Planning for a long-term financial goal, like retirement, buying a new house, or paying school fees, should be an exercise that we must take care of early in life. The different implications (how much, when, in which instruments, tax implications, etc.) will demand a detailed and regular assessment, at least once per year.

It is reasonable to assume that our personal circumstances could change (different salary, new family member, inheritance received, the need to access the funds, etc), and the need to adapt our plan would arise in order to achieve our financial goals. Thus, we would be in a position to mitigate the uncertainty and obtain peace of mind

Every situation is unique. After all, you may have specific ideas about how you want to spend your retired life. This is why it’s important to have a plan designed specifically to suit your individual needs.

At Moneyfarm, we are conscious that planning for retirement can be intimidating as it requires us to be up to date with important information, such as fiscal policies, and to have access to specific planning tools that can help illustrate lifetime cash flow scenarios.

Embedding cash flow tools into the financial planning process is extremely useful for gaining insight into whether you’re on the right path to achieving your saving goals. However, it should not be the sole tool used, as a comprehensive financial plan requires a broader range of strategies and tools to address all aspects of financial health.

Regardless of the complexity of your particular financial situation, planning could allow you to have a clear forecast of your retirement needs, helping to map out certain life events and goals on a visual timeline.

Common concerns

Have you ever asked yourself:

- What investments do I already have that will support my retirement?

- How much can I invest?

- Can I consolidate previous pensions?

- What level of income do I want, or need, in retirement?

- Are my current investments appropriate for my objectives?

- What level of growth do I need to achieve a certain amount?

- Will I run out of funds?

- Can I simulate different scenarios, like a market crash, variable growth, and inflation rates?

If you can relate to the above questions, the proper use of a planning tool can help you visualise your individual circumstances and goals with the aim of making better-informed decisions.

Things to consider when planning

Planning reduces uncertainties and helps us achieve our goals. In my experience, people are more likely to work with a plan they know and understand.

Basic steps to consider when setting a plan:

- Evaluate your current financial situation

- Understand how much income you need in retirement

- Assess the amount and regularity of contributions you would need to make in order to achieve that specific goal

- Identify your income options

- Assume different scenarios (suitable level of growth, average inflation, ‘stress test’, meet a specific goal, etc).

- Take action and make regular reviews

The benefits of planning

- Planning can help you determine an adequate level of contribution to help you meet your particular goal and at the same time assess the possibility of additional contributions in order to maximise the possible final amount.

- Good planning will allow you to keep track of all your current and future expenses, making decisions accordingly and ensuring these expenses will be covered.

- By planning you can assess a possible ‘market crash’ which could affect your income needs.

- Planning is essential for any individual, and the lack of it may lead to uncomfortable situations. One benefit is that it helps you analyse different performance scenarios, which can help you visualise your goals.

- It will also enable you to prepare financial budgets for the years to come, keeping cash reserves and avoiding overspending.

- Without a plan, you won’t be able to monitor how much you need to contribute or what level of growth you would need to achieve a specific amount.

- Analysing your particular situation can help you determine whether your financial condition is stable, or shows an excess or shortage.

- Thanks to planning, you gain control, monitor your spending, determine your liquidity, and assess regular changes and growth assumptions to ensure you will have sufficient cash reserves in case of unexpected events and stay on track with your goals.

Visualising your future with different scenarios

We have used the FE CashCalc tool to illustrate all the examples below, which contain a lifetime cashflow forecast. FE CashCalc is the cash flow planning tool provided by FE Funfinfo which allows us to analyse specific assumptions of incomes, expenses, savings and investments to illustrate whether the simulated financial objectives are achievable, and how certain decisions will be likely to affect a plan in years to come.

Several assumptions have been made, including an expected rate of inflation and an estimated investment return rate, as well as a hypothetical tax position. In reality, these figures may fluctuate and have a significant impact on the final results. There are many other ways to set up your plan with different cash-flow tools adapted to your own circumstances.

We have assumed a growth rate of 7% which represents the annual average return for our P6 portfolio since January 2016.

Past performance is not a reliable indicator of future performance.

Example

Max is 40 and has two daughters who are five and eight. Max has £100,000 in a pension from previous jobs.

He earns £100,000 a year and spends £78,000. He wants to help his daughters by maximising their Junior ISA investments each year until they turn 18.

He also wants to contribute to his own pension (SIPP) to reach £500,000 by the time he retires at 68. He plans to invest for 28 years.

In the first scenario, whereby Max takes no action, it shows that he would run out of money by age 85.

However, according to our calculation, if he invests his extra income each year, assuming an annual average growth of 7%, he could potentially avoid running out of money and extend his savings beyond age 100, depending on market performance.

