Recent market volatility has meant that many investors are neglecting one of the most important economic indicators: inflation.

Since the financial crisis of 2008, investors have been looking at their radars trying to spot the next meltdown. There is a lot on the line in 2016. China, which helped maintain developed economies after the crash, is beginning to slow down and investors are looking for the hard landing. India seems to be the only relatively reliable investment opportunity of the BRICS; there’s uncertainty surrounding Russia and Brazil is in the midst of what Goldman Sachs describe as an “outright economic depression”. Added to this, the 2015 stress in the high yield debt market prompted fears of further widening of corporate spreads, one of the key indicators of an economic crisis.

What is inflation and how does it affect investments

Inflation measures how the price of a basket of goods/services has moved over a period of time (usually one month or one year). It allows consumers and savers to see how their purchasing power has changed. Economists use inflation as an indicator of economic health in a country and investors look at this carefully as it tells them what the real rate of investment has been.

When we look at the return of an investment, we usually consider the nominal return, but an adjustment should always be made to account for the impact of inflation. If we take the 10 year Brazilian Government Bond that provided a nominal yield of around 16%. That sounds like quite an attractive return, however, Brazilian inflation is now at 11%. This brings the real return of the bond to 5%.

Inflation can be measured by looking at the variation of different price indexes, depending on the goods/services included in the basket. A common measure is the Consumer Price Index (CPI), which includes consumer goods and services such as petrol, food, clothing and cars. Another popular index is the Producer Price Index (PPI), which measures the average change in selling prices by domestic producers of goods and services. CPI measures price change from the perspective of the purchaser and PPIs measure price change from the perspective of the seller.

Why inflation is important

Central banks are responsible for monetary policy, having control of the “amount of money” that flow through the economy. Since inflation is a measurement of price changes, and prices are linked to the amount of money in an economy, monetary policies and inflation are closely related.

Understanding why inflation and Central Banks are so closely related allows us to better grasp the importance of inflation for the current situation. Nowadays Central Banks easing or tightening policies are the main driver of the prices of financial assets; a stronger than expected inflation rate could lead to a tightening of the monetary policies, while a weaker than expected inflation rate could instead lead to a further easing, with deep consequences on markets.

Is inflation good or bad?

From a savers or a consumers perspective a slower increase in price levels could be deemed more appealing. However, inflation affects different people in different ways, and a lot depends on whether inflation has been expected.

When inflation is higher than expected, creditors lose and debtors gain. If the lender does not anticipate inflation correctly, uncertainty about what will happen next makes corporations and consumers less likely to spend and people living off a fixed-income, such as retirees, see a decline in their purchasing power.

Poor inflation may indicate that the economy is weakening or, as with the current situation in Europe, the economy is stagnant. Low inflation could lead to lower interest rates, weakening savings capacity and compromising financial stability. If falling prices endure, then debts, fixed in nominal terms, are harder to pay and a decrease in PPI can also seriously compromise industrial output, since companies sees output decreasing.

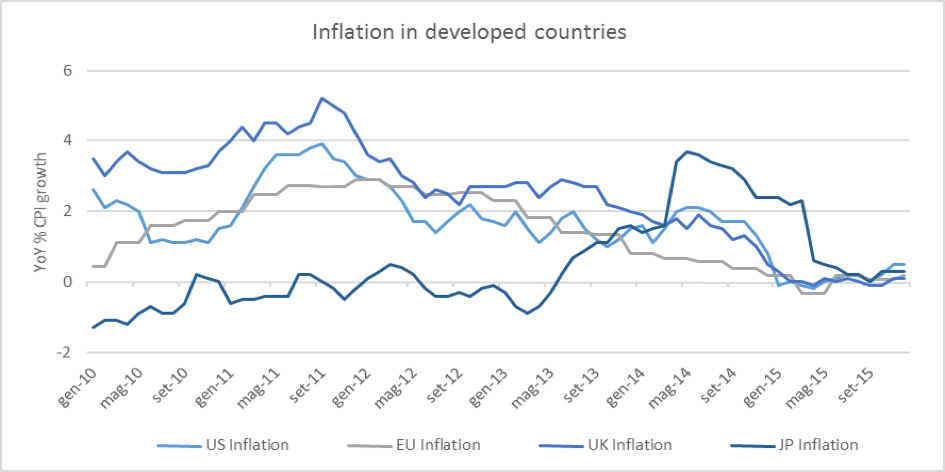

At the moment inflation as a whole has declined in the last year. This is primarily due to the collapse in energy and commodities prices, which are included in the basket used to compute CPI and PPI. Focusing on Europe and Japan, inefficient labour markets are keeping wages low, this forces purchasing power and the overall price level to remain low.

What’s next

The Federal Reserve’s interest rate hike in September 2015 was a good signal. The US reached it’s 2% inflation target and it was expected to be sustainable. The US market is one of the few where central banks have been able to ease off.

Committing to Quantitative Easing and zero (or negative) interest rate policies, from a monetary perspective, may indicate a future pick-up in inflation. Along these lines, we could hope for a rebound in commodities prices, and thus, in Price Indexes.

On the other hand, global growth slowdown, low wage pressure and downturns in retail sales and consumer spending are compromising the rebound in inflation. Slower demand, related to lower growth, could lead to lower wages, and then to lower spending causing lower demand. Furthermore, Quantitative Easing programmes have, up to now, failed to increase inflation through monetary channel, giving few hope for a strong inflationary rebound in the short term.