Investing in an ISA is one of the simplest ways to grow your money tax-free, but the generous benefits available mean there are some rules you have to keep to, like how many ISAs you can invest in.

How many ISAs can I have?

You can only put money into one of each type of ISA in one financial year, although you can spread your annual allowance across a number of different types of ISAs – cash, stocks and shares, Innovative Finance and Lifetime ISA.

This means you could choose to invest your entire £20,000 annual allowance in your stocks and shares ISA or, for example, invest £10,000 for the long-term, and put £10,000 in your cash ISA for shorter-term goals.

That doesn’t mean you’re restricted to one provider, however. You can open one stocks and shares ISA each year. If you have a number of different ISAs with different investment providers, you’ll have to choose which one you want to pay into in a single tax year.

Transferring your ISA

If you decide to open a new ISA with a different provider but have already used part of your annual allowance, you’ll need to transfer your old ISA to your new provider to pay into it.

If you do want to transfer your ISA, make sure you understand whether/what you’ll be charged. Some providers have complicated and expensive fee structures which means transferring your money can become expensive.

At Moneyfarm, we don’t charge you a thing to move your money to or away from us, which gives you the flexibility to do what’s right for you and your family.

Transferring old ISAs won’t impact your annual allowance, either. For example, you could transfer £75,000 from an old ISA and still have your £20,000 allowance to invest for the remainder of the tax year – assuming you hadn’t already used any of your annual allowance.

To transfer your ISA to Moneyfarm, all you need to do is open an account, select ISA, then fill out an ISA transfer form, detailing exactly what you want to transfer to us. We’ll do the rest, it really is that simple.

Make sure you transfer your ISA properly to ensure you keep your money within the tax-free wrapper and don’t lose any of your tax-efficient benefits.

How many different ISAs are there?

Savers and investors really are spoilt for choice when it comes to the number of different types of ISAs on the market.

The two most common ISAs are cash ISAs and stocks and shares ISAs, both of which play an important role in financial planning.

Cash ISAs are good for savers who want to protect their money, but don’t have a long time horizon and don’t want to take on much risk with their money.

Although cash ISAs can protect the initial value of savings over the short-term, the low returns on cash ISAs means a lot of money sat in cash could be losing value to inflation over time.

Stocks and Shares ISAs are good for those who want to prioritise growing their money over the long-term. Make sure you’ve paid off any expensive debt, have three months of outgoings saved up in case of an emergency, and have a longer time-horizon before you start investing.

You can also invest in a Lifetime ISA and Innovative Finance ISA. Despite promising a 25% bonus to help first-time buyers, the new LISA has been controversial due to its plans to penalise savers if they need to access their cash early.

The LISA can only be used to buy a first home or for retirement at the age of 60, otherwise it’s locked up. When you invest in a pension, you can access your savings from the age of 55.

If a saver needs to urgently access their savings, they’ll have to pay out 25% of the amount withdrawn as a penalty – which includes the bonus, any income generated on that bonus and a fee.

Calls by an influential government body to abolish the Lifetime ISA have put the future of this government savings scheme under doubt.

How much can I put in an ISA?

You can put up to £20,000 into your ISA each year, and any growth in the value of your money and any income can build up tax free. There’s no lifetime limit, which means you can make your money go further over the long-term.

The annual allowance is flexible, and you can put money in and withdraw it within the financial year and it won’t affect your annual allowance.

It’s also a personal allowance, which means a couple can invest up to £40,000 a year tax free. If you don’t want to invest all of your ISA allowance, you don’t have to. You can spread it across different ISAs to make the most of the different financial planning tools available to help secure your financial future.

How many different ISAs per household?

You can have a number of different ISAs per household as there is an ISA to suit everyone.

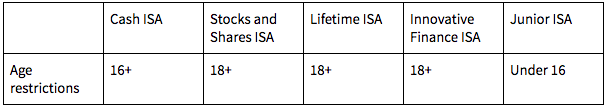

If your child’s under 16 you can put money in a Junior ISA for them, after which they can open a cash ISA (age 16 minimum). You need to be 18 to invest in a stocks and shares ISA, Innovative Finance ISA and LISA.

Essentially, as long as you’re a UK resident, there’s an ISA for you.

Can I consolidate all of my ISAs into one?

If you’ve got a number of different ISAs, consolidating them all into one place can make your investments easier to manage and cheaper to run.

It can be difficult knowing whether you’re on track to reach your goals if your money is spread out across a number of different ISAs. Not only will putting your investments in one place make it easier to keep on track, but you’re also more likely to benefit from the power of compounding.

Compound interest is where the returns your money earns are reinvested and earn their own returns. This can make a real difference with larger sums of money and can maximise your returns over the long-run.