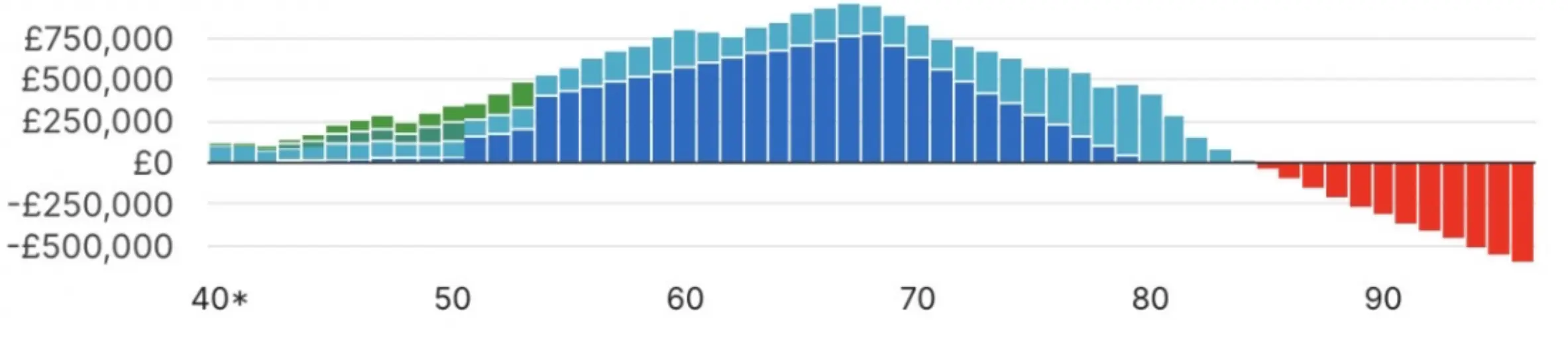

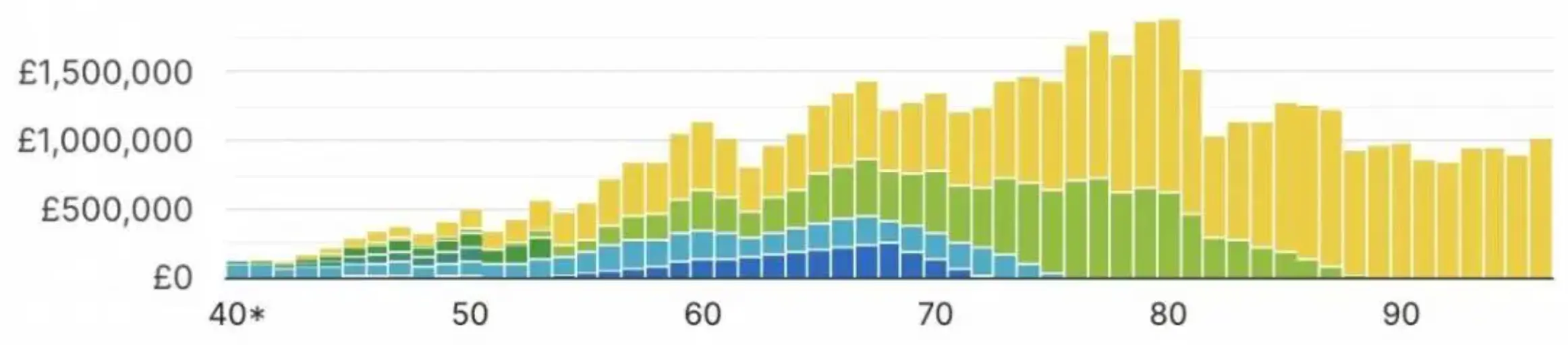

The charts below help us visualise the difference between inactive and active investment over time and the effects of each. Note the deficit (in red) after the age of 85 if not investing at all.

(Whereby the blue bars represent Max’s current account, the Turquoise his employer’s pension contributions, and the Racing green and Dark green represent Charlotte and Lily’s JISA contributions, respectively. The red bars represent the eventual deficit after reaching 85.)

(This example demonstrates the effects of active investment over the same period of time, assuming 7% growth rate, showing no deficit after 85. Blue – Max’s current account; Turquoise – employer pension contribution; Racing green – Charlotte’s JISA; Dark green – Lily’s JISA; Light green – Max’s ISA; and Yellow – Max’s personal SIPP)

By using cash flow scenario tools, you could also assess adverse situations which could allow you to evaluate how a big ‘market crash’, like the one in 2007-2009, could affect your retirement plans.

The example above is a hypothetical situation, and each person’s circumstance is unique, that is why it’s fundamental to get professional advice when planning for the future. No advice was intended when providing these examples.

Conclusions

- Planning is crucial to achieving your big goals

- The earlier you start, the better

- Every situation is quite unique

- Work out how much income you might need in retirement

- Assess different possible scenarios

- Take action and make regular reviews to adapt your plan

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.