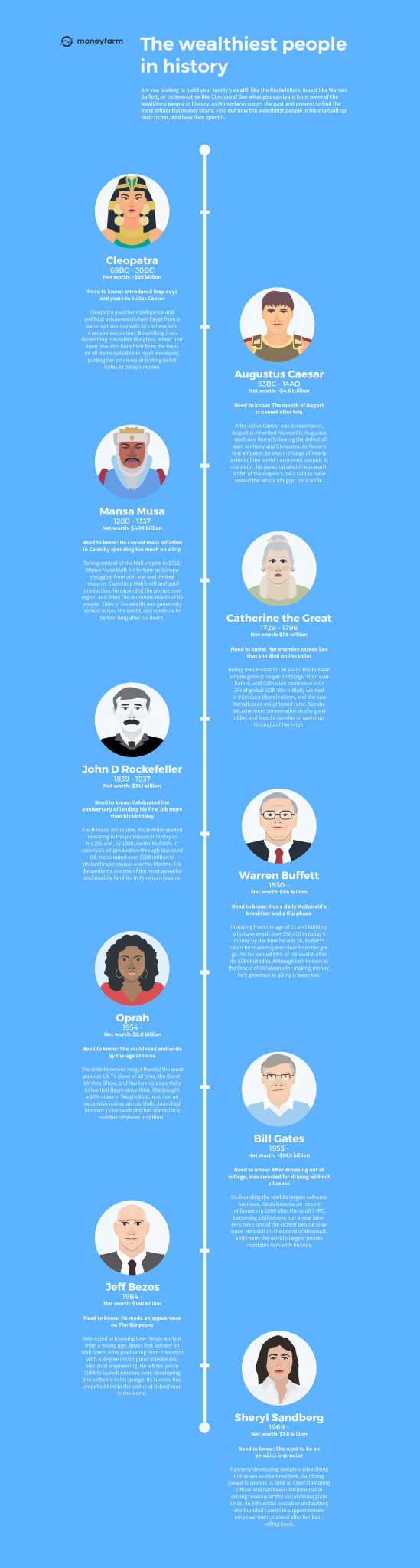

Are you looking to build your family’s wealth like the Rockefellers, invest like Warren Buffett, or be innovative like Cleopatra? In the Moneyfarm Wealthiest People in History timeline, find out how some of the wealthiest people in history built up their riches, and how they spent it.

Moneyfarm has scoured the past and present to find the most influential money titans. Here are the top three things you can learn from some of the wealthiest people in history:

- Make the most of the technology available to you

- Start as early as possible, but it’s never too late

- Take risks

Make the most of the technology available to you

With the founder of Microsoft, Amazon and the Chief Operating Officer of Facebook rubbing shoulders on the Moneyfarm Wealthiest People in History, it’s no surprise that technology is influential in creating, nurturing and maintaining wealth.

Technology has the power to transform your life for the better, whether that’s through efficiency, convenience or networking.

More recently, tech is being used to transform the way people manage their money, shifting the mindset from one of confusion and avoidance, to engagement, flexibility and transparency.

Moneyfarm blends world-class tech with the human expertise of our experienced fund managers to make investment advice accessible to those who have traditionally been unable to invest.

There are a number of reasons why Brits have historically been unable to make the most of their money, whether that’s because they lack the experience, are time poor, or don’t want to pay the fees of traditional financial advisors.

Today, technology allows us to provide regulated investment advice at good value for money.

Start as early as possible, but it’s never too late

It can’t be stressed enough that time is your friend when it comes to investing. The earlier you start, the longer you have to reach your goals and the more calculated risks you can take in the search for higher returns. We’ll go into risk in a bit more later.

Rockefeller started investing in the petroleum industry in his 20s. Just two decades later was in control of about 90% of the industry. Unfortunately, this would be difficult to replicate today.

Entertainment mogul Oprah could read and write by the age of three. Thanks to her Grandmother, this set her up well for her life in front and behind the camera.

Amazon founder Jeff Bezos had an interest in how things worked at an early age. This later helped him set up one of the most successful companies in history from his garage.

Warren Buffett started investing at the age of 11. By the age of 16 had grown his money to a decent size. However, and perhaps more importantly, the investor earned most of his wealth after his 50th birthday – proving it’s never too late to get started.

Take risks

None of the people on this list would probably be there if they hadn’t taken a few risks in life.

Bezos left his job on Wall Street to found what was initially just meant to be an online bookstore. Facebook’s Sheryl Sandberg launched a book and organisation on female empowerment. Bill Gates dropped out of Harvard and launched Microsoft.

Mali’s Mansa Musa and Cleopatra wouldn’t have been able to turn their struggling empires around without taking on a little risk either.

When it comes to investing, risk works hand-in-hand with return. The more risk you take with your money, the higher you can expect your returns. Remember, your investments also have further to fall.

When building the investment portfolio to help you reach your financial goals, diversification can help manage this risk in line with the returns you’re after.

The investments that go into your portfolio will depend on your investor profile, appetite for risk and time horizon.

[Click image to enlarge]