Our investment philosophy is based on one conviction: time is an investor’s best friend. Every aspect of our service, including our market outlook, investment strategy, portfolio construction and products, is designed to help investors protect and grow their capital over time. We believe that consistent investing with a long-term time horizon helps achieve financial and life goals that would otherwise be out of reach. We see three advantages of long-term investment:

1. Greater predictability of asset performance

Although it may seem counterintuitive, making long-term predictions is easier than forecasting short-term asset moves. Let’s imagine tossing a coin that guarantees a 60% chance of winning. If every time we win, we gain 5 pounds, and every time we lose, we lose 5 pounds, the expected return is 1 pound (£1 = £5 x 60% + – £5 x 40%). If we flip the coin just once (i.e., with a short time horizon), the chances of experiencing a significant loss are 40%. The more times we flip the coin, the closer the average gain from each toss will be to 1 pound, which is the expected return.

2. Leveraging the natural growth tendency of markets

The reasoning above can also be applied to financial investments: markets are volatile, and the probability of experiencing a negative period within one or two years is not negligible. However, the longer the investment period, the more the actual return tends to overlap with the expected return. Historically, markets have had a tendency to grow, and we do not believe that this will change.

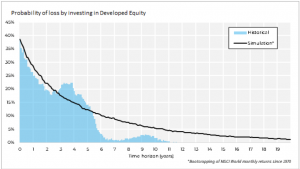

This is precisely the “trick” that makes the coin a winner in most situations. The longer you stay invested, the lower the probability of generating a loss. In the chart below, we simulated the probability of loss after a certain number of years of investment and validated the simulation by adding real data from the past 40 years to the model. As you can see, the longer the time horizon, the closer the probability approaches zero.

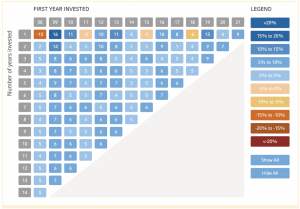

Another way to evaluate this possibility is to observe what the result of an investment over the past 15 years would have been, despite the numerous economic crises that have occurred during this period.

3. Harnessing the power of compounding interest

When investing, if you stay in the market you have the opportunity to reinvest the generated returns. Over the long term, the returns generated from these extra profits tend to surpass the returns generated from the initial investment, with an exponential effect. The compounding of interest can create unexpected growth prospects, but to maximise its effect, one must stay in the market for as long as possible.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.