When it comes to investing, risk management is as important as the pursuit of returns. But what does managing risk mean? Let’s try to explain how we go about managing risk.

Firstly, managing risk does not mean eliminating it entirely. Doing so would mean sacrificing returns, which are only justified as the compensation for that risk.

So we need to identify the most suitable risk tolerance for each investor’s profile, objectives and goals, which our advisory team is responsible for overseeing.

A priority of our portfolio management and wider service is managing risk to ensure that the long-term management remains consistent with our clients’ profiles. However, managing risk is not easy, as it takes many different forms and can have an effect at various levels. Appreciating the benefits of good risk management is not as straightforward as understanding more tangible factors like performance. After all, risk remains almost unseen until it becomes apparent.

But what risk management activities does our team undertake?

- Investor profiling: During the profiling phase, we try to identify an investor’s risk profile. This includes factors such as market volatility tolerance and maximum acceptable loss.

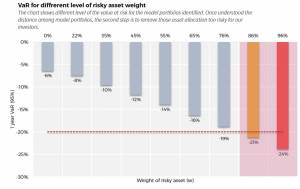

- Identification of suitable portfolios: We then identify the appropriate portfolio for each investor based on risk tolerance. To do this, we define a range of model portfolios that we believe can be offered to clients. These portfolios form the basis of the portfolios we offer and each has sufficiently variable expected volatility levels to ensure different outcomes over time. In this phase, we establish the initial boundaries to exclude overly risky allocations.

- Qualitative control: The process of creating portfolios is primarily quantitative but is subjected to the scrutiny of the Asset Allocation team, who have the ability to highlight specific risks. The portfolios are also subjected to simulations and stress tests to assess their behaviour in extreme market situations.

- Continuous monitoring: Our team constantly monitors the markets to ensure that the risk of the portfolios remains aligned with the objectives. If necessary, the Asset Allocation team considers potential rebalancing actions to realign the portfolios with our predefined targets.

Professional risk management is a key to any investment’s success. Our risk management not only allowed the portfolios to outperform their peers over a five-year time horizon but also ensured that our strategies consistently moved according to the objectives defined with clients.

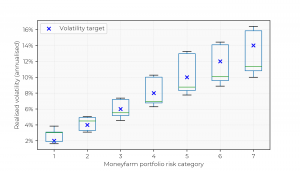

Our risk management strategy has helped us to respect our predetermined volatility targets most of the time. In the chart below you can see the distribution of weekly volatility (annualised) over the last three years for our main portfolios, each one represented by a candlestick. As you can see, despite the numerous risk events, portfolio volatility remained around the target (cross) in most cases. This is especially true for riskier portfolios, where our risk management choices have shifted the volatility distribution below targets over most weeks.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.