17 years after the European countries bound themselves together with a single currency, the region still remains vastly divided between a wealthy, economically stable north and an indebted, slowing growing south. Whilst northern nations such as Germany and France enjoy current account surplus, low level of unemployment and a relatively robust economy, the southern peripheral nations such as Spain, Italy, Portugal and Greece generally all have deficits that exceed the EU thresholds and a larger proportion of young people without jobs and savings.

In financial markets, these divisions are particularly visible in the widely different rates paid by the European governments to borrow money. Germany’s benchmark 10 year borrowing rate, also known as yield, is now around a record low level of near 0.05%. The equivalent rate in Italy is 1.43% and 1.47% for Spain. Greece’s government yield reached highs of 18% in July 2015 during the Greek government debt crisis, before calming down to 7.6%, which is still considerably higher than Germany’s cost of borrowing for the same maturity. These higher yields compared to the German Bund return generally reflects the higher risk associated with investing into the peripheral economies.

Peripheral bonds gain popularity in the world of low return

Despite a higher implied risk with peripheral bond investments, many investors seem to think bond markets in the southern periphery of Europe provide more attractive risk adjusted returns compared to other asset classes.

This is not a surprise. Since the last quarter of 2015, weakening global growth, geopolitical uncertainties and central bank policies across the globe have caused a great deal of market uncertainty. This has fuelled strong demands among investors for yield generating and safe haven assets, such as long dated, high quality government bonds.

During its March 2016 policy meeting, the European Central Bank (ECB) decided to increase the scope of its quantitative easing programme by further cutting interest rates into negative territory and adding an extra €20bn a month to the existing bond-buying scheme, which includes Euro denominated investment grade corporate bonds.

Notably, the gross supply of new sovereign bonds in the Eurozone is expected to be €744bn this year, down from €790bn in 2015. ECB bond buying is expected to exceed net new issuance, putting further pressure on yields on the benchmark bond such as German bund.

The ECB isn’t the only central bank that implemented this easing strategy to boost the economy. Thanks to similar accommodative monetary policies employed by central banks around the world, about one-third of the existing Eurozone government bond market already trades with a negative yield and this number is approaching $10 trillion for global government bonds issued. Investors who buy these bonds and hold them to maturity are guaranteed to end up with a capital loss, whilst hoping to profit from selling the bonds on at an even higher price or betting on a particular currency move.

For a positive yield chasing investors, they are left with two options: buy longer dated debt or debt issued by countries with shakier risk profiles, such as those issued by the peripheral Eurozone countries.

