There are a number of financial faux-pas you can make trying to protect your money during periods of uncertainty. The most common is forgetting that it’s time in the market, not timing, that can help maximise your returns over the long-run.

Volatility is uncomfortable for investors, which is why so many favour the perceived safety of cash during turbulent periods – like at the end of 2018. But cash isn’t as risk-free as it would lead you to believe.

Whilst you might not be directly exposed to the volatility of the financial markets, you could miss out on potential growth in the value of your capital, and inflation could reduce the purchasing power of your money over time.

Put simply, if the returns on your savings account – or investments – aren’t keeping up with the pace of inflation, your money is losing value.

Imagine you had £10,000 and put it in an easy access cash ISA with a 1% return. After one year, you would have £10,100. If inflation reached the Bank of England’s target of 2%, however, the real value of your savings would have fallen to £9,901.96 – below your initial deposit.

As the return from your savings account has failed to keep up with inflation, you won’t be able to buy as much with your money as you could 12 months ago.

It can be easy to forget about the silent threat of inflation on your savings, especially when the returns on cash ISAs are only just showing signs of a recovery from record lows. One way to protect your savings from the eroding nature of inflation is to invest it.

Investing during periods of uncertainty

When looking to invest during periods of uncertainty, it’s easy to think you need a complicated investment strategy to maximise your returns, but all you really need is time.

However, holding your nerve and sticking to your long-term investment strategy when your portfolio value temporarily falls below a level you feel comfortable with can be difficult.

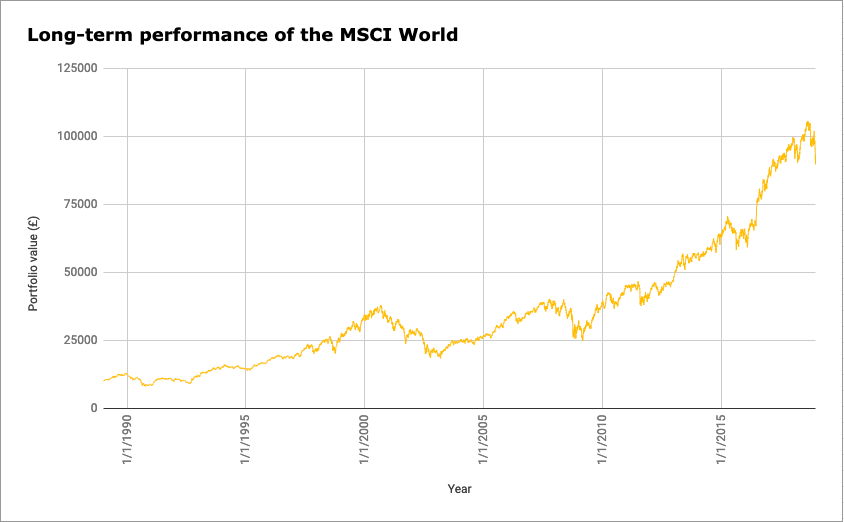

Imagine it’s 1989, and you’ve just invested £10,000 in the MSCI World Index – a list of large market value companies from developed market economies. You’ve got a long-term strategy, and won’t need your money for 30 years.

If you had stuck to your strategy over the three decades, you’d have experienced big market sell-offs in 2000 at the end of the Dot Com bubble and in 2008 during the Global Financial Crisis. These sell-offs left markets feeling battered, so where would your portfolio be today?

If you’d kept your £10,000 invested in the MSCI World Index to the end of 2018? your portfolio would be worth £90,000 – which is growth of 800%.

A long time horizon allows investors to take on more risk with their investments, which increases their scope for return. Whilst higher risk also means the value of an investment has further to fall, the longer time horizon gives investors the opportunity to ride out any short-term fluctuations.

But is time even the unlucky investor’s friend?

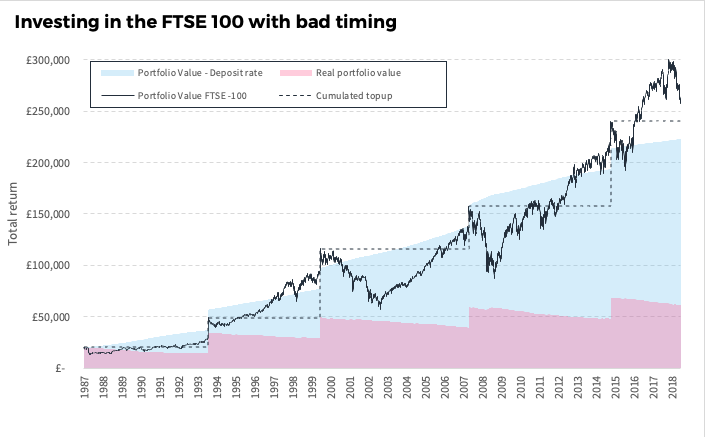

Imagine you felt like the unluckiest investor in the world; you’d invested £20,000 in the FTSE 100 at the peak of each market cycle since 1987 – just before Black Monday in 1987, the 1997 Global Crash, the 2000 Tech Bubble, the 2008/09 Global Financial Crisis, and before the significant sell-off in 2015/16.

The large amount of money you invested over the course of 30 years in £20,000 lump sums would have grown to be worth £262,933 on 31 December 2018. Had you kept this in cash, the real portfolio value (including the impact of inflation) would be just £61,492.

Yet, whilst research shows that longer time horizon can help maximise returns, not everyone wants to invest for 30 years. For some, ten years is a more appropriate long-term goal.

