Today the Organisation of Petroleum Exporting Countries (OPEC) has agreed to cut oil output. OPEC is made up of all the main oil producers in the world, and they have agreed to reduce OPEC oil production by 32.5 million barrels a day, this is equivalent to around 4.5%. Markets have shown early signs of a positive reaction to this news; Brent was up by 6.94% by the close of UK markets.

The oil challenge

Over the last few years we’ve had an over-supply of oil, this meant that more oil was produced than was needed. Markets have seen a drop in oil prices, and there have even been rumours of floating storage as there wasn’t space for the oil barrels on land.

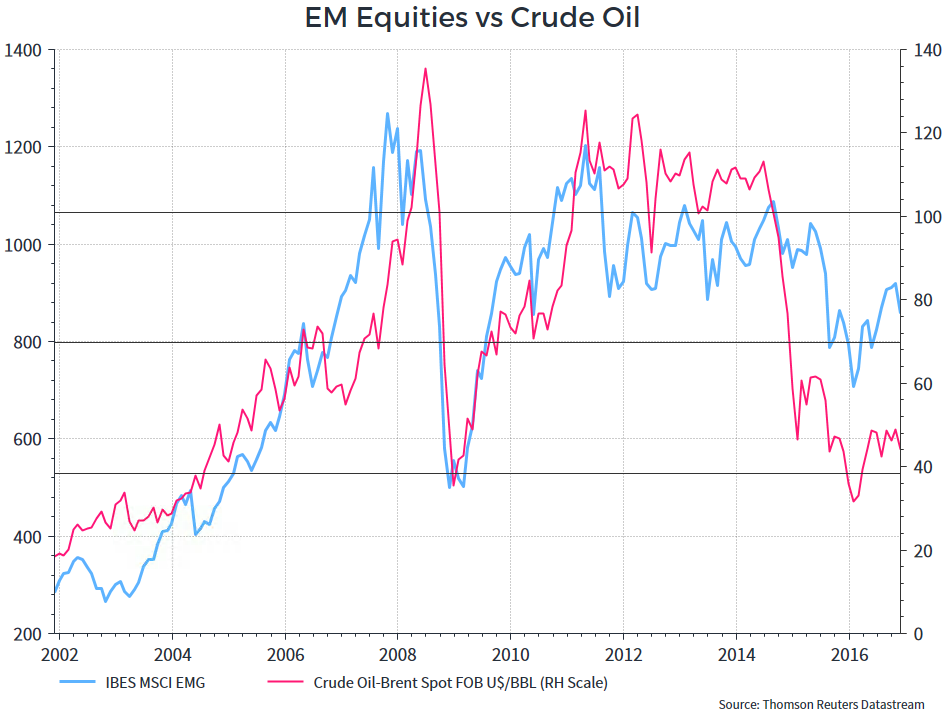

Besides the potential environmental risk this created, this also led to volatility in the oil price which spilled into other markets. The change in oil price has been one of the main drivers of equity performance this year and you can see a huge correlation between the rise in oil price and the rise in equity.

This is most evident in the emerging markets because they are often large exporters of oil. In global emerging markets energy is one of the main categories of the index. As you can see from the chart, over time the performance of each index has moved in-line with one another.

How could the OPEC announcement impact investors?

Ultimately, if you are mainly concerned about the price at the pump this may not be fantastic news. If the new price sticks, the price of petrol is likely to increase over time. However, the freeze in fuel duty announced in last week’s Autumn Statement will mean the impact of this is more muted.

It’s important to remember that most UK pension funds have exposure to the large UK oil companies, namely BP and Shell. An increase in the price of oil is good news for these organisations and could provide a boost to pension funds. Given the correlation between oil and equity this could also be positive for those investors with a diverse investment portfolio.

Much of the impact of this announcement will depend on whether the price sticks. It will be interesting to see how quickly investment goes back in to the oil sector. As the price decreased many oil rigs in the US closed down. Since many rigs in the US are onshore it is fairly easy to reopen these as you can start drilling more quickly, and they fall outside of OPEC, if these rigs are reopened then supply could start to creep back up.