When you’re building the investment portfolio that will help you achieve your financial goals, deciding the right currency exposure for your risk tolerance and investment strategy can be difficult.

Globalisation and advances in technology mean many companies and individuals now own assets – whether business operations, buildings or investments – that sit both in the UK and abroad.

In the 1930s, the Bank of England abandoned the gold standard, so sterling’s value was no longer fixed against gold. Today, the pound has a dynamic relationship with other currencies, which means the value of assets held in different countries can fluctuate.

What is currency risk?

Imagine you run a grocery business with branches in the UK and Europe, and you decide to report your earnings in sterling. Your earnings from the European business total €1 million in both of the first two years.

Sterling is strong at €1.4 when it comes to reporting your first-year results and your €1 million gives you £714,286 when converted into sterling.

The pound weakens to €1.1 in the second year, which might seem like bad news, but actually means you can buy more pounds with your euros. Your €1 million is suddenly worth £909,090, without any uptick in business performance.

How does currency impact equities?

The performance of shares listed on the stock market are heavily influenced by company profit; strong earnings generally underpin share prices, whilst underperformance may trigger a decline. Because of this, currency movements can have a big impact on equity markets.

This is exactly what happened to the FTSE 100 after the Brexit referendum. Sterling collapsed, but because the majority of the UK’s biggest companies generate their earnings outside of the UK, the FTSE 100 index rallied to hit multiple all-time highs.

How does currency impact bonds?

Compared to equities, bonds have limited returns – the principal value repaid in full and any interest accrued over the life of the bond. This means currency volatility can have a big impact on foreign bond returns.

If you invest in a bond that’s denominated in a currency that’s not your domestic currency, you’re exposing your expected return to currency risk.

Say you invest in a sterling denominated bond but your domestic currency is dollar. If the pound falls in value once you’ve bought the bond, your returns will decrease. If sterling increases in value, your total return will improve.

For example, imagine you purchase a one-year bond for £1,000. The pound was strong when you bought it, with an exchange rate of $1.40. This means you paid $1,400 for the sterling-denominated bond.

If the sterling/dollar exchange rate falls to $1.1 one year later, you’ll receive just $1,100 at maturity, making a $300 forex loss.

How can you limit currency risk?

Timing the market to benefit from currency fluctuations is a risky and expensive game to play. With the risks set firmly outside your control, currency can have disastrous consequences if not managed properly.

Instead of exposing yourself to just one currency, many investors prefer to manage this risk by diversifying their exposure. By doing this, you hope that any losses from one exchange will be offset by gains made elsewhere.

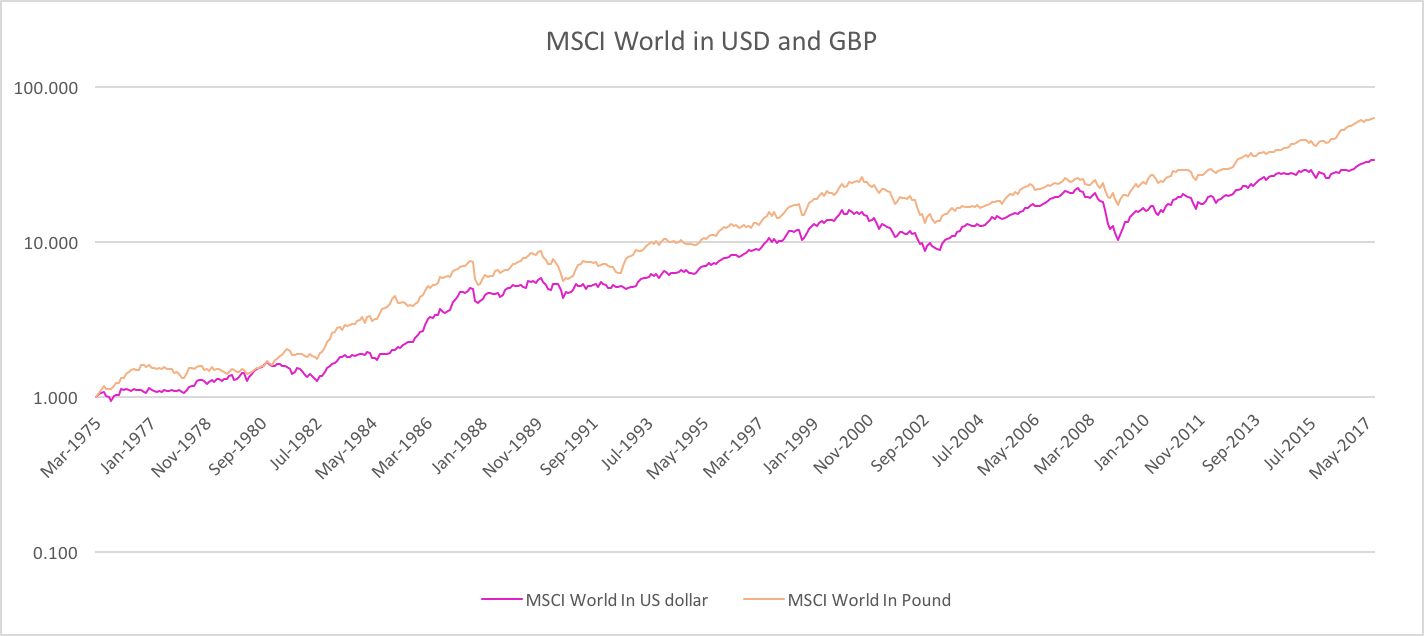

Whilst you can see from the chart that currency weakness tends to recover over the long-term, diversification can limit the impact exchange rate fluctuations have on your money.

Diversification, whether across asset classes or geographies, is a difficult thing to get right. One simple solution is proportionality – allocating currency exposure in relation to the size of the individual regions the global market.

It’s a simple solution, but is not without its problems. As a UK investor, you might have a larger exposure to the dollar because of its bigger hold on global markets.

It takes a lot of time and skill to keep on top of global currency markets, accurately value each investment and spot any opportunities as they arise. It’s also incredibly expensive for investors to do it by themselves.

Hedging your bets

Exchange traded funds (ETFs) are a simple and low-cost option for investors looking for diversification. ETFs track an investment or market, with the aim to replicate its return.

Whilst ETFs do offer diversification, you’ll need a currency-hedged ETF to specifically manage exchange rate fluctuations. You can get these ETFs in a single currency, or multiple currencies, which will focus on a single region or type of company.

The one thing that’s different is the exposure to forward currency contracts – which allows you to lock in a price today no matter currency fluctuations in the future.

Currency risk is cyclical; whilst it can weigh on your returns, it can also enhance it. Strategic asset allocation will look to build portfolios that will benefit from long-term currency trends.

Markets move and opportunities arise, and it’s up to Moneyfarm to identify these opportunities for our investors. Smaller adjustments can be made to the currency exposure in our portfolios in line with our investor profiles, to ensure our investors benefit from these trends and limit losses through volatility.