presidency, Kemal Kılıçdaroğlu of the Kemalist CHP party. Erdogan, who has led the country uninterrupted for the last 20 years, did not pass the 50% threshold in the 14 May elections necessary to be declared the outright winner, by polling at 49.9% versus 45.28% for the challenger. This created a situation which made it necessary to have an unprecedented second round of voting, which is scheduled for this Sunday, the 28th of May. Faced with this particular situation, given that for the first time in 20 years Erdogan’s undisputed power is starting to waver, what financial implications could we expect?

Election outcome unlikely to weigh on international markets

After the first round of voting, Erdogan obtained the support of Sinan Ogan, a challenger who finished in third place, with 5% of the vote. However, it is widely believed by markets and political pundits that Erdogan should edge the vote, with the 5% ultra-nationalist block likely to swing in his favour in the second round.

Whatever the outcome of the elections, no major impact on the financial markets is expected. The country does not represent a fundamental driver for global growth (it is the 19th largest economy in the world), and therefore the ability to move general market sentiment remains very low

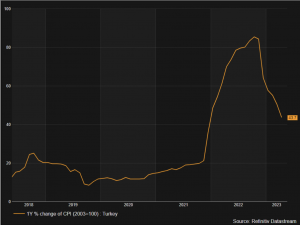

On the Turkish economy, investors were disappointed after the first round of voting, and had expected a change in national policy following the recent challenges Turkey has faced in terms of growth, inflation and earthquakes. It wasn’t to be. The uncertainty that was linked to the first round of elections, and to the fact that Erdogan is now considered the favourite to win, has resulted in a depreciation of the Turkish lira. While the currency is suffering, the impact on broader markets, including those related to emerging markets, also remains low. This is perhaps partly because Turkey has been considered an economy in difficulty for some years now – the surprises on the downside are therefore somewhat limited.

What if Kılıçdaroğlu wins?

A victory for the opposition could lead to positive effects for the lira in the medium and long term, even if elements of uncertainty remain. Firstly, if Kılıçdaroğlu were to win, he would immediately establish a more austere monetary policy than that of Erdogan. While this may appear to be a positive for the currency, the underlying repercussions may not be so immediate as it would see an end to the interventionism of the central bank, which for years has been selling reserves and putting pressure on national banks to support the currency. Secondly, in view of the local elections of 2024, essential for political stability, the new leader could be less rigid than expected, maintaining the focus on economic growth and reducing the effort on the fight against inflation. This would ultimately be detrimental to the value of the currency. Finally, there is the risk of political instability linked to the fact that after 20 years of government, Erdogan has brought allies and friends in to fill the main institutional roles.

What if Erdogan wins?

If, on the other hand, Erdogan were to win, the push towards his own unorthodox monetary policies would increase, among them the cut in interest rates despite the increase in inflation.

Closing thoughts

Although the lira continues to be at high risk, the economy is weak, and inflation is at risk of staying high. The markets are not worried about the possible effects on global growth and on the broader area of emerging countries, fully aware that Turkey has little bearing on international markets.

Moneyfarm will of course continue to monitor the situation and, if necessary, take decisions accordingly to protect our investors’ portfolios.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.