After one of the strongest stock market performances in a decade, the first three quarters of 2019 have been kind to Moneyfarm portfolios.

During this period, a softer approach to monetary policy from global Central Banks underpinned strong performance in both the equity and fixed income markets, despite growing geopolitical and macroeconomic uncertainties.

Government bonds benefited from a flight-to-quality and softer monetary policy from the US and European Central Banks. Despite Brexit delays weighing on near-term inflation expectations, the global decrease in interest rates allowed longer duration inflation-linked bonds to outperform, providing a solid return for portfolios.

In the equity market, an escalation of trade tensions between the US and China sparked panic in August, before a tentative trade deal was struck between them. The deal, which sees America halt any further tariffs on Chinese imports if China promises to purchase billions-worth of farm goods, reassured investors. As a result, equities ended the quarter in positive territory.

Developed market equity was the main source of performance in higher risk portfolios during the third quarter. UK equity rose 0.9% and the US grew 1.7%, with Europe up 2.9% and Japan jumping 3.47%. Emerging market equity was most affected by the escalation in US-China trade tensions in the third quarter, although emerging market currencies went some way to offset this fall.

Moneyfarm’s model portfolios continued to perform well amid heightened volatility thanks to their diversified currency exposure, with safe haven currencies like the US Dollar (+2.8%) supporting the portfolio in the most crucial moments.

A different tone

This is a very different picture to the one investors faced at the end of 2018. Nervous that Central Banks might choke off economic growth in their determination to roll out their monetary policy programmes, investors retreated from stocks and bonds to cash, with the US S&P 500 index falling by over 19% in the three months to Christmas Eve.

Whilst volatility can be uncomfortable, it’s important investors don’t give in to the temptation of reacting to short-term noise, and instead stick to their long-term investment strategies.

Switching your money to sit in cash might seem like a risk-free solution against uncertainty, but you risk inflation eroding the value of your savings. Instead, investing your money can be a more effective way to preserve and grow your wealth over time.

Moneyfarm portfolio performance

The scope of this exercise isn’t to promote short-term investing. In fact, it’s quite the opposite. By taking the right amount of risk with your investment portfolio over a sustained period of time, you can build a more financially secure future.

The simplest way to highlight this is to measure what you could have made if you’d invested £100,000 at the beginning of 2019.

In this example, we’ll look at the returns from three of Moneyfarm’s diversified portfolios – lower risk (Portfolio 2), medium risk (Portfolio 4) and medium-high risk (Portfolio 6). Each portfolio targets a different volatility level in line with the risk tolerance of our investor profiles. This influences each portfolio’s equity exposure, with the allocation to the asset class ranging from 10-85%.

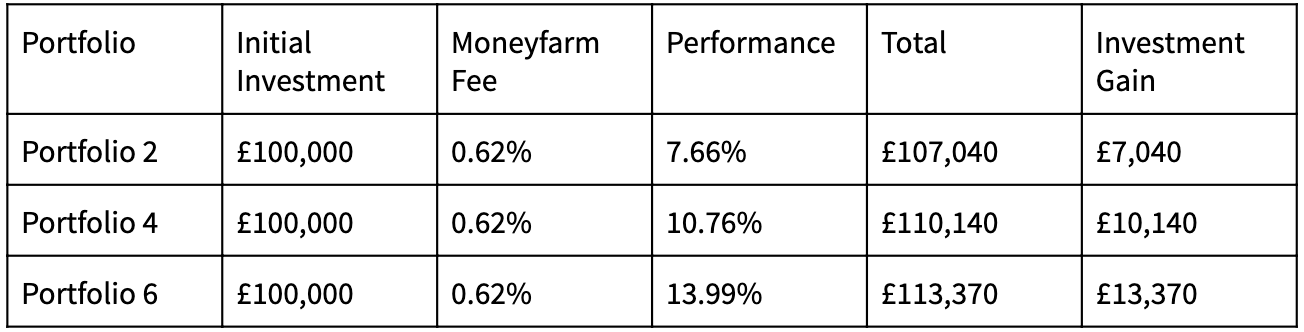

The results, net of annual fees, are listed in the table below. The final column shows the net investment gain.

Developed market equity was the main source of performance in higher risk portfolios during the third quarter. You’ll notice that those portfolios with a higher exposure to equities benefited most, growing between 7.7% and 14%. This translates to an investment gain of £7,040 for the lowest risk portfolio and just shy of £13,400 in our medium-high risk Portfolio 6.

The impact of compounding and pound cost averaging

One way to reach the beginning of 2019 with £100,000 in an investment account would be to have built it up over time. Doing so would have been faster than simply saving £100,000 in your bank account, due to a phenomenon called compounding.

This is where the return from your investment is reinvested and generates its own returns. Even Einstein was a fan – he called it one of the most powerful forces in the universe.

