It is widely believed that higher risk is equal to greater returns. Therefore, by taking on more risk in the portfolio (by buying more equity for instance) one would expect higher returns in the long run compared to investing in lower risk asset classes (such as bonds).

However, investors need to be aware that in the same way that risk can lead to higher returns, it can also lead to higher losses.

Equity is often considered to be the more ‘risky’ asset class, but does it make the best investment in the long term? Let’s for instance look at at equity risk premium – the excess return that investing in the stock market provides over risk-free return such as yield on holding short-term government bonds – it is clear how equities are in general riskier and more volatile than government bonds. Therefore, equity should offer the prospect of greater returns compared to bond investments and compensate for the excess risk that equity investors are taking on.

It is all relative

Investors need to be aware of single country influence. Many studies on equity market returns are based on data from the start of the 20th century. Global equity market performance was largely driven by the US in this period. Over the past century, the US market has somewhat been an outlier in global equity markets.

If investors, at the start of the 20th century, had picked the German market as the destination for their long-term investments, a reasonable choice at the time, they would have seen their assets erased by hyperinflation in the 1920s and by the the two World Wars. If investors had chosen the UK in 1900 as their long-term investment target, their return profile would be very different to that of an investor who had chosen the US markets.

According to a study on long-term investment returns published by academics at the London Business School*, many developed equity markets, including the US, suffered a long period of negative real returns (nominal return – inflation rate) over the last century. It would have been a struggle for most retail investors to wait for a recovery, both financially and psychologically.

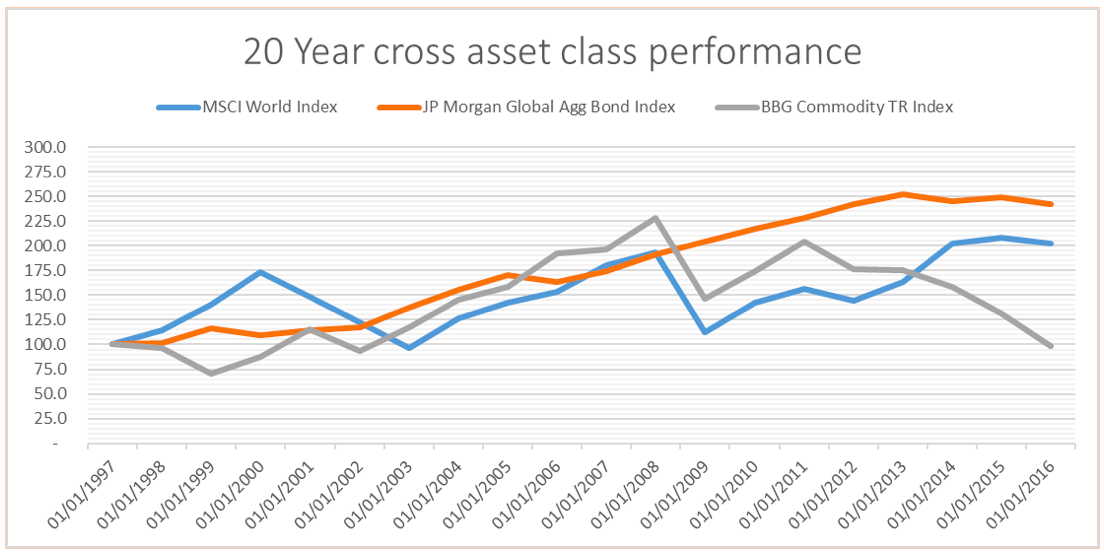

The chart below compares the total returns (including dividend and coupons) from equities (MSCI World), bond investment (mixed of corporate bond and government bond at different maturity) and commodities over the past 20 years. This shows that bonds actually outperformed equities in the long-term, despite the equities recovery after 2009. By picking a different starting point of evaluation, the chart could deliver a very different result.

Do not put all your eggs in one basket

It is reasonable to conclude that equities are not necessarily the best asset class to invest in for long term returns and investors should understand that these can underperform compared to other asset classes. It is particularly relevant for investors who are willing to take on greater risk and have higher equity allocation in their portfolios, as they can be very exposed to large losses when things start to go wrong.

A rational investor should therefore consider factors such as starting valuation (when starting valuations are high, future returns will be lower and the likelihood of outperforming decreases) when making an investment, or diversifying their investment into different asset classes and to have alternative drivers of performance in the portfolio. In the long run, a strategically designed, well-diversified portfolio, is much more likely to prevail than investment into any single asset classes.