You have a diversified investment portfolio because, according to modern portfolio theory, different asset classes rarely move up and down in sync with one another. But how true is that? Have the changes in monetary policy in 2016 increased correlation between asset classes and therefore made diversification more difficult, or are you unknowingly creating a portfolio that isn’t that diversified? We explore correlation to see how investors can better manage their wealth.

What is correlation?

In the investment industry, correlation is a measure of how two assets move in relation to one another. This measure is known as the correlation coefficient and will fall between 1 or -1. If two assets have a correlation of 1, they move perfectly in sync with one another. If the correlation is -1 they move in the opposite direction, whilst a correlation of 0 means there is no relationship.

What you have to remember is that no correlation is stable and this has to be factored in when building a portfolio. During certain periods of market stress, correlations between different financial assets can rise or fall considerably, and this instability can cause issues for an investor.

Why is correlation important?

Diversification is a big part of portfolio creation; an investor will typically look to have a range of exposures around the globe, to avoid putting all their eggs in one basket. Owning assets that don’t behave in the same way all the time helps to smooth out returns over time. If assets are perfectly positively correlated they will always perform in the same way, if they’re perfectly negatively correlated they’ll cancel each other out, so you want something that sits in the middle.

There’s no such thing as the ‘ideal’ correlation, ultimately the future isn’t always clear, 2016 has been evidence of that fact. In your portfolio you want a mix of correlations, broadly these would be positive, with some negative correlations.

How correlation changes over time

When you look at a short time frame correlations between different assets can be incredibly noisy. Within a single year they can go from positive to negative, but ultimately this isn’t that useful. When you look over a longer time horizon it is much easier to spot trends.

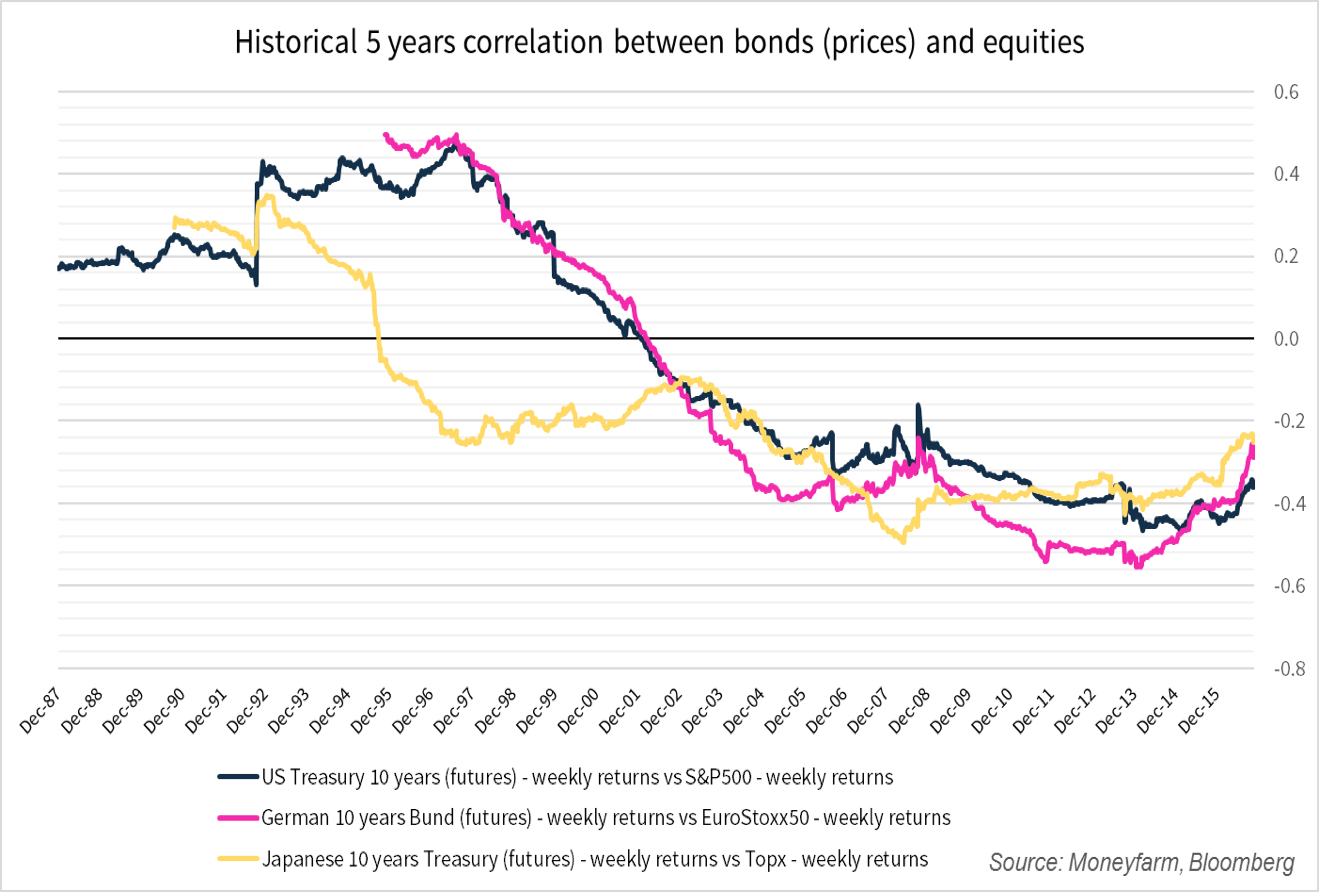

Over the last 15 years the correlation between bond and equities has been negative, this has weakened over the last three years, the relationship is getting closer to 0. This started to increase in 2013, arguably due to the intervention from the central banks. Currently this is good news for investors, as the losses and returns won’t be cancelling each other out, however, if this relationship were to turn positive again this could make diversification more difficult.

