Hope for a strong economic recovery in the Eurozone has prompted investors to seek value investments in this area. Those investors are still waiting for the payoff.

The price level of the main European equity indices is still lower than the highs printed in 2001. In May 2001 MSCI Europe was priced at 122 points, it currently reads at 113 points. However, the price level of an index can be a little bit misleading; it does not take into account dividends paid (Eurozone listed companies have been quite generous to date). Taking dividends into account (the total return of the Index) the situation improves. But when you look at the below chart of developed market indexes, which includes the effect of dividends, it is clear that the Eurozone is still lagging behind its peers.

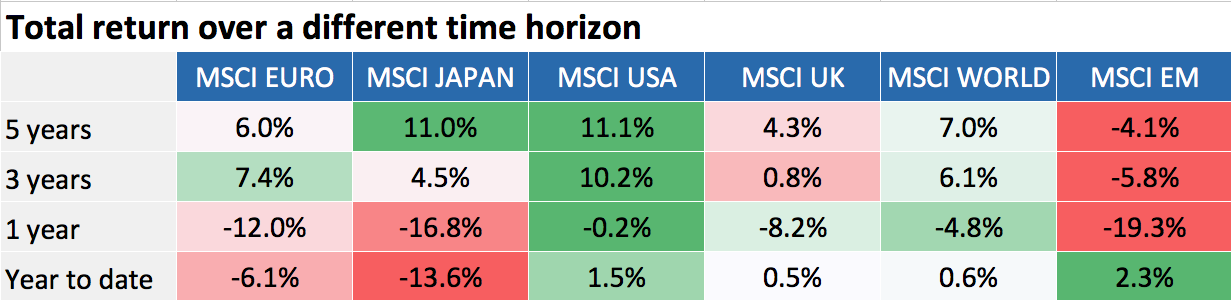

Over the last 15 years, only Japan has performed worse than the Eurozone. The situation does not improve when a different timeframe is examined; the Eurozone has always underperformed against the USA.

Why European equity underperforms against the US

The aggregated Eurozone equity index shows the weighted average of performance of all country-level indexes. Each country generates different returns over the same time horizons. Some countries will negatively impact the performance of the overall Eurozone equity market. But even the best performers in European equity indexes (such as Germany and Netherlands) still struggle to keep pace with US performance.

The difference in sector exposure between the benchmark equity index of the Eurozone and the US also impacts performance. This is most prevalent when looking at industrials (13% in the MSCI Eurozone as opposed to 9.5% in the MSCI USA), financials (21% vs. 17%), banks (11% vs. 6%) and technology (5.6% vs. 12%). The top-heavy cyclical exposure in the Eurozone translates to a much greater variability in profit margin. The overweight of banking sector in an era of high regulation and low-interest rates has not helped, along with underexposure to technology, which has been the best performing sector in the last 3-5 years.

The US has recently been dominated by “growth stocks” (stocks with a high Price to Earnings ratio, low dividend yield and higher growth prospects), whereas “value stocks”, (stocks with low Price to Book value, high dividend yield and thus more appealing valuation) have had a more dominating presence in European equity market. This has dragged European performance. The key driver of Eurozone underperformance is political fragmentation and the uncertainty that surrounds the European Union. The lack of a common view on the fundamental topics like foreign policy, fiscal policy, refugees, along with separatist forces, cast a shadow of uncertainty and weakness over Europe, which is proving to be unsustainable.

Now could be the time to invest in Eurozone equity

At the moment, the Eurozone is more appealing to investors than the US market. Price to book values in Europe are still in line with the historical average and lower than the 2006 level. Estimated price earnings for the Euro area is slightly higher than the historical median. By contrast, the US equity market is relatively more expensive. Given the low rate environment, the dividend yield is higher in the Eurozone (3.8% vs. 2.2% in the US market).

From a macroeconomic perspective the still-weak euro, low oil price and the European Central Bank reflation policy are all positives for the Eurozone economy. While US GDP growth has been revised down recently, the Eurozone growth remains resilient. Numbers in the coming weeks will provide further clarification on the momentum of Eurozone economic growth.

The European Central Bank reflation policy should also support cyclical stocks (buying cheap stock from a fundamentals perspective). Now is a good time to buy this value stock as bond yields are bottoming out. Value investing has recently started to outperformed growth stocks in both Europe (+1.8% over the last month) and Global indices (+0.6%). Fading deflation fears combined with more central bank easing should support further outperformance of the value stock, which is trading at an all-time low valuation discount (65% in price to book value). A low yield environment could also favour high dividend stock, the real alternative to high yield bond.

A few considerations when looking at Eurozone equity

The political outlook has never been so uncertain in Europe. The referendum on the European Union in the UK has had disrupted policies aimed at European integration, which is now politically difficult to achieve. The revision of the regulatory framework of the banking system, the immigration crisis and the massive amount of public debt in some countries are all still on the table.

We can expect an extremely politically eventful summer in Europe; this could quickly drag up the mild growth which has been achieved so far.