If you hold investments in cryptocurrencies, you might be concerned about reports that some experts expect another significant crypto crash as we settle into 2023. The problem is its intrinsic volatility. In this article, we’re going to explore how that volatility could affect the crypto market in the coming months.

Throughout 2021, crypto recorded significant gains and record highs. On 4 December, however, concerns about the crypto marketplace caused a crypto crash that wiped billions of dollars off the various currencies in less than a week. It followed Bitcoin, the leading cryptocurrency, recording a record high in value of over $68,000 in November.

| ❓ What is bitcoins highest price ever? | Over $68,000 |

| 🤔️ Is cryptocurrency a high-risk investment? | Yes |

| ☢️ Why is cryptocurrency highly volatile? | It has no underlying asset |

| 👎 What can cause cryptocurrency to crash? | Supply and demand, regulation threats, negative news, inflation, and fear |

Why is the crypto market crashing?

The latest surprise crypto market crash resulted in approximately $300 billion worth of value being wiped off the crypto market in under two days. But why is crypto crashing? And will it follow the predictions some are making?

The December 2021 cryptocurrency market crash was fuelled by reports of investors ditching mining equipment as China publicised new regulations.

The Central Bank of China has now announced that crypto mining and transactions have been made illegal. According to the People’s Bank of China, overseas exchanges have been barred from providing services to investors based in China. In addition, they have stated that cryptos (including Bitcoin, of course) are not fiat currencies and therefore cannot be circulated.

The reason behind the bank’s move, they say, is to protect the Chinese people’s assets. In a strong statement, they said that virtual currency-related transactions are deemed to be illegal financial activities and will no longer be tolerated.

When will crypto crash next?

The move is made amid speculation that China is attempting to clear a path for a digital currency to be issued by its central bank. The fear to consider is the effect this would have on other world cryptocurrencies if China, the world’s second-largest market, does go down this route. It could signal a crypto crash.

As with anything related to blockchain technology, cryptocurrency predictions are extremely difficult, and we should always avoid speculating with any certainty.

What does the current crypto price crash mean for crypto investors?

It’s not just bitcoin that has suffered. Other significant cryptocurrencies, including Binance Coin, Cardano, Ethereum, Ripple XRP and Solana, have all nosedived. The point is whether investors will hold their nerve or jump ship.

The FTSE 100 crypto index announcement triggers a slight recovery

The nature of volatility in investments is the propensity of the products’ value to ebb and flow. The market staged a partial recovery only a few short days after the Chinese announcement and the cryptocurrency crash. This comes on the back of the news that the company behind the FTSE 100, FTSE Russell, plans to launch a crypto index designed to list and track significant digital assets that will run alongside it.

The value of Bitcoin demonstrated its famous volatility throughout December. Having started the month a fraction under $60,000, the value of one Bitcoin, following the crypto crash after China’s news, saw its bottom at around $45,000.

The 2022 FXT crypto crash

In November 2022, one of the largest cryptocurrency exchanges crashed. The collapse of FTX shook the crypto market and unleashed a wave of fear and uncertainty regarding cryptocurrencies. The FTX crash affected other major crypto exchanges with exposure to FTX crypto assets, and price volatility was seen across major cryptocurrencies on the cryptocurrency market, including bitcoin and ethereum. Crypto investors lost over $3.1 billion.

Now people are calling for tighter crypto industry regulations from US SEC. As a crypto investor, now would be a good time to move your cryptocurrencies into a waller. As sketchy coins flood the crypto market, more crypto crashes are yet to come, so your digital assets knowledge and investment strategy need to be on point.

Should you jump on the crypto bandwagon or not?

Today, at the time of writing, the value of one Bitcoin is $16,274.20. Will crypto crash again? Yes, probably at some point. But if you haven’t invested in it yet, should you?

