Alternative investments are any assets that fall outside of the traditional financial instruments like stocks, bonds, and cash. They include investments in hedge funds, real estate, private equity, private debt, precious metals, wine, art, stamps, or cryptocurrency.

Traditionally, alternative investments have been somewhat restricted to high net worth individuals. However, they are becoming more common and mainstream as time goes on – more and more investors are adding alternative investments to their investment portfolios. According to Preqin research, the alternative investments industry is expected to reach over $14 trillion in assets under management by 2023, a growth of 59% from the end of 2017.

It’s important that investors diversify their portfolios, spreading the risk across a variety of asset types. Alternative investments are one way of doing precisely this. They usually have a low correlation with traditional asset types, like stocks and bonds. Therefore, they function as hedges against investments in traditional securities.

Alternative investments can also generate higher returns than mainstream assets. However, it is essential to know that alternative investments have high purchase costs and low liquidity. As a result, an investment strategy that involves alternative assets requires a distinct set of skills, knowledge, and risk tolerance.

Types of alternative investments

There are several types of alternative investments, and they are categorised into two, tangible and intangible investments. Both offer endless investment opportunities from private equity, private debt, derivatives, managed futures, collectables, and commodities. Here are some of the common types of alternative investments.

Intangible alternative investments

Intangible investments do not have a physical presence, you can’t touch them, but they have a monetary value. The most common type of intangible alternative investments include:

- Private equity: Private equity investments are investments in private companies, public companies that intend to go private or are not listed on public stock exchanges. The three investment strategies for private equity include Venture Capital for startups and early-stage ventures, Leveraged Buyouts such as MBOs and MBIs, and Growth Equity such as trade sales, IPO, and recapitalisation.

- Hedge funds: Hedge funds use a wide range of investment strategies to generate high returns on investment. Investment strategies differ depending on the hedge fund managers or firms. Some investment strategies used in hedge fund investing are long-short equity, short only, market neutral, volatility arbitrage, merger arbitrage and quantitative strategies skills. Hedge funds are primarily used by high net-worth individuals and institutional investors such as pension funds and mutual funds.

Tangible alternative investments

Tangible investments have a physical presence. You can touch and feel it. The most common types of tangle alternative investments include:

- Real assets: There are several types of real asset investments. Real assets include real estate, land (farmlands, timberland), utilities, transportation, and infrastructures such as airports and power plants. Intellectual property such as artworks and antiques are also considered real assets. Real estate is the largest asset class, and you can buy investments in real estate through the stock market (REITs) or private investments.

- Commodities: It involves investments in physical commodities or producers of commodities and natural resources. Examples include precious and industrial metals, natural oil and gas, corn, cotton, lumber, etc. Commodities are used to hedge against inflation, and the typical investment strategy is to use commodities derivatives such as swaps or futures.

