2016 was an interesting year for emerging markets, and they’ve started the year as a much talked about asset class. They seem to be correlated with the oil price so that could be good news, but the Trump presidency could undermine this. We lift the hood on emerging markets equity.

What are emerging markets equities?

The emerging markets have been called several names over the years; from developing economies to less developed economies. But perhaps the switch to the word ‘emerging’ reflects the opportunity for growth a little more accurately. An emerging market is defined on the average income per person in these countries, and the extent of political and institutional development.

For an investor, if you own emerging market equities, you own assets in a range of markets. Most notably China, South Korea, Taiwan, India and Brazil.

Investment opportunities in emerging markets

There are three main reasons why people might invest in emerging market equities:

- They have the potential to grow faster than developed markets as they play ‘catch up’, in this situation that could translate to better equity returns.

- They are cheaper than developed markets, perhaps reflecting greater risks today. But as the companies and countries ‘improve’ there’s potential for these markets to trade at higher valuations.

- These markets are less well-covered by investment analysts than developed markets, so there are more undiscovered gems for investors to find.

There are a few criticisms that can be levelled at these arguments. First, the correlation between real GDP growth and equity returns is not very compelling. This partly reflects starting valuations and expectations (notably in the Chinese domestic market at various points). Second, the assumption that countries or companies will improve hasn’t always worked out as hoped.

Recent performance of emerging markets

Over the past five years, emerging markets equities have disappointed compared to developed market equities. According to Bloomberg data, between the end of 2011 and the end of 2016, MSCI World Equities returned 112%, while MSCI Emerging Market Equities returned just 35%.

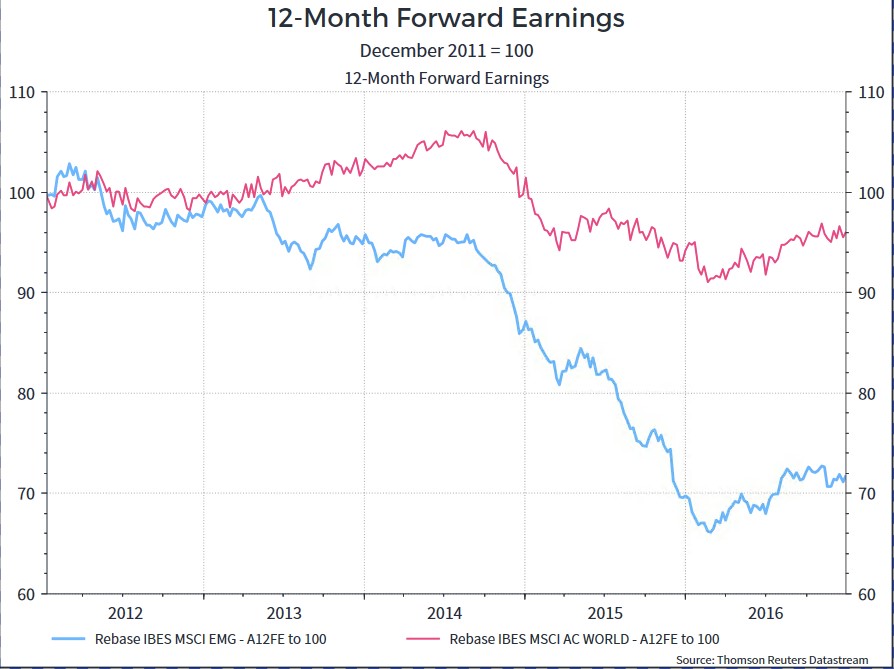

There are a couple of interesting things to look at to explain that difference. The first chart shows expected future earnings over time for emerging markets and world equities. We see that expected earnings in emerging markets have been consistently reduced over time. Weaker earnings help to explain part of the underperformance.

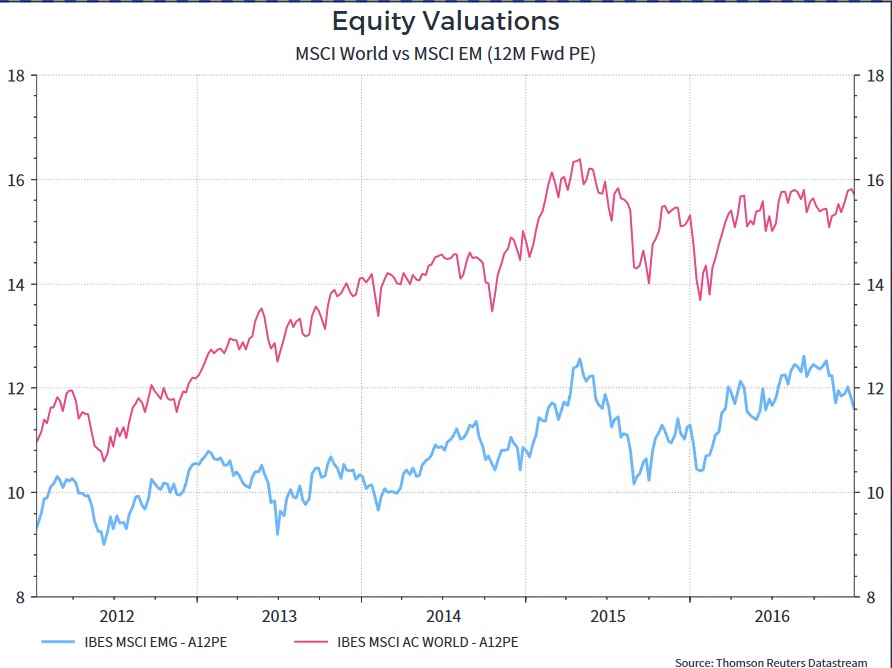

Valuations are another thing to look at. The chart below shows the forward Price/Earnings Ratio for emerging markets and world equities – a common valuation metric. In both cases, we see that the value of that ratio has been rising, but the increase has been less pronounced in emerging markets than world equities. You could argue that multiples like these reflect investor confidence in an asset class, and this chart would suggest that investors remain more sceptical of emerging markets.

What are the key risks?

The biggest risks in emerging markets have been well-flagged. China is a key driver for the asset class, and the world economy. Policy-makers there face several challenges as they address the high debt levels in certain parts of the economy. And some of the rhetoric from Trump in the run up to his presidency, particularly around trade, has raised concerns among some of the more export-oriented markets. If the world is about to grow more quickly emerging markets would be one of the beneficiaries. However, the trade landscape will be key to this.

The future of emerging markets

We’ve seen that emerging market equities have underperformed against the global equity universe over the past five years, and probably with good reason. But maybe things are beginning to improve. The earnings expectations look better for emerging markets over the past year (as opposed to the past five years), which suggests that maybe investors are realistic about the prospects for the asset class. Emerging markets are more lowly-rated than global equities, although they don’t appear extremely cheap versus their long-term history (neither do global equities). Emerging markets equity could be a good value investment for the long-term investor as part of a portfolio built of a range of assets to manage risk.