Two commodities have dominated the headlines in 2016: oil and gold.

“Supply-demand imbalance boosts oil prices”

“Uncertainty sparks a rush for gold”

“OPEC’s dire finances fuel oil freeze talks”

How many times have we read headlines like this, this year? Gold and oil have been receiving a lot of attention from investors, and the press, both have been closely watching and discussing performance. But regardless of what comes next for these two investments retail investors need to ensure they invest in a range of assets.

The performance so far

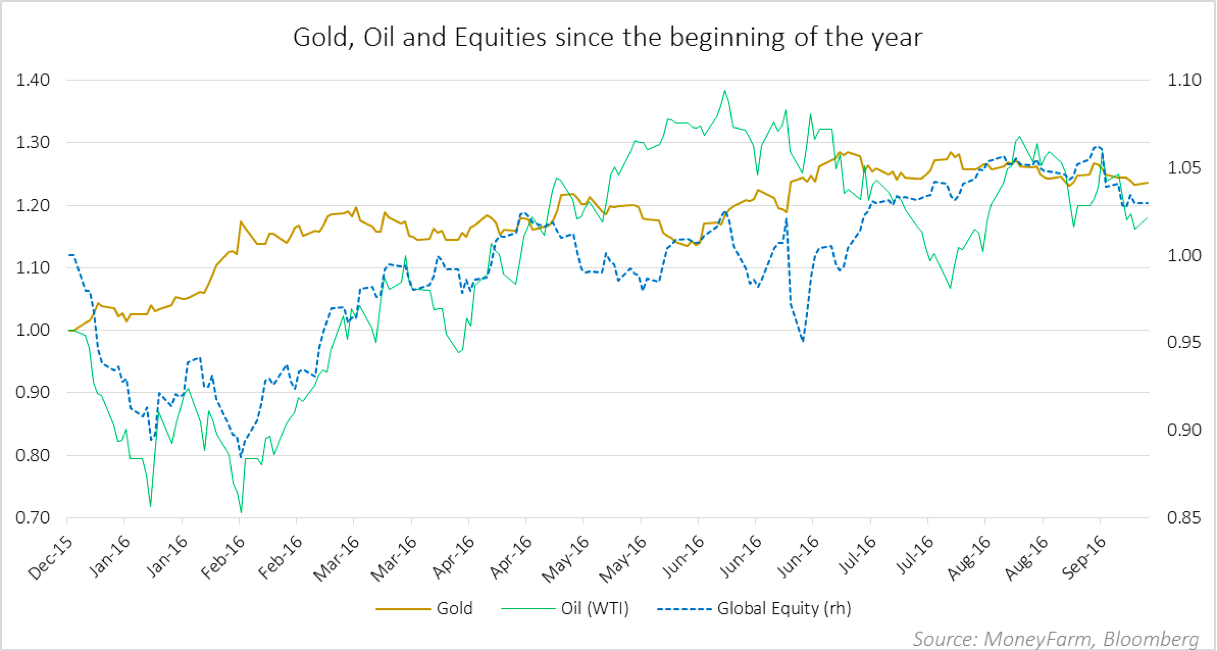

Despite both being included in the broad definition of “Commodities”, gold and oil react in very different ways to the movements in financial markets. Gold has been perceived so far, and is still perceived, as a “hedge” against uncertainty in financial markets. It performed particularly well in early February and at the beginning of July, when the equity markets were suffering the most.

By contrast, oil investments can sometimes have an amplifying effect on the portfolio risk in addition to other risky investments (i.e. equities), as they tend to have a high degree of correlation. In fact, oil was performing particularly well when equity rose, but there was a complete fiasco when equity fell as highlighted in the graph.

The correlation year to date between oil and equity markets has been positive (0.52), whilst the correlation between gold and equities has been negative (-0.32), suggesting an inverse relationship between the two asset classes.

More and more retail investors are moving into Gold ETPs (in USA almost $12 billion has poured into one exchange-traded fund in 2016). Interest was created by the move from ZIRP to NIRP, (zero to negative interest rate monetary policies), ongoing uncertainty surrounding Brexit, volatility during the US presidential election race, and continued concerns about a slowing Asian economy and its impact on the global economy.

What’s next for gold

Global equity markets have rallied significantly over the last five years, and many investors now see this asset class as overvalued. In a scenario of an equity correction towards the downsides levels, gold is still likely outperform, in fact over the past 46 years, gold has outperformed the S&P500 by 45% on average during major market corrections.

Another point in favour of gold is that it was positive seven times out of the past 11 FED rate hike cycles. If we are effectively close to a rate’s hike, fundamental factors such as inflation and capital flows could be supportive of gold.

Last but not the least, a constructive set up for gold in the medium term is favored by an increased risk of capital flight from China as the yuan continues to depreciate and there is a persistence in global uncertainty.

What’s next for oil

For oil the short-term outlook is more hard to assess. The huge supply imbalance has notably reduced and talks between OPEC members (Organization of the Petroleum Exporting Countries) in order to freeze the output are under way, but very high volatility makes a short-term forecast very difficult. Twice this year, in the first quarter and the third, hedge funds and others have taken out record short positions on oil, generating a lot of volatility and making it difficult to have a clear picture of the asset class.

Forecasting the future is impossible

Forecasting the short term is impossible. For every scenario that is supportive of gold and/or oil, there is an event that could generate significant losses. The risk of losing value in an investment portfolio by focusing only on one commodity is very likely, and thus is very important to stay diversified and to mix the portfolio with several asset class for long-term gains.