Generating profit with long-term investments means enjoying the benefits of economic growth. A key driver of this growth is companies’ ability to increase their turnover by developing new technologies.

To help investors both contribute to and benefit from this process, we have created the Technology and Innovation portfolio. This allows investors to dedicate a part of their portfolio to exchange-traded funds (ETFs) that invest in industries at the cutting edge of technological innovation.

This portfolio is part of the range of Moneyfarm thematic portfolios and, in terms of classic investment management, it is configured as a ‘satellite solution’. According to our forecasts, thematic portfolios have higher potential returns in the long term, but carry with them the risk of greater volatility in the short term.

For this reason, we help each client define the maximum amount of their capital that can be dedicated to thematic investments in order to maintain risk exposure consistent with their profile.

In this article, we explain the key features of the Technology and Innovation portfolio. We believe that at times of great technological innovation, it is important to have skin in the game. That way, you can both participate in and reap the rewards of progress. If you want to have access to Moneyfarm’s personalised investment solution complete the quick online process to discover which of our portfolios is more fit to your needs.

START NOWA new industrial revolution

Technological innovation is currently accelerating exponentially. Let’s take artificial intelligence: a technology on everyone’s lips thanks to the diffusion of tools such as Chat GTP.

According to Price Waterhouse Cooper, the spread of artificial intelligence could have a positive impact of 26.1% on the US economy and 14.5% on the Chinese economy by 2030. In fact, artificial intelligence could boost the global economy by more than $15 trillion by the end of the decade, more than the GDP of India and China combined.

But artificial intelligence is not the only area to keep an eye on. Think of robotics and the impact it could have in transforming the economy and the world of work. This sector, according to analysts, is expected to grow by more than 17% annually over the next decade. All these innovations are just the building blocks of what many have identified as the industrial revolution 4.0. This is a brand new economic era characterised by connectivity, advanced data analysis and automation. The wave of change began in the mid-2010s and has the potential to transform the future of manufacturing.

The development of new revolutionary technologies is an ongoing process, but we expect this trend to continue to accelerate, taking advantage of the continued increase in investment in innovation. In fact, 2022 was the record year for the number of licences filed and for investments in research and development in OECD countries.

What are the potential consequences for investors of these changes? Just think back to what happened even recently. The digital revolution has transformed the economy in the past 30 years, constituting a third industrial revolution. During this time, new leaders burst onto the market. Companies like Google, Facebook and Amazon went from being marginal or even non-existent to become the heavyweights of stock market indexes and attract huge levels of capitalisation.

Investors who invest on these companies right from the start have managed to accumulate impressive profits. The problem is that it is not always easy to identify the companies that will play leading roles in the economy of the future. Exposure to emerging markets brings risks precisely because it is not easy to choose which technologies and companies will prevail. Nevertheless, the corollary of the volatility involved in these investments is much higher potential long-term returns. For this reason, at Moneyfarm we have developed an approach that maintains flexibility while also guaranteeing investors a consistent level of risk.

Moneyfarm’s approach to thematic investing

Moneyfarm’s thematic portfolios are about investing in ‘megatrends’. So what is the difference between megatrends and simple themes? A megatrend is a broad economic change, while a theme encompasses a group of companies united, for example, by the use of a new idea or technological process. A megatrend is thus supported by a variety of themes: for example, the transition to a sustainable economy is a megatrend, while the search for new battery technologies, or for renewable energies, are themes. Moneyfarm’s portfolios, including our Technology and Innovation portfolio, are multi-thematic portfolios, in the sense that they contain different themes within themselves. But how do we decide what will constitute each portfolio and its themes?

1) Defining our thematic EFTs

Classic Moneyfarm portfolios are built through ETFs. For thematic solutions, too, we identified all the European and UK stock exchanges that we believed met the definition in question, in this case Technology and Innovation.

These ETFs:

- have a positive exposure to technological and socio-economic change.

- invest in companies that are part of a specific segment of the economy or a specific macroeconomic trend.

After a preliminary screening process, we have identified more than 150 suitable ETFs.

2) Definition of themes through the pooling of funds

The next step is to define investment themes. ETFs are grouped into subgroups (clustering), each of which relates to a specific theme. To define the groups, we start from the declared investment area (theme). To avoid confusion and overlap, we created a quantitative process (using machine learning technology) to analyse the content of the various funds. This also helps us to study correlations (a key step in understanding risk). Once the ETFs are grouped, we can put a label on the various groups of funds (robotics, artificial intelligence, automation, smart city). These are the themes underpinning the final portfolios.

3) ETF selection

Once similar ETFs are grouped correctly, we select the best ETFs to represent each theme within the portfolios. Even retrospectively, we note that the performance and volatility of various ETFs in the same theme can vary a lot. When selecting the best choice for the investor we must take into account not only the potential performance, but also the risk. At Moneyfarm, we have refined an ETF selection process over the years that is based on seven key criteria (including cost and liquidity). We have optimised our selection process to better adapt it to the characteristics of thematic investments.

