One of the most common roadblocks for people getting started with investing, including those looking for the cheapest stocks and shares ISA, is the ISA charges. You might be interested in what a stocks and shares portfolio can do for your savings, and you may have done all your research and picked a product that suits you, possibly a cheap ISA. When it comes down to parting with your cash and paying ISA costs, though, it can be easier to put it off.

ISA fees explained: Summary Table

| Types of ISA fee structures? | Single fee, Nominal fee, Commission/trading costs, and Zero commission trading fee |

| How do fees impact ISA returns? | The lower the fees, including ISA charges, the higher the returns. This is a key consideration for anyone seeking the cheapest ISA fees. |

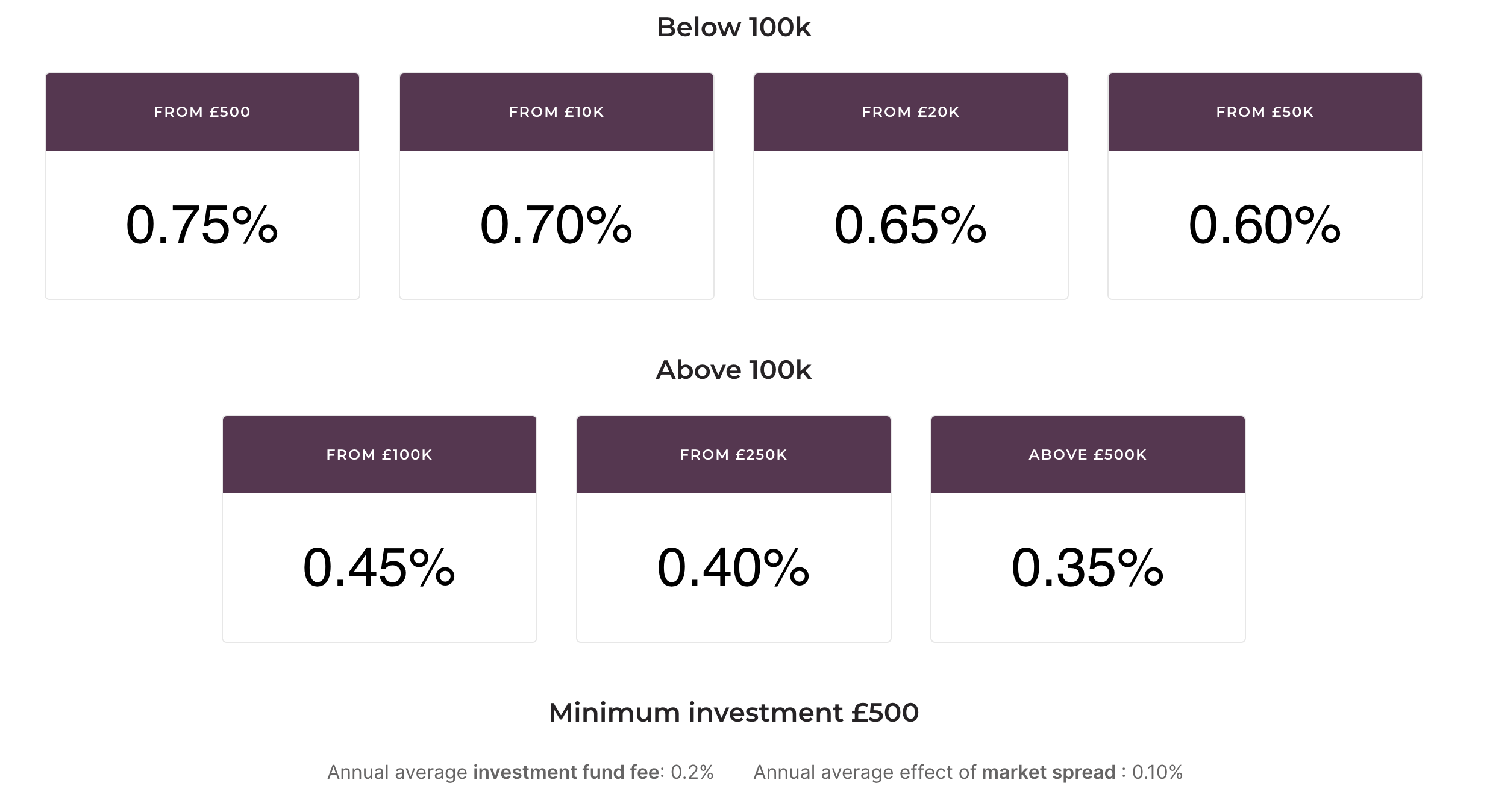

| What is Moneyfarm’s fee structure? | •0.75% – From £500 •0.70% – From £10,000 •0.65% – From £20,000 •0.60% – From £50,000 •0.45% – From £100,000 •0.40% – From £250,000 •0.35% – Above £500,000 |

It’s important to understand how fees, including ISA charges, can impact your returns – the reason any of us invest, at the end of the day. Some ISA providers will offer discounted fees on larger investment amounts, while others will take one clean percentage of your annual returns. Some will charge additional fees under the surface, while others will give them to you as one transparent figure, which is crucial for anyone needing ISA charges explained.

With the end of the financial year fast approaching, here is our breakdown of the different fee structures, including ISA charges, you might find for stocks and shares ISAs. We’ll go into how they can affect your bottom line and why ours is a cheap, efficient option for those concerned with ISA costs.

