Richard Flax, Chief Investment Officer, Moneyfarm

You could argue that the past three months in financial markets has been directed by just one subject; the US Central Bank.

In early October, the Federal Reserve’s (Fed) Chairman Jay Powell remarked that the Fed was a long way from neutral rates – where economic growth and inflation is stable. After the expected rate hike in December, Powell said the Fed was still upbeat on US growth, even if market participants were taking their nerves out on the financial markets.

The market vs the Fed

The Fed regularly publishes anonymously where its members expect US interest rates to be over the next couple of years – the so-called dot plots. The chart below compares their forecasts in September and December 2018.

Notably, the median Fed Governor now expects two rate hikes in 2019, down from three in September.

Source: Bloomberg

Compared to the market, the Fed reckons it can maintain its interest rate programme with some vigour as economic growth remains stable. Yet market expectations for the probability of no rate hikes in 2019 has gone from below 20% probability in October to close to 80% today.

So, what’s happened? Well, there’s a certain circularity here.

Investors believe that financial markets are forward-looking – they are, but they can also change their minds. If markets signal weakness, then maybe we should listen.

So far, we haven’t seen much weakness in macro forecasts. The chart below shows consensus expectations for 2019 GDP growth in the US – no sign of weakness there yet. But that makes sense, as forecasts like this will almost always lag.

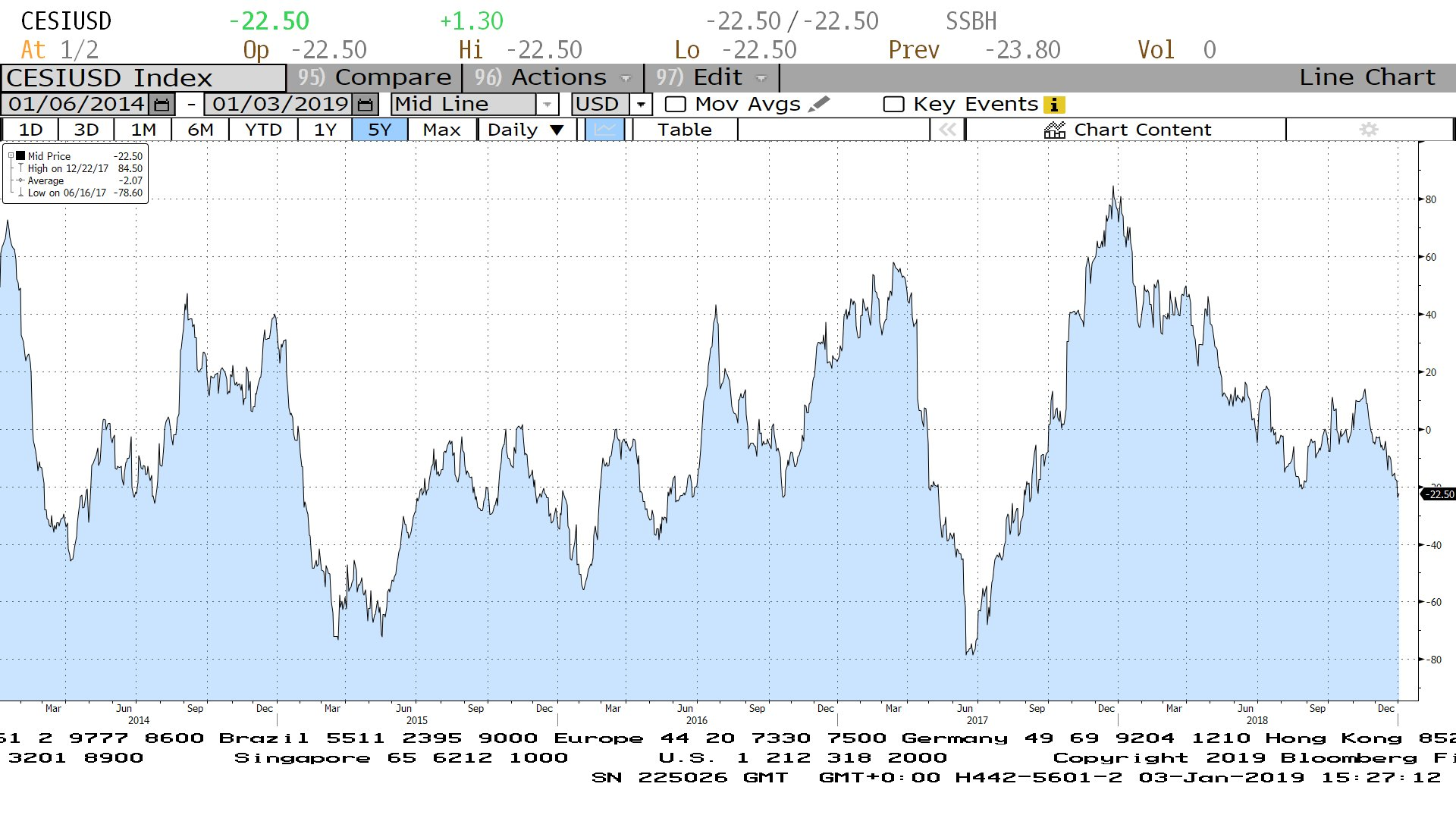

Higher frequency data tells a less robust story. The chart below shows the Citi Economic Surprise Indicator for the US. A negative number means that macro data is coming in weaker than expected. This indicator has turned negative recently, although it hasn’t been a dramatic move.

Source: Bloomberg

There are also inflation expectations, and this is where it gets quite interesting.

Long-term inflation expectations have collapsed in recent weeks. The chart below shows US 5 year forward expectations, a measure of long-term inflation expectations. It has fallen from 2.20% to 1.82% in a couple of months.

The US 10 year yield shows a similar picture, down over 60 bps in the past eight weeks. That should catch the Fed’s attention.

Source: Bloomberg

What does this mean for 2019?

Financial markets are telling you that the economy is weakening, as some macro data begins to soften. The current government shutdown in America will probably exacerbate that a bit, we hope only temporarily.

If we continue to see softer data, the case for two rate hikes this year should disappear pretty quickly.

Our best guess today is that we won’t see two rate hikes in the US this year. That could reassure financial markets, unless the economy really grinds to a halt. If the Fed sticks to its most recent dot plot, however, it’s probably bad news for risky assets.

What does this mean for the way we manage portfolios?

Whilst uncertainty can be uncomfortable for investors, we aren’t changing the way we manage portfolios to try and gain short-term wins.

At Moneyfarm, we firmly believe that to maximise your returns, you need time. A longer time horizon allows you to take on more risk, allowing you to expect larger returns, confident you’ll have the time to see out any short-term fluctuations in the financial markets.

But it’s important you do this in line with your investor profile. By taking your risk appetite, financial background and time horizon into account, you can build a portfolio that reflects you and your goals.

The path to your goals might not be straight forward, but it will be within the parameters set by your investor profile, which will help you maximise your returns over the long-run.