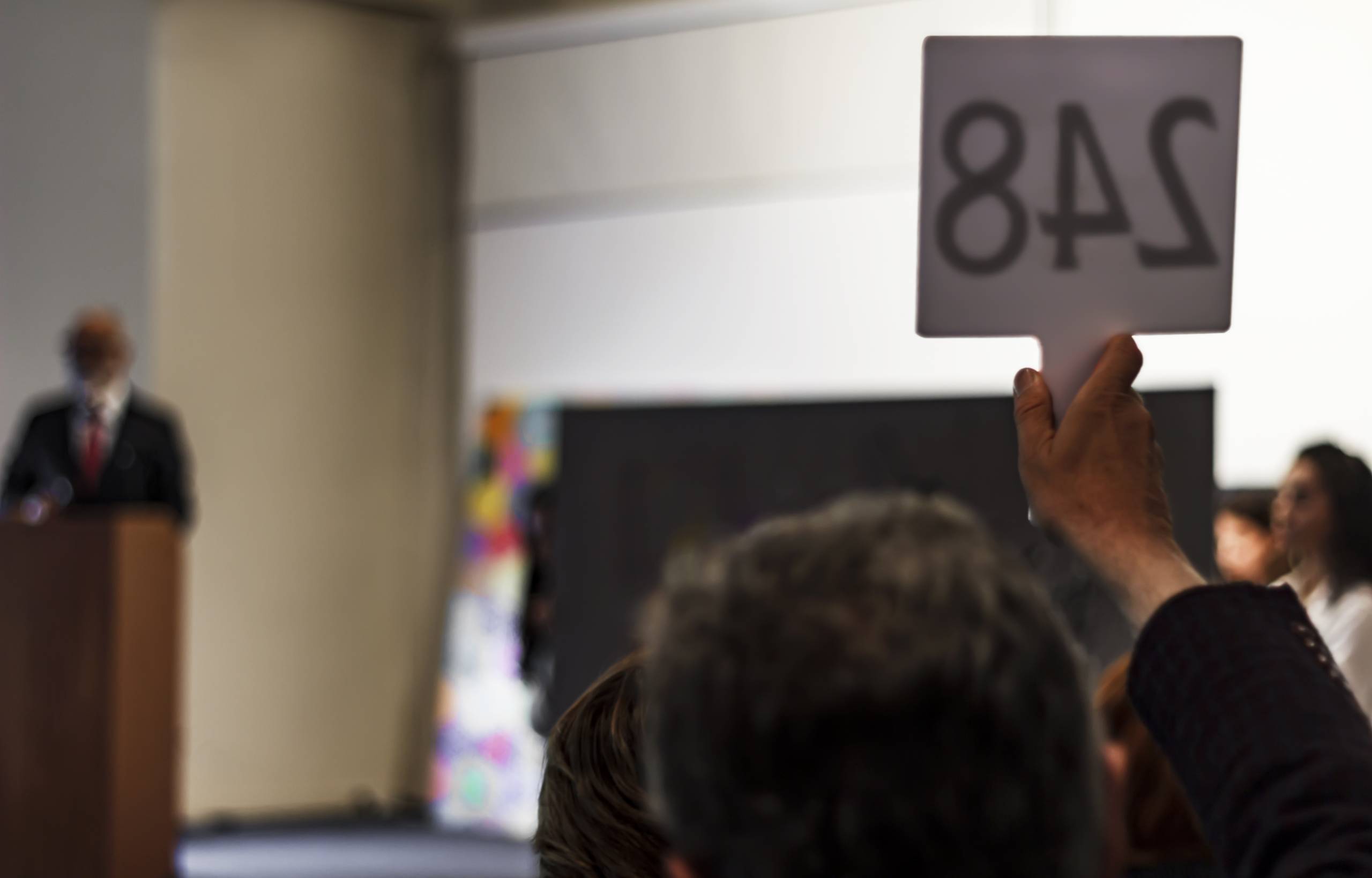

- Collectables: Collectables investments are physical items acquired with the hope that they will appreciate over a period of time. Items include rare wine, fine art, vintage cars, coins, stamps, and sports card collections.

Best alternative investments

Some of the best alternative investments include:

- Peer-to-peer lending: This type of investment entails investors combining funds to lend to individuals. There are several P2P platforms to facilitate the process.

- Real estate: Real estate investments can be residential or commercial. Residential real estate is the world’s largest sector. Real estate investments create equity and a consistent cash flow from rent. An alternative to owning real estate is to invest in REITs.

- Cryptocurrency: This digital blockchain currency has become a trendy alternative investment. Bitcoin and Etherium are easily bought using exchanges like Coinbase. The price volatility is a concern, but it does not negate the fact cryptocurrency holds value, but for this reason it is also taxable.

- Gold: Investment in gold can be physical by buying gold coins, jewellery, and bullion. An alternative is to own gold certificates or invest in gold mutual funds, gold mining stocks or ETFs. Gold is an excellent way to hedge against inflation.

- Equity crowdfunding: Instead of owning your own business, you can own part of a business. You will be rewarded handsomely by investing in a company if the company succeeds.

- Collectables: Commodities like fine art, rare wine, scotch whisky, sneakers, luxury watches and bags, and others are some investment opportunities experienced investors or novices use to diversify.

Examples of alternative investments

Let’s look at some examples of alternative investments that can help understand alternative investing strategies and investment decisions made by investors.

Examples #1

Emma is looking for asset classes and investment opportunities to shield her investments from rising inflation and stock market volatility. After consulting with a financial adviser, she was advised to invest in commodities like gold, oil, grain, and REITs instead of the traditional assets like stocks and bonds. As a result, she decided to invest 10% of her portfolio in some of these tangible assets.