The fact of the matter is that investing in any volatile product is hugely risky. You can make or lose a lot of money almost overnight. This time, the answer to why crypto has crashed is evident and understandable. Thank you, China and Sam Bankman-Fried (CEO of FXT).

But is the cryptocurrency crash irreversible? No, it isn’t. We will always see a recovery, and it may reach a new record high at some point. The question is, when? And, in the meantime, what will happen?

Will there be an eco-friendly cryptocurrency market crash?

Many investors are now going down the ESG investment road. ESG stands for Environmental, Social and Governance, and it is a trend that is rapidly gaining pace. Some green investors are extending their portfolios to embrace eco-friendly cryptocurrencies like Bitgreen, Cardano, Chia, IOTA, Nano, and Solarcoin. But does the eco-friendly cryptocurrency market crash too? Yes, it does.

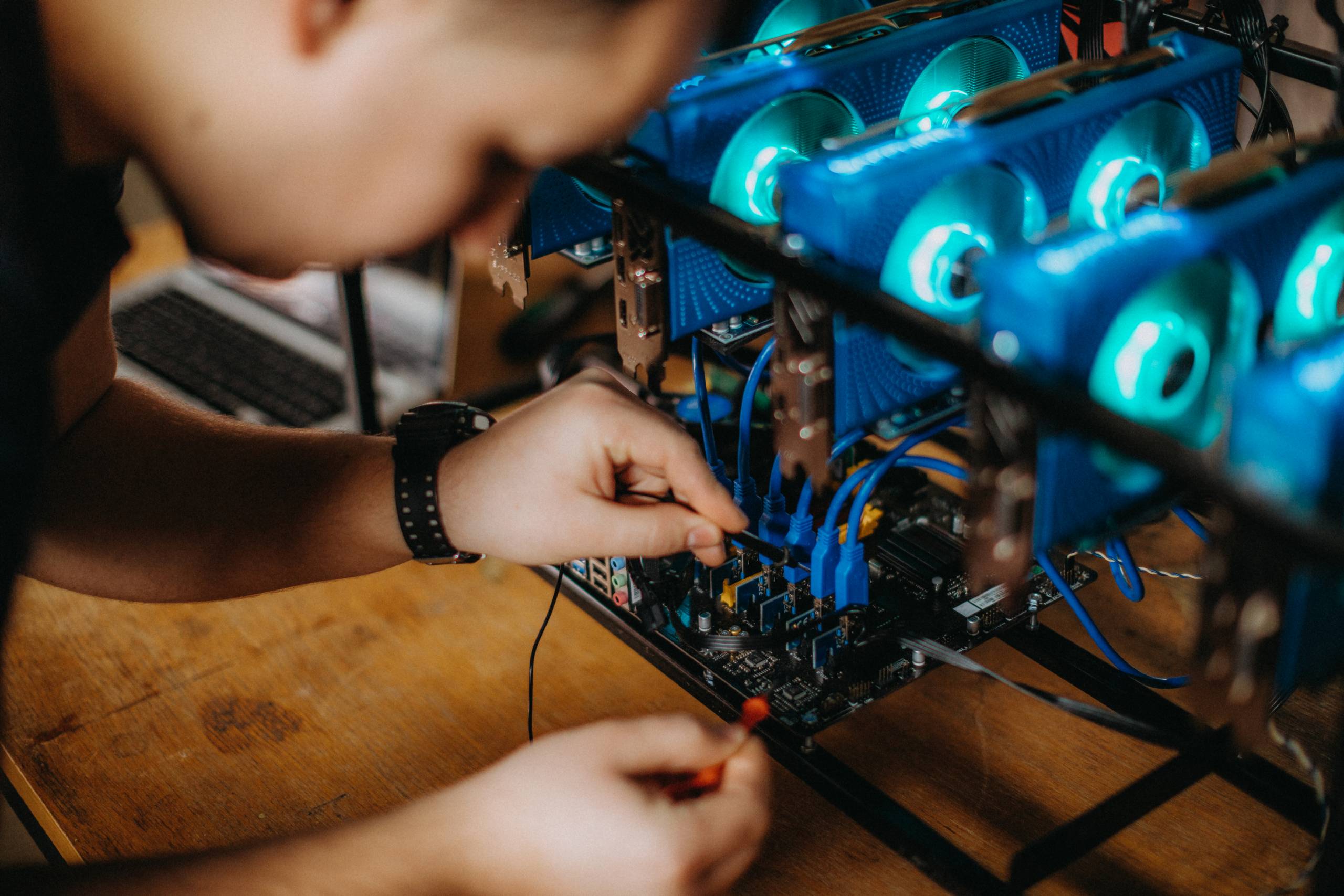

Just like investors turning their back on mining operations that damage the environment and use limited resources, the mining of crypto is said to do the same thing. It is said that it:

- Uses high-powered computers competing against each other to verify transactions in return for coins

- Soaks up large amounts of electricity calculating complex algorithms

According to Cambridge University, Bitcoin mining uses more energy per annum than Malaysia or Sweden.

If this opinion sway continues or magnifies, it could potentially produce another crypto price crash.

Beware offers of free crypto out of the blue

Beware Greeks bearing gifts. That is the message concerning accepting free gifts of cryptocurrency. If you receive an unsolicited offer out of the blue, it is likely to be a scam. Cybercriminals are inventive and always look for new ways of sneaking under people’s guards. The launch of a new cryptocurrency is the perfect vehicle.

It might be a genuine currency – it might not. Worrying about a crypto price crash could be the least of your worries. However, if it is a scam (and many of them look very realistic), you could have your identity stolen or your bank account emptied. So if the offer is unexpected and it’s from someone you haven’t been in contact with, give it a miss.

If you are new to crypto, seek expert advice