A correlation close to 0 suggests very little relationship between the two asset classes which can help with portfolio diversification. As the relationship between government bonds and equity changes, you need to ensure you diversify in other ways, a simple 60:40 portfolio is unlikely to protect your wealth in the same way as a wider investment spectrum.

It is very difficult to find uncorrelated assets within a particular asset class. Often investors willing to take a large amount of risk will flock to equity, and ‘diversify’ by choosing equity from different markets.

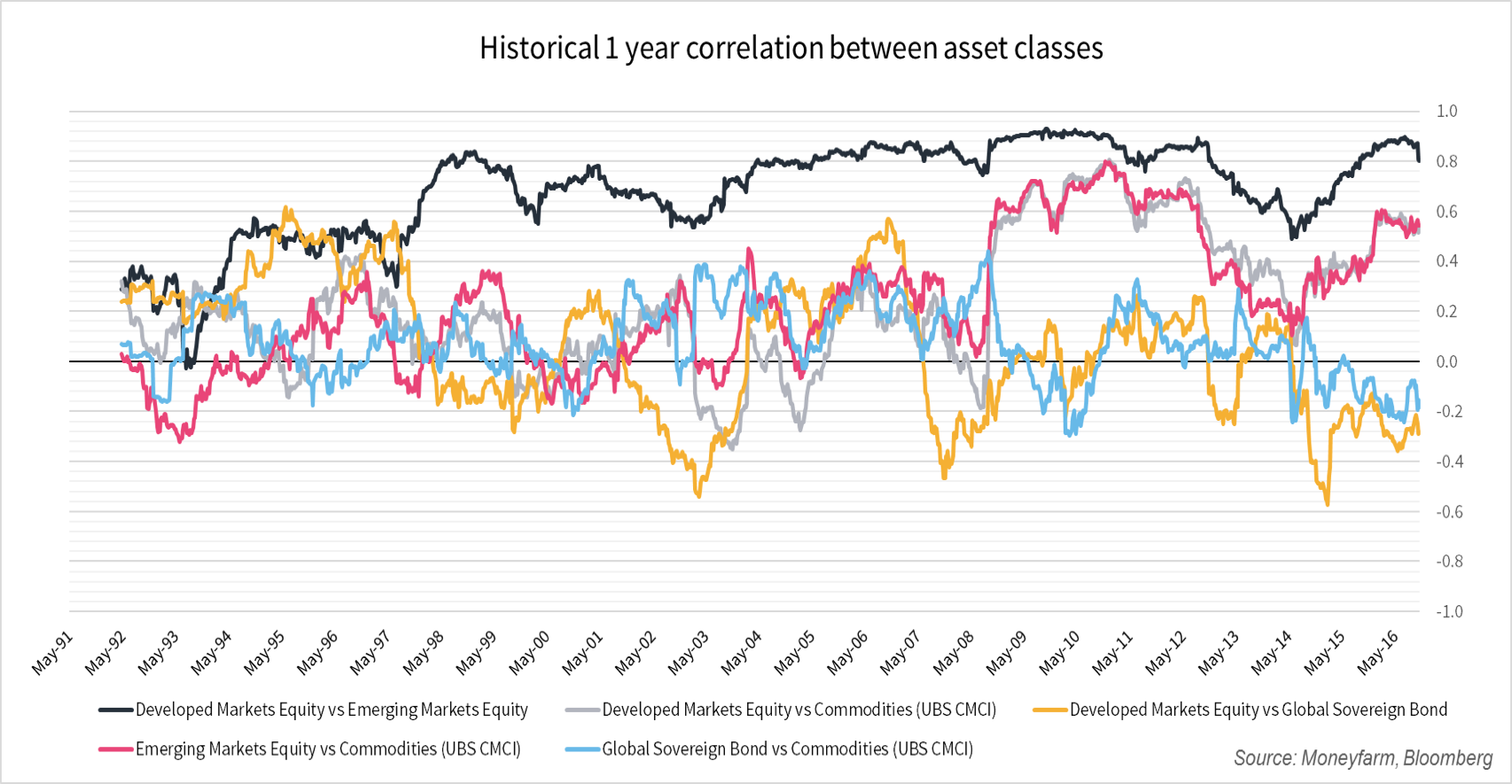

Many would view developed markets equity and emerging markets equity to be diversified because of the different economic environments. But as you can see from the historical 1-year correlation they are close to being perfectly correlated and perform in the same way.

This rush to create a ‘diversified’ investment strategy based on what we know is known as familiarity and poses a risk to portfolio construction. By investing in what you know, not only do you risk missing out on opportunities, but you also run the risk of having overly correlated investments, much in the same way as a home country bias can have a negative impact on your portfolio.

What can investors do about correlation?

To manage correlation, you need to take a longer term view. Over the last 15 years government bonds and equities have been negatively correlated, therefore by having a mix you ensure a certain level of diversification. You do however, need to ensure that you have flexibility, or liquidity, within your investment when macroeconomic trends and investment opportunities change. There is no one silver bullet when it comes to diversification, but ensuring you assess the correlation between asset classes will help you to protect your wealth.