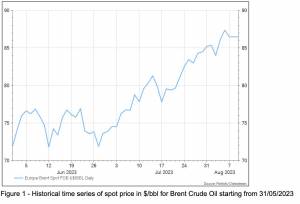

Since the end of June, the upward trend in the price of a barrel of oil seems to have had no end. The spot price of Brent Crude Oil in dollars per barrel ($/bbl) has risen from $74.51/bbl at the end of June to $86.47/bbl on 9 August, 2023, marking a 16.05% increase over this time frame (Figure 1).

But what has caused this increase? Let’s analyse the reasons together.

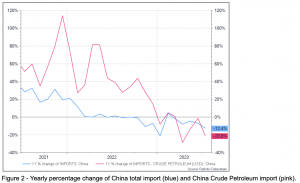

The global macroeconomic landscape remains uncertain. In particular, China, the world’s largest oil importer, is facing a significant economic contraction following a brief upward trend that followed the reopening after the COVID-19 pandemic-related restrictions. In July 2023, Chinese imports were down by -12.4% compared to July 2022, and even more pronounced is the percentage decrease in crude oil imports at -20.8% (Figure 2). The decline is mainly linked to a contraction in the manufacturing sector, with the corresponding Purchasing Managers’ Index (PMI) for July standing at 49.2, which is below the neutral value of 50, hinting at gloomy short-term expectations for a sector recovery.

Furthermore, the International Monetary Fund (IMF) has lowered its growth estimates for real global GDP, projecting 2.8% growth for 2023 compared to 3.4% in 2022. Developed economies are mainly the ones slowing down, with overall real GDP growth expected to be around 1.3%.

Within this macroeconomic context, the International Energy Agency (IEA) has estimated an increase in global crude oil demand by 2.2 million barrels per day (mb/d) in 2023, revising its previous estimates downward.

With economies slowing down and a projected decrease in demand, expecting a decline in crude oil prices should be intuitive. So why isn’t it happening?

Fundamentally, it’s because the OPEC+ alliance, representing approximately 40% of global oil production, has been implementing production cuts since November 2022 to support the upward price trend in anticipation of the expected demand drop. In particular, Saudi Arabia has significantly reduced its production by 1 mb/d, and recently announced that this measure will continue through September. During this period, Russia also announced a cut in crude oil production by 300 kb/d (thousands of barrels per day). According to IEA data, in the recent past, the alliance’s production decrease has been offset by increased production activity in other countries, such as the United States, with US production rising by 610 kb/d in 2023, for example.

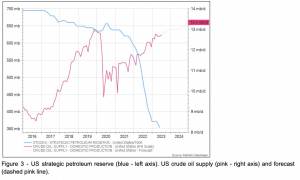

However, in the immediate future, this might not be sufficient, and given the persistence of OPEC+ in reducing production, global supply is poised to potentially experience a significant decline in the coming months. Moreover, to stimulate an increase in production, the US has been forced to tap into their strategic oil reserves, which consequently have been steadily declining since late 2020 (Figure 3). As a result, this factor in the near future will not be able to contribute to production growth and price support as it has done so far, since strategic reserves need to be replenished. A slowdown in US oil production is therefore to be expected (forecast in Figure 3).

It’s also worth noting the slower-than-expected economic slowdown in developed countries in the second quarter of 2023, which partially supported demand and consequently led to price increases. US GDP grew by 2.4%, compared to the expected 1.8%, and France also showed slight signs of acceleration, although the overall aggregate growth of the Eurozone remained in line with expectations.

Does this mean that the price of crude oil will inevitably continue to rise? Not exactly.

Many analysts agree that the recent oil rally over the past 40 days is not sustainable in the medium term. The OECD projects a target price of $75/bbl by the end of 2024 (Figure 4). The main causes can be attributed to the aforementioned macroeconomic uncertainties. While the US seems to have averted the risk of a recession, the contraction of the Chinese economy could weigh heavily on the overall global oil demand. At the same time, OPEC+, led by Saudi Arabia, appears strongly determined to support the price of crude oil, and potential further production restriction measures cannot be ruled out.

Davide Petrella: Davide is a Portfolio Manager at Moneyfarm. He earned an MSc in Quantitative Finance from Politecnico of Milan Graduate School of Management and a MSc in Physics at University of Rome La Sapienza. Davide started his career in Anima Sgr in 2017 as Assistant Portfolio Manager in the multi-asset team and then he moved to Allianz Italy in the ALM & Strategic Asset Allocation team. From January 2022 to January 2023 he worked as Quantitative Analyst in the Fixed Income Boutique of Vontobel Asset Management in Zurich, working closely with Portfolio Managers in order to build quantitative front-office solutions for the boutique.

Davide Petrella: Davide is a Portfolio Manager at Moneyfarm. He earned an MSc in Quantitative Finance from Politecnico of Milan Graduate School of Management and a MSc in Physics at University of Rome La Sapienza. Davide started his career in Anima Sgr in 2017 as Assistant Portfolio Manager in the multi-asset team and then he moved to Allianz Italy in the ALM & Strategic Asset Allocation team. From January 2022 to January 2023 he worked as Quantitative Analyst in the Fixed Income Boutique of Vontobel Asset Management in Zurich, working closely with Portfolio Managers in order to build quantitative front-office solutions for the boutique.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.