Please remember that when investing, your capital is at risk. The value of your portfolio with Moneyfarm can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance. The views expressed here should not be taken as a recommendation, advice or forecast. If you are unsure investing is the right choice for you, please seek financial advice.

Last year was challenging for investors. In fact, it was the worst year for financial markets in over a decade, in both bonds and equities. With the Ukraine-Russia conflict ongoing, inflation running rampant, and soaring interest rates and energy costs, it was tempting for many to cut their losses after such a disappointing year. But disinvesting at this point may not always be the wisest choice.

This year’s performance so far, however, highlights the precise reason why staying the course and adopting a long-term mindset is so vital to a successful investment strategy. Here, we’ll take a look at past performance, markets rebounding and the pros and cons of disinvesting, especially after a year of poor returns.

Don’t let your emotions get the best of you

Investing is both rewarding and challenging, especially for those new to it, and one critical decision that we often face is when to disinvest. And the break-even point can be an attractive exit point for many investors after a period of negative performance.

Our decision-making is often driven by emotion rather than reason. Many investors feel a real sense of relief when their portfolio returns to zero after a period of heightened market volatility, as we saw last year. This can easily cloud our judgement when it comes to portfolio management.

But a successful investment strategy requires discipline and a long-term outlook, where your decisions are led by reasoned analysis rather than impulses based on short-term performance.

Realise future growth potential

One of the major drawbacks of disinvesting is not realising the future growth potential that your investment may have. What’s important to remember is that investments tend to fluctuate over time, and the market’s inherent volatility often leads to temporary downturns. For example, in any given 10-year period, we would expect to see perhaps 7-8 years of positive performance compared to 2-3 years of negative performance.

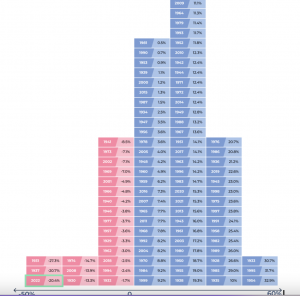

As you can see from the chart above – which shows the annual returns of a balanced investment of 60% US equity and 40% US bonds (Source: Bloomberg) – over the last 92 years (since 1930) 77% of the years were positive and 23% were negative.

So if you’ve just experienced a short-term period of negative returns, by closing out at break-even, you are quite likely to miss out on opportunities for your investments to rebound when markets are gaining momentum and starting to move in your favour. Therefore disinvesting at this stage means potentially sacrificing long-term growth in favour of locking in your initial investment with zero returns.

Timing the market is tough… even for the pros

Timing the market correctly, and consistently finding the ideal entry and exit points, is an exceptionally challenging task, even for the most seasoned traders. One of the major benefits of having a team of experienced portfolio managers managing your investments is that we are constantly monitoring markets, adjusting portfolios and looking to the longer term, to take the emotion out of investing.

By taking a balanced, long-term view, we believe that markets will, on the whole, perform positively given the way our portfolios are composed. Markets tend to move long before general public sentiment improves and these periods after the most difficult can actually be the most prosperous.

Keep a diversified approach

A well-balanced portfolio has multi-asset diversification at its heart. As with marketing timing, we believe a balanced portfolio composition is essential for our clients’ financial success. Disinvesting from a diversified portfolio into, say, a cash savings account or similar product limits your exposure to potential gains and exposes you to higher risks – that is, putting all your eggs in one basket. It’s important to remember that diversification is a fundamental principle for investors and is designed to reduce your risk by spreading investments across various asset classes.

Thinking long-term

Disinvesting at break-even can be tempting for investors who are looking to secure their initial investment. But break-even is just one milestone in a journey that should be centred around achieving your specific, long-term financial goals.

At Moneyfarm, we believe sticking to a well-thought-out investment strategy is more likely to lead to greater financial success than constantly disinvesting and re-entering the market, thus missing out on periods of huge potential growth.

By staying committed to your goals and avoiding impulsive decision-making, you’re more likely to achieve lasting financial success, especially after such a period of poor performance, now that the markets are finally moving in our favour.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.