If you are considering investing in crypto for the first time. In that case, it will pay to do some research into the question of why did crypto crash on several occasions over the years before adding it to your investment portfolio. In addition, it will give you some idea of just how volatile this type of product is.

If you plan to go ahead, there are two things you should do. The first we have already mentioned, and the second thing is not to invest any money that you cannot afford to lose. Also, to mitigate crypo investment risk, you can invest in a crypto ETF that gives you exposure to multiple cryptocurrencies.

Will cryptocurrency crash again? Yes, probably. But, if you are prepared to invest long-term, you can ride out the lows. It has tended to bounce back over time.

The second thing is to take professional advice. Crypto is still a relatively new investment product; few people are familiar with it and its crypto taxation system. Investing in a product you know little about is foolish, so check out what the experts say.

Should you invest in Bitcoin?

This is a question that only you can answer. Bitcoin is undoubtedly the most traded cryptocurrency, and that speaks volumes. But a crypto crash isn’t selective. It usually affects most currencies because it is the market as a whole that is volatile.

But if you are not risk-averse, you have unallocated funds available, and you are prepared to invest in the long term, it could prove profitable.

FAQ

Is bitcoin a crypto investment?

Cryptocurrency, a digital currency designed to be used as an alternative form of payment, is now being used as an investment vehicle for investors and traders. However, due to its extreme volatility, it may create a lot of financial uncertainty. Therefore, before investing in crypto, it is best advised you consult a professional financial adviser.

What factors affect cryptocurrency prices?

Several factors affect the price of cryptocurrencies. They include supply and demand of cryptocurrencies, investor sentiments and expectations, monetary policy, geopolitical decisions, economic conditions, government regulations on cryptocurrencies, and cryptocurrency competition.

Other cryptocurrencies apart from Bitcoin?

Although bitcoin is the most popular cryptocurrency, others are just as important. They include Ethereum, Tether (USDT), USD Coin (USDC), Binance Coin (BNB), Binance USD (BUSD), XRP, Dogecoin (DOGE), Solana (SOL), and Polkadot (DOT).