Ten years on from the last hike and as the UK enters its 100 month of low interest rates, a generation of savers have grown up accepting the measly returns available from cash savings accounts. Post-crisis rhetoric may also be preventing many from seeking a better deal on the financial market, willing to accept uninspiring returns for seemingly reassuring stability of cash.

How far has the interest rate fallen?

The UK bank rate reached 5.75% in the prelude to the global financial crisis, but, as global markets crumbled, the Bank of England’s Monetary Policy Committee had slashed interest rates to 0.5% by March 2009. Headed up by Mark Carney, the policy setters halved the rate to 0.25% after the UK’s vote for Brexit in 2016.

But how has 100 months of low interest rates impacted your savings? Would you have been any better off putting your money to harder work on the financial markets?

Low interest rates mean stifled returns on cash savings accounts – the returns on an easy access cash ISA fell from 2.72% to 0.65% over this time¹, softening in line with the base rate. More importantly, these returns are now failing to keep up with inflation, which reached 2.9% in May 2017². This means any cash sat idly in a savings account is losing purchasing power.

The impact of low interest rates on savings

Say you kept £1,000 in a cash savings account offering a 1% interest rate, you’d have £1,010 after one year. If inflation runs at 2%, the Bank of England’s target, you’d need £1,020 to account for higher prices. As the return from your savings account has failed to keep up with inflation, you won’t be able to buy as much with your money as you could last year.

That’s a simplified example of how interest rates and inflation can impact your money.

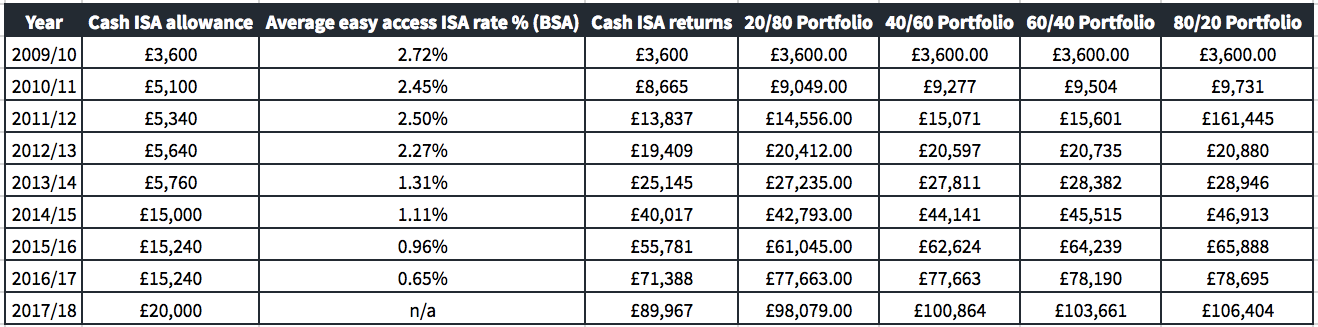

What about if you’d saved your full ISA allowance in a Cash ISA each year from April 2009-April 2017? With the ISA allowance growing from £3,600 to £20,000 over the eight-year period, you’d have put away £90,920 – including the final £20,000 deposit.

Add in the returns from your cash ISA savings account and strip out the impact of inflation, and you would have just £89,967 at the end. Keeping your money in cash might not be as safe as you might have thought.

How to maximise your returns with low interest rates

Financially savvy savers may have looked to put their cash to work on the financial market, trying to maximise their returns during this low interest-rate period with a stocks and shares ISA.

If you prioritised protecting your money and invested in our most conservative hypothetical portfolio with a 20/80% split equities/bonds, you’d have returned 8% over this period, pocketing £98,079 at the end. Equities are viewed as riskier assets with higher potential returns than bonds, which are traditionally seen as safer, but have a limited scope for profits.

As investing is all about balancing risk and reward, adventurous portfolios would hold more equities than bonds, likely in an 80/20 respective split. If you’d invested your ISA allowance in this portfolio, you’d have made 17% over the period – taking home £106,404.

Why understanding your investor profile is important

Looking at these numbers it might seem a no-brainer to opt for the riskiest portfolio for the best returns, but investors view success differently depending on their investor profile. It’s also important to remember that markets were in pain in 2009, bruised from the fallout of the financial crisis. Starting from such a low point will have exaggerated the returns on the markets.

It’s crucial you understand your investor profile before you look to commit your hard-earned money to the financial markets – knowing this is one of the first steps to meeting your financial goals.

Every investor is different; we all have unique goals we’re trying to achieve and on different time horizons. This dictates the level of risk you can tolerate, which impacts what you invest in and what you deem a success. The one thing we all have in common? That we want to protect our money for our future.

1 Building Societies Association

2 Office for National Statistics