Before we get started, you can find out what a stocks and shares ISA could do for your savings in just a couple of clicks. Before the end of the tax year, open a Moneyfarm ISA and put your savings to work, considering the ISA charges.

ISA Charges: Common Fee structure

When you get started investing in stocks and shares ISA, you’ll encounter a few common types of fee structures. They vary both in the amount they take and the impact they have on your investment style. Being aware of the different types, including ISA charges, is a good first step in choosing a plan that suits you.

The following is a list of the most common fee structures wealth managers use:

Single fee – The most basic fee structure you’ll find is ‘single fee’ or ‘one fee’. As you might expect, this means that no matter the value of the account, you’ll pay the same percentage in fees. So, an account with £200,000 would pay the same percentage in fees as one with £1,500.

Nominal fee – A nominal fee structure means that the company charges a set amount regardless of the value of the account. So, someone with £200,000 in their account would pay exactly the same amount in fees as someone with £1,500. This approach quite clearly favours those with larger amounts to invest.

Commission/trading costs – These are fees associated with investing. This means you are charged a fee every time you or your investment manager takes action to cover trading costs or pay for the service on a use-by-use basis. This can add up, particularly if your account is diversified and actively managed.

Zero commission trading – This approach tends to have low account and trading fees or 0%. In return, your broker will sell your trading information to market participants ahead of any trades you make, which can, in many cases, mean you get a worse price.

There are several additional things to look out for when choosing a wealth manager. These include any hidden fees for trading, depositing, withdrawing, etc. The best wealth managers charge a transparent, easy-to-understand fee with no nasty surprises in the small print. Make sure you do your research before going with a provider.

The impact of fees on returns

Many people don’t realise how much of an impact the ISA charges and fees can have on returns when they start investing in ISAs. The difference between half a percentage point might not seem like a lot, but over time, it can make a huge difference to the size of your savings.

You might have heard of compounding interest in investing. Well, investment ISA charges and fees work in the same way, just with the reverse impact. As your wealth grows, the difference in percentage takes on a compounded significance and can, over the years, seriously eat into your real returns.

To give you a better idea of the impact of fees over the long term, we simulated three investments paying 0.5%, 0.8% and 1% in fees, respectively. The chart above shows the trajectories of the accounts and demonstrates the cumulative difference made by the fee percentages.

How Moneyfarm’s fee structure works

At Moneyfarm, our active management fee structure is designed to benefit all parties involved. In essence, our ISA charges and fees are structured in a tiered manner, meaning your investment is divided into seven distinct ‘buckets’. The initial four tiers cater to investments under £100,000, covering ranges from the first £500 invested up to amounts exceeding £50,000. The remaining three tiers are dedicated to investments above £100,000, spanning from £100,000 to any amount beyond £500,000, with the fee percentage decreasing as you cross each threshold.

So, each ‘bucket’ is charged at a different rate. This means that the more you invest, the lower the real fee rate will be for your account as a whole. This benefits our clients, as their fees drop as their accounts grow. Past £500,000, the marginal fee on every pound managed is 0.35%.

Our pricing page lays out the type of investment solutions available and exactly how much you’ll pay in fees depending on the amount you’re looking to invest.

Investing with Moneyfarm gets cheaper as your wealth grows. We’re also fully transparent about the investment fund fees we charge – you’ll never pay more than 1.05% (0.75% fees for a £500 investment, 0.20% underlying fund fee, and 0.10% market spread fee) when you invest with us, as an absolute maximum. You can also get your ISA charges and fees down to as little as 0.35% with more investments. Included in the price, you get access to our team of investment consultants, who are on hand to discuss your investment decisions and the progress of your portfolio, as and when you need them.

The key takeaway for anyone learning about fees is to do your research. It pays to have a fundamental understanding of the things we’ve discussed in this piece, but you’ll need to interrogate any provider’s fee structure before making a decision. If you want to discuss Moneyfarm’s fee structure in more detail or find out how much you’ll be paying on a certain amount, feel free to get in touch with our investment consultancy team.

FAQ

Do ISAs have fees?

Yes, ISAs come with fees and commissions, including ISA charges, and each ISA provider determines its fees. ISA fees come in various forms, ranging from management, platform, trading, exit, and account closure fees, all of which can be considered part of ISA charges. This is a critical factor for anyone comparing cheap ISAs.

What is the disadvantage of ISA fees?

ISA fees or ISA charges can eat away at the returns on an ISA investment. So, it is essential to know exactly how much you’re being charged. ISA fees are competitive, so look for the best rates that fit the financial product you want, especially if you’re searching for the cheapest ISA fees.

What does Moneyfarm’s fee include?

There are three annual fee components to Moneyfarm fees: the Moneyfarm charge, underlying fund fee, and market spread. Moneyfarm charges include investment management, custody, trading and digital investment advice, and human support, all integral to the overall investment ISA charges. The underlying fund fee, also known as the total expense ratio, is the fee charged by the ETF providers. Market spread, or transaction cost, is the cost charged on your investment when you trade, contributing to the total ISA charges. For example, a £20,000 Moneyfarm investment has an annual fee of 0.95% (0.65% Moneyfarm fee, 0.20% underlying fund fee, and up to 0.10% market spread), encompassing the comprehensive ISA charges.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.