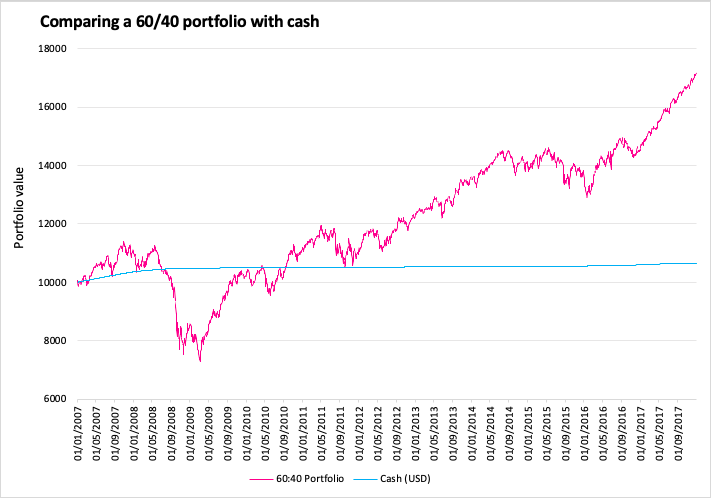

This time, imagine you invested £10,000 in a portfolio with a 60% equity and 40% bond split in June 2007. By March the following year, your portfolio would have slumped by 35% by March 2009. The pressure to sell would be high.

Those investors that surrendered and hit the sell button would have only made that loss a reality. Had they kept their money in cash from the beginning of 2007, they’d be almost 65% worse off over the ten years (in terms of the real portfolio value).

Those that stuck to their investment strategy, however, would have reaped the rewards. Not only would their investments have recovered, but they would have also climbed even higher, returning 70% by the end of 2017.

Investing during uncertainty today

As 2019 gets underway, the uncertain backdrop has the power to distract investors with longer time horizons. Whether it’s triggered by geopolitics – Brexit, trade tensions, the rise of populism – or economic stress, financial markets can easily feel overwhelmed. In this scenario, it’s difficult to see the long-term picture.

Moneyfarm’s investment strategy is based on the belief that a long-term focus increases the likelihood of success. This philosophy translates into an investment process that looks over a ten-year time horizon, accompanied with adjustments made over the short- to medium-term.

By updating the long-term outlook once a year, Moneyfarm gets the opportunity to look above the short-term noise. This year, it shines a light of optimism.

Moneyfarm’s Investment Outlook reflects a significant improvement in the expected returns for Developed Market Equities over the next ten years, with the annualised forecasts rising two percentage points to 5.9%. This is the highest expected returns for the asset class since 2013.

Following the 2018 Developed Market sell-off, most equities are now trading at a discount to historical averages, and we view this as a long-term investment opportunity.

The outlook for Developed Market Bonds has also strengthened over the last year, and this asset class will play an important role in portfolios, however we believe equity exposure will be essential to beat inflation over the long-term.

How to make the most of this opportunity

Whilst time is your friend, expert management of your investment portfolio could help you reach your financial goals within your desired time frame and suitable for your risk appetite.

It’s crucial you invest in the right way for you, and reflect your risk appetite, financial background and time horizon in the make-up of investments in your portfolio.

Your portfolio might still rise and fall in line with the markets, but it should do so at a level you’re comfortable with, which means you don’t feel under pressure to make a knee-jerk decision in the hope of reaching your goals.

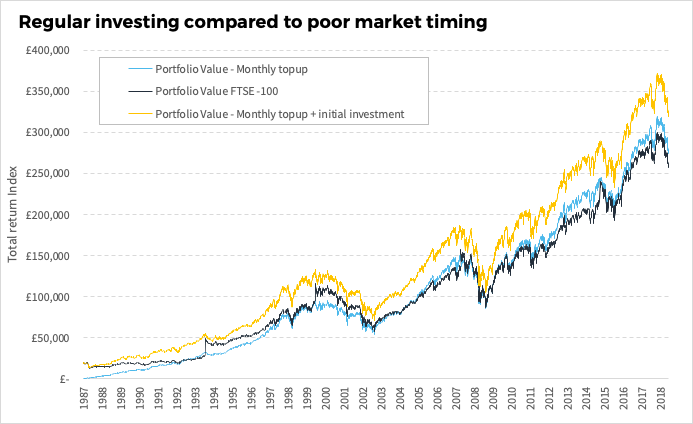

One way investors can manage risk and maximise returns is by setting up a regular direct debit. Investing regularly smooths out the price you pay for an asset. It can lower the amount you actually pay for it during periods of volatility.

Known as pound cost averaging, this simple trick can help maximise returns over the long-run.

Take the example above where we invested £100,000 in the FTSE 100. Had this been split into monthly payments of £269 (instead of £20,000 at the peak of each cycle), you’d have had £279,672 at the end of 30 years, 6% more than the £262,993 you’d have had investing lump sums of £20,000.

Had you invested the initial £20,000 and then set-up a monthly direct debit of £269, you’d have had £326,058 at 31 December 2018 – 24% more than you’d have and investing £20,000 lump-sums.

But setting up a direct debit has more benefits than that, it takes the hassle out of investing for people who are too busy to manage their investments themselves, or just have other priorities.

Our Investment Consultants are here to talk you through every part of your investment journey – whether you have questions about investment advice, Moneyfarm products, or the the decision-making behind our fully-managed portfolios. Technology makes our investment advice cost-efficient; our Investment Consultants make our service work for you. Book a call today or visit the Moneyfarm website.