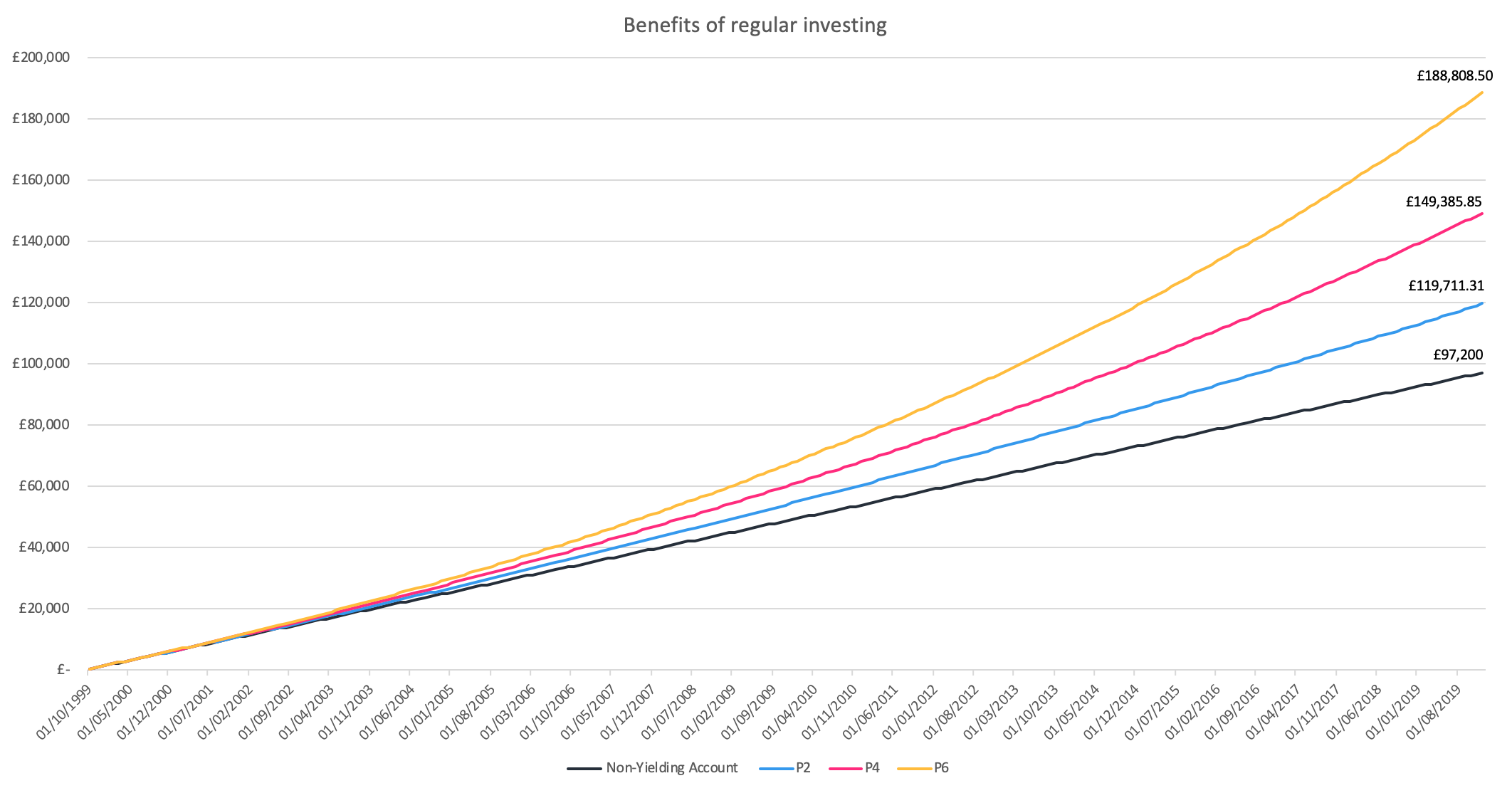

On its own, £400 paid into a (non-yielding) account every month would total £96,000 after 20 years. However, factor in that as soon as your money is invested it has the ability to generate its own return – known as compounding – and the picture changes dramatically.

In the example above, we’re assuming Portfolio 2 grows by 2% a year, Portfolio 4 by 4% and Portfolio 6 by 6%. These are conservative expectations next to Moneyfarm’s performance history.

You can see from the chart, that you invested £400 a month in a P6 it would have taken you 14 years to have a portfolio worth £100,000. If you’d have popped it in a P2 it would have taken you an extra four years. The more you can invest, the faster your money can grow.

Investing regularly over time would have also allowed you to benefit from something called pound-cost averaging.

Pound cost averaging is a technique where you make investments on a regular basis and therefore average the price you pay for the total investment over time.

When you invest small amounts frequently, these investments hit the market at different times (for example, at the end of each month). This means that the amount you pay for an investment changes each time. By smoothing out the price you pay for an asset, you can maximise your returns during volatility.

When investing, remember that time is your friend. Ignore the short-term noise and keep focussed on your long-term strategy. These small tips will help you maximise your returns and get closer to achieving financial freedom.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.