The British public have voted to leave the European Union. Forecasting what is about to unfold is near impossible, but that does not mean investors should be overwhelmed by the unknown.

On Friday 24 June it was announced that 52% voted to leave the European Union. It could take 2 years for this to become effective and a lot depends on the ongoing discussions between the UK government and Brussels. Nobody has ever exited the European Union before so the shape a potential deal could take is unclear.

The debate that sparked market uncertainty

Since the referendum was announced in February 2016 financial markets in both Europe and across the globe priced the likelihood of BREXIT low. Credit and currency markets showed initial concerns, whilst equity markets and interest rates were hardly affected by the upcoming referendum. With markets in risk-on mode from March to May, the vote remain outcome of the referendum seemed to be more likely.

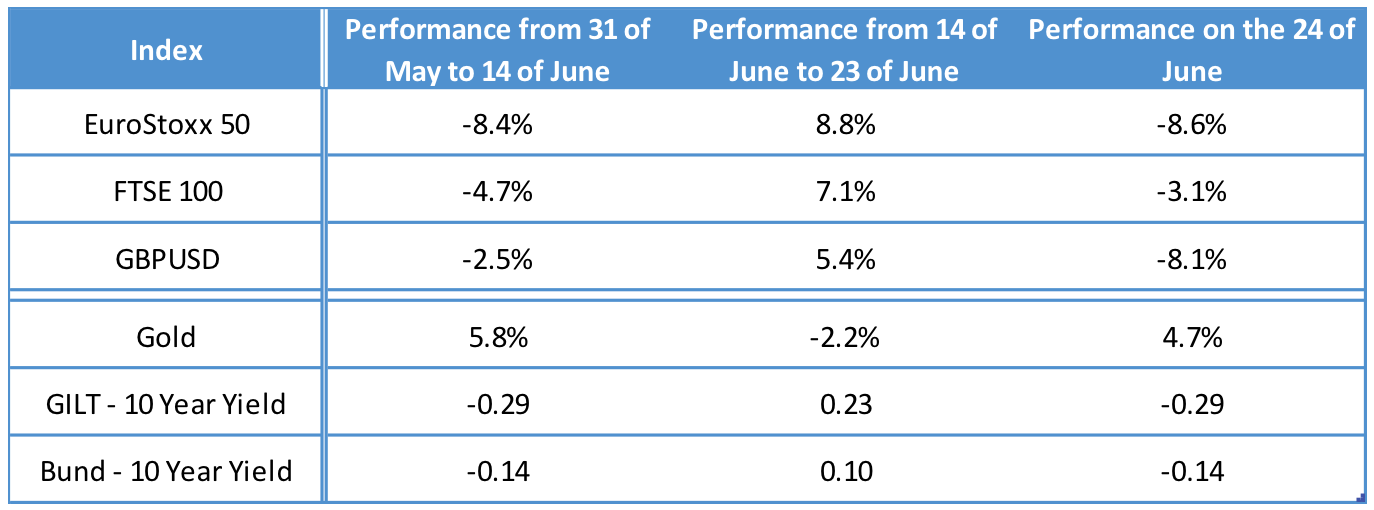

However, at the beginning of June many polls started to suggest there was a slight tilt towards a vote to leave. This struck markets, especially risky assets. Equity markets were initially down and the pound was weaker, as more and more polls suggested a vote to leave was more likely. Then the mood suddenly reversed the week prior to the referendum after the murder of the Labour MP Jo Cox, a strong advocate of remaining in the European Union. As the odds for a vote to remain increased, markets started to bet against BREXIT.

In the early hours of Friday 24 June, markets were proven wrong. As markets opened equity started to drop, not just in the UK but across the world. These were results not seen since the financial crisis of 2008 and for some asset classes the performance reached lows not seen since the 1980s. The markets had switched to a risk-off mode.

Sterling lost 8.1% vs USD, and UK 10 Year Gilt’s yields fell by nearly 30bps, more than the benchmark German sovereign bond’s yield. UK government bonds surged for a second day on 27 June, sending yields below 1 percent for the first time on record. The FTSE 100 was partly protected by the decline in sterling, the biggest pain was reserved for Japan and the Eurozone. The Yen suffered due to the “safe-haven” status of its currency while the Euro was hit by fears of contagion, both economic and political.

This is not the time to panic

Nobody can predict the exact economic impact for either the UK or the EU. There could be a financial crisis, we could face bearish markets or even a possible recession in Britain, it is unclear. Currently the political implications are much more of a threat. The vote to leave could trigger a wave of political instability across Europe that could undermine the European economy.

Spain has kick-started the general election cycle in Europe. The 5 largest Eurozone economies will all be going to the polls over the next 18 months; that includes Spain, Holland, France, Germany and Italy. In October, Italy will hold a constitutional referendum to decide the fate of the current Prime Minister. Outside of Europe the US election takes place in November with polarising candidates that could further impact financial markets.

Those political risks would have generated market concern regardless of the outcome of UK’s EU referendum. There is clearly a level of dissatisfaction with the current European Union, it would be silly to pretend otherwise. Adopting a single currency without harmonising fiscal policies was a bold move and the self-interest of member states has created friction, regardless of BREXIT. Policies of austerity have had a damning impact on monetary union

We are currently dealing with an unknown timetable for the UK’s departure from the European Union. David Cameron has pushed back the timetable for this by resigning and declaring that the next leader will manage the departure from the EU. We may be waiting until October before the newly appointed Prime Minister will decide whether or not activate Article 50.

The UK can, and perhaps will, use the Article 50 notification as a bargaining chip on a number of sensitive issues, there is a probability that it will never be invoked. Is there anyone who would be willing to take responsibility for such a historic and potentially disastrous move?

Markets seem to be reacting in a similar way. If we look at the intraday performance of the FTSE 100, EuroStoxx 50 and GBP/USD rate on the 24 of June, we can see that the losses were mainly concentrated on the first hour of trading, when all the liquidation took place, while for the rest, markets were more in a wait and see mode.

What to expect

The implications for the UK economy are hard to asses. Scotland seems to be considering a second referendum on its independence. With a new Prime Minister not expected until October and the Labour party facing shadow cabinet resignations, there is likely to be further uncertainty ahead. Even the leaders of the leave campaign seem to be reluctant to celebrate.

Political clarity will help to bring stability in the financial markets. What is clear is that there will be huge opportunities ahead for long-term investors, provided they can see beyond the short-term volatility. At times of volatility diversification is key, alternative asset classes will be the key drivers of performance. Our team of investment consultants are on hand if you wish to discuss anything further, they can be contacted on 0800 433 4574.