4) Portfolio creation

The final stage is portfolio construction. We group the various themes (which are now represented by a single ETF) into a thematic portfolio. We group the various topics according to a qualitative criterion, creating three portfolios that refer to a specific macro trend: eg, Technological Innovation, Demography and Social Change and Sustainability. We then create a multi-trend portfolio that contains a selection of the best funds. To avoid excessive concentration of risk, portfolios are optimised and controlled through qualitative processes.

The entire portfolio creation process is then reviewed regularly:

- to ensure that the level of risk remains consistent and appropriate for investors.

- to update the composition of the portfolios with the addition of new themes and new funds, so that the mission of the portfolios – that of investing in innovation – remains consistent over time.

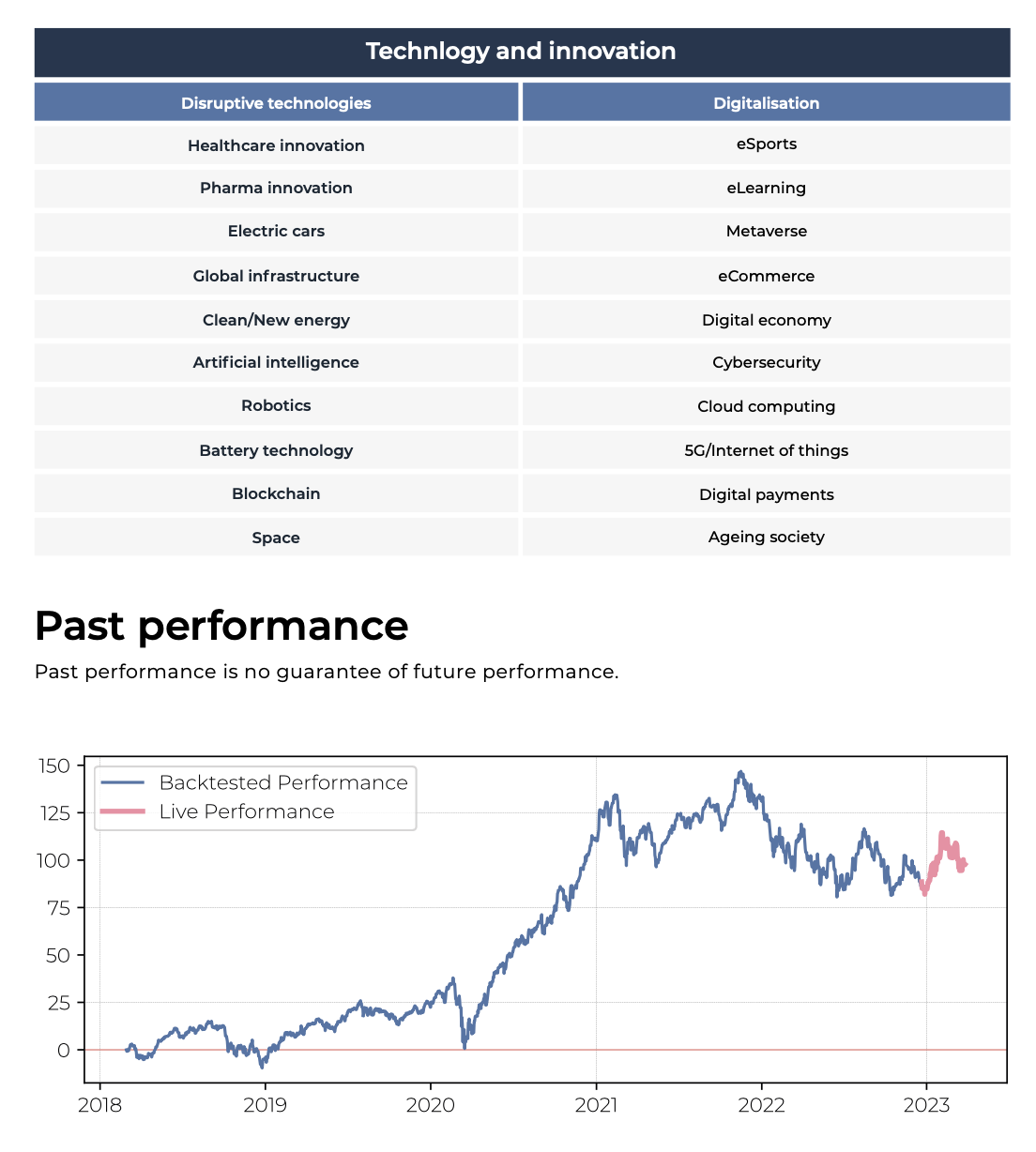

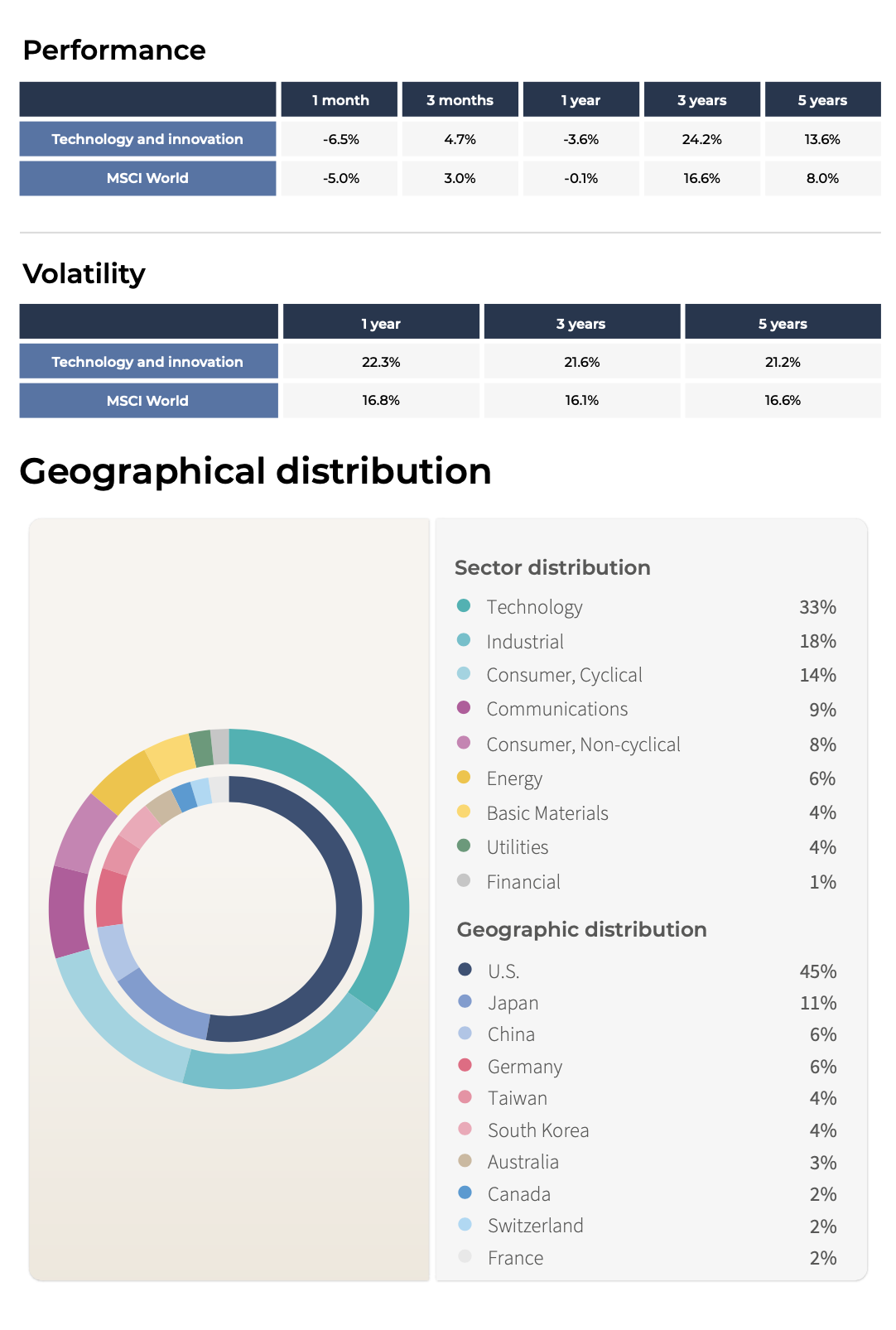

Technical characteristics of the thematic portfolio on technological innovation

The thematic portfolio on Technology and Innovation includes ETFs investing in companies specialising in the development of disruptive technologies and the digitisation of the economy. As we have explained, this portfolio includes a large number of themes to which different funds refer. Below you will find the topics that we include under the technological innovation macrotrend.

Bearing in mind that past performance is no guarantee of future performance, these are some of the (theoretical) results that the portfolio would have achieved in recent years.

What should investors do?

We have decided to offer thematic portfolios to our investors because we believe they are capable of generating extra returns in the future. This is an attractive option for investors looking to increase the sophistication of your portfolio, and customising it according to your inclinations and preferences.

You can allocate part of your portfolio to one or more thematic portfolios. We take care of suggesting the maximum amount you can invest to keep the risk profile of your investment consistent. You can then access investments through your dedicated area, or contact our advisors with any doubts or questions.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.