Examples #2

The Venture Capital industry has seen a boom in the UK since 2020. John wants to diversify his portfolio but believes in investing in early-stage companies in return for a stake in a company. However, he is looking for a tax-efficient investment method. So he decides to invest 8% of his portfolio in the Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS), alternative investments UK. These schemes offer tax relief, up to 50% income tax relief and capital gains tax deferral.

Forms of alternative investing vs ETF investing

While different forms of alternative investing strategies may be appealing to investors, they are not everyone’s cup of tea. Investing in alternative assets means high minimum investments, more fees and lower liquidity when compared with conventional financial assets. Moreover, due to lack of regulation, alternative investments are also prone to investment frauds and scams.

On the other hand, exchange-traded funds (ETFs) can be a middle ground between the two. ETF investing is not as traditional as investing in stocks, and it provides good exposure to alternative assets. Investors can also choose to invest in ETFs that specialises in alternative investments. ETF investing offers the best of both worlds by letting investors experience alternative investing without being exposed to illiquidity and other atypical risks – ETFs are regulated and easy to manage and sell.

For instance, investors can invest directly in private equity, but it involves a lot of initial capital, along with high risks and low liquidity. On the contrary, the same investors can invest in ETFs that track the performance of alternatives indices. For example, iShares Listed Private Equity UCITS ETF that tracks the performance of the S&P Listed Private Equity Index or Xtrackers LPX Private Equity Swap UCITS ETF that tracks the performance of LPX Major Market Total Return Index.

Why investing in ETFs is a good alternative?

ETF stands for exchange-traded fund. A fund pools investors’ money and invests it into securities and assets. In the case of alternative asset ETFs, they own underlying assets like gold, foreign currency, cryptocurrency, private equity, or real estate and divide the ownership of these assets into shares. These shares are then traded on the exchange. Thus, these assets become indirectly owned by investors.

Investing in ETFs is a popular alternative to investing in both traditional assets and alternative assets directly for the following reasons:

- Diversification: ETF investing offers similar diversification to the investment portfolio as investing in alternative assets. Investors get exposure to a variety of assets and can spread their risk across different sectors, countries, strategies and asset types.

- Liquidity: Another significant advantage of investing in ETFs is liquidity. ETFs trade throughout the day on major exchanges, just like stocks. Thus, investors can access alternative investments without the risk of getting locked in. They can jump in or out whenever they want to and sell ETFs short or on margin.

- Cost-effectiveness: ETF investing is more cost-effective than investing in traditional assets and alternative assets. Investing in individual stocks leads to an accumulation of transaction fees for each stock, while trading one ETF that invests in a basket of stocks is considered as one transaction. Additionally, ETFs’ management fee and expense ratio are lower than that of mutual funds as ETFs are not actively managed.

- Simplicity: ETF investing is simpler to understand than the complex structure of alternative investing. The design is simple and can be easily comprehended by individual investors without the need to seek professional help. Therefore, the barrier to entry is lower than it is with alternative investing.

How to invest in the alternative investment markets

One of the best alternative investing strategies involves using ETFs. ETF investing is an excellent way to enter the world of alternative investing. ETFs give you diversification, liquidity, simplicity, and cost-effectiveness without the complicated structure and high fees of truly alternative assets. So, they represent effective vehicles for both traditional and alternative investing.

However, ETF investing also needs skills, know-how, and consideration of various parameters for successful returns. Therefore, it would be best if you considered the following factors to have success in investing in ETFs:

- Basic information: The first step to success is simply knowing what you’re investing in. It would help if you looked at which index the ETF is tracking, how long it has been around and how it’s constructed. Knowing whether the ETF is actively or passively managed is also important. Passive ETFs look to match the performance of an index, while active ones look to beat the index’s performance.

- Expense ratio: It is important to consider the expense ratios of ETFs before investing in them. Higher expense ratios may eat into the capital gains and lead to no gains. Therefore, if all else is equal, an ETF with a lower expense ratio will help make more money.

- Build the portfolio based on your investment goals: Another key to success in ETF investing is proper planning. Investors must look at their investor profile, investment goals, time horizon, and risk tolerance before picking suitable ETFs for them.

As a bottom line, alternative investments are excellent avenues for diversification; however, they are subject to a variety of downsides, including illiquidity, lack of regulation, and high initial capital requirements. For those who are not familiar with investments, ETF investing is still considered an alternative but marries the positives of traditional investing with those of alternative solutions.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.