If you’re thinking about investing with a retirement partner for the long term, it’s so important to feel that your money is properly protected. At Moneyfarm, safeguarding your money is always our top priority.

So, how can you be sure your money is in safe hands when you invest with us?

Here, we’d just like to give you an overview of the steps we take so you can be assured that Moneyfarm accounts are secure.

Fully regulated by the Financial Conduct Authority

Moneyfarm is regulated by the Financial Conduct Authority (FCA) in the UK. This regulatory oversight ensures that we operate within the strict guidelines set out by the FCA and ensures the strictest standards are maintained when it comes to protecting all client funds.

Separation of client funds

As part of our FCA regulatory obligations, all our client assets are held separately from Moneyfarm’s own assets. This segregation ensures that client money is ring-fenced and can be returned to clients in the unfortunate event of insolvency.

This adds another level of security for our clients, so they can be assured their funds are being managed responsibly at all times and we do our best to manage risk around potential unforeseen eventualities.

Our third-party custodian is Saxo bank, who we run regular checks on to ensure they are fit for purpose to safeguard client assets. In the event of our insolvency Saxo would work with an administrator to move client assets to another provider.

We’re part of the Financial Services Compensation Scheme

The FSCS is a UK scheme designed to protect consumers when financial firms fail. The FSCS provides compensation to customers of financial services firms that have failed and are unable to fulfil their financial obligations.

If you’d like more information about the Financial Services Compensation Scheme and in particular protection for pensions, you can visit their website here.

Two-factor authentication

As a digital wealth manager, the security of our clients’ accounts is our top priority. With the rise of sophisticated phishing scams, data theft and other types of cybercrime, it’s more important than ever to have the most robust account security in place.

That’s why we’re requiring all Moneyfarm clients to upgrade their account security by using two-factor authentication (2FA) when logging in.

If you haven’t yet enabled two-factor authentication on your devices, you can find out how to do it on our dedicated 2fa blog here. It only takes a minute to Add an extra layer of account protection with two-factor authentication, to prevent any unauthorised account access, giving your greater peace of mind.

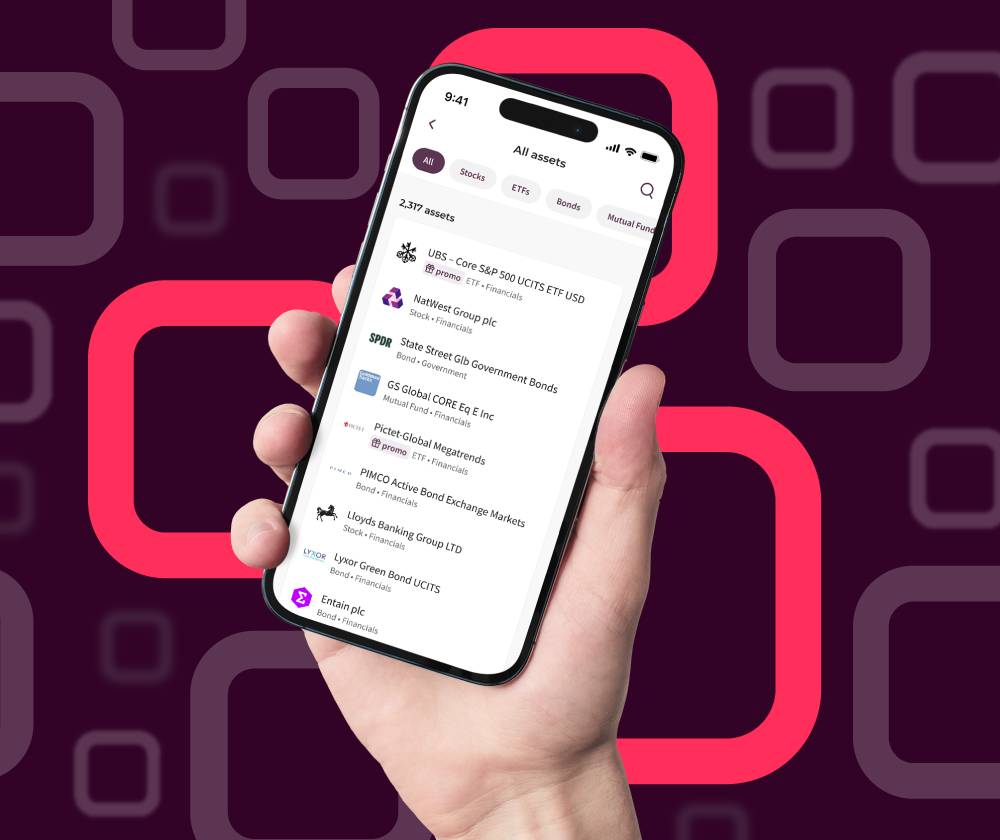

A range of diversified investment strategies

Our range of managed portfolios is carefully constructed by the Moneyfarm Asset Allocation team to ensure broad diversification across geographies, asset classes and risk levels. This, in theory, can help to hedge against some degree of market volatility and manage the overall risk profile of the investment.

We believe this is the best strategy to help our clients meet their unique investment goals, no matter their time horizon or risk tolerance. You can discuss your goals and priorities with one of our investment consultants at any time and they’ll be happy to walk you through investment options available to you. You can book an appointment online here, or simply get in touch with us via phone or email.

Robust IT system security

Client data, including bank account and personal information, is held and stored in strict accordance with all applicable regulations, including GDPR.

Our expert team uses advanced cybersecurity technology to monitor for any potential breaches of our systems so you can rest assured that all your credentials are safe with us.

We also conduct regular auditing and constantly monitor transactions to ensure your safety from fraud and other financial crime.

What if you change your mind about saving for your retirement with us?

Of course, we’d be sorry to see you go, but if you no longer wish to save and invest with us you can transfer your funds to another provider or withdraw to your bank at any time.

Have any questions about your account or fund security?

If you have any questions or would like more information about fund security, you can speak to a member of our team at any time. Simply book an appointment online, or give us a call or send an email at your convenience, and we’ll be happy to help.

Want to start saving for your retirement with a partner you can trust?

Opening or transferring your pension to Moneyfarm is quick and easy. Plus, with our new Find, Check & Transfer service, we make tracking down your lost pots easier than ever before. We’ll do all the work for you – from searching for each lost pot to consolidating them all in one place. Provided you can work out who you worked for, and when you worked for them, we’ll be able to trace down your legacy pensions, even if they’ve changed hands. You can find more about our new Find, Check & Transfer service on our dedicated page here, or simply book an appointment with an adviser to learn more. Please note that a 1% fee applies to any pension transferred through the Find, Check & Transfer service.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.