We’ve all got financial goals we want to achieve, whether it’s a big family holiday, upsizing your family home, or retiring in style. When you’re making sacrifices today for your future self, you want to know you’re doing the right things to get your family across the finish line.

Personal finance is just that; personal. When it comes to managing your money, the things that work for you will probably be different to your friends and colleagues.

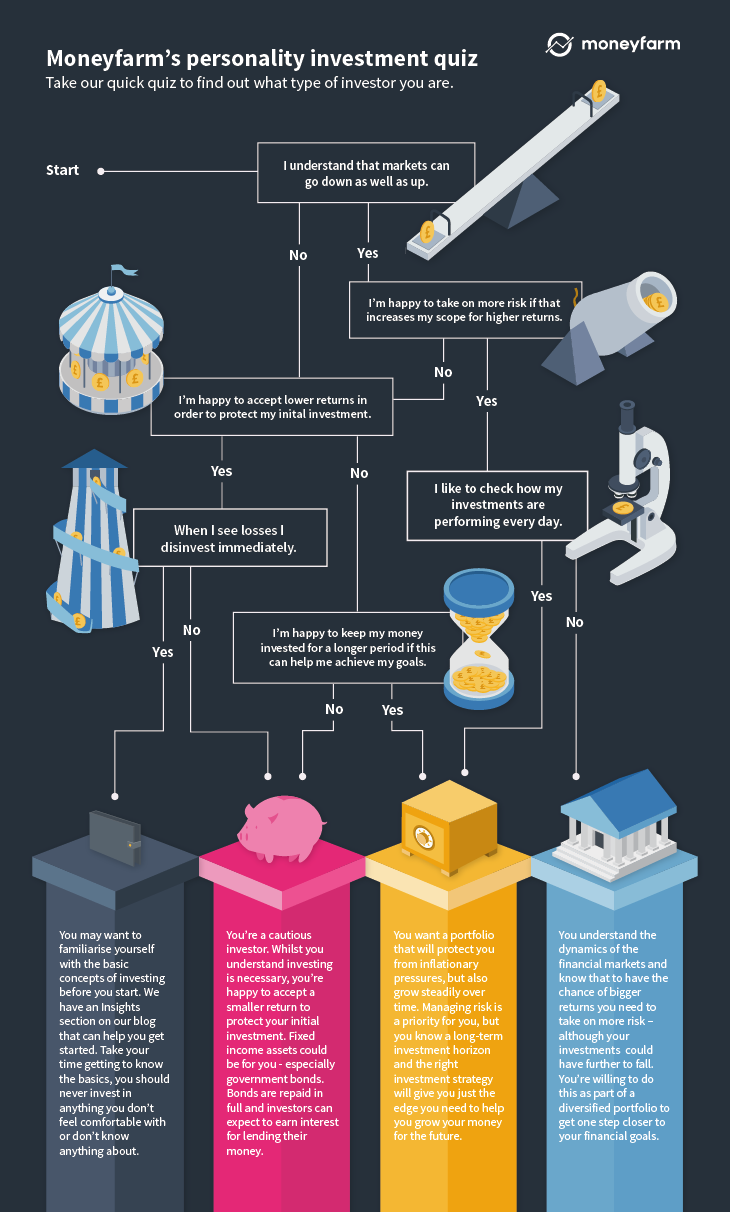

Your investor profile is influenced by what you’re saving for, when you’ll want your money, and your financial background. These pillars essentially support your attitude to risk, which help you make the right financial decisions for you.

That’s why Moneyfarm has created this infographic to help Brits understand what they should be looking for from their investments.

Before you look to the financial markets to help you protect your money and grow it for the future, make sure you’ve paid off any expensive debt and have got at least three months of savings in an easy access savings account.

Beat inflation on the financial markets

Brits are getting a rough deal in the current savings landscape; not only are wages stagnant against rising prices, but inflation is eating into the value of hard-earned savings.

Whilst cash is generally thought of as a safe asset for wealth protection, investors are having to accept returns that aren’t matching the pace of inflation. This means cash is losing purchasing power over time – so not as safe as you might have thought.

That’s why many investors are looking to make their money work harder for them on the financial markets. A successful investment strategy can give investors a shortcut to meeting their financial goals.

Attitude to risk

What you invest in and how you split your money between the investments in your portfolio depends on your investor profile, which outlines your tolerance to risk.

Risk is often misunderstood on the financial markets. By taking on more risk, you can expect higher returns from your money – although the further your investments can also fall.

Understanding the relationship between risk and return can allow you to offset the impact of inflation on your portfolio and select the right investments to help you reach your goals on time.

The impact of time on your financial goals

Time has a large impact on your attitude to risk. The longer you have to invest, the more risk you can afford take with your money as your investments will have the time to recover from any short-term fluctuations that arise.

If you want to gift some money to your children to help them on the housing ladder in 12 months’ time, you’ll want to protect the value of your money rather than hunt out blockbuster returns – as you won’t have the time to recover from any surprise hiccups over the year.

In this example, your asset allocation will have a larger exposure to bonds rather than riskier assets like equities.

Whilst investors search through many investment strategies trying to find the elusive edge to achieve their financial goals, the only thing you really need is time.

Not only does it allow you to take on more risk, but it also allows you to benefit from one of the most powerful forces when investing; compounding. Compound interest is when the returns on your investments are reinvested and earn their own returns. Over time, this can make a real difference.

Time in the market

It’s ‘time in’ not ‘timing’ the market that has the most powerful impact on returns.

A long time-horizon also encourages you to ride out any short-term fluctuations in an asset’s price, and helps you avoid any costly mistakes by disinvesting as soon as you see any losses.

A study by JP Morgan highlights just what an impact this can have on overall returns. If you had invested in the S&P 500 in the two decades to 2014, you’d have made just shy of a 10% annualised return.

If you had tried to time the market but ended up missing the 10 best days of performance, this return would have shrunk to just 6.1%.

Understanding the power of time and your investor profile are the first steps to achieving your long-term financial goals. Get it wrong, however, and you could end up further away than you expected.

Remember, the most important person to listen to when you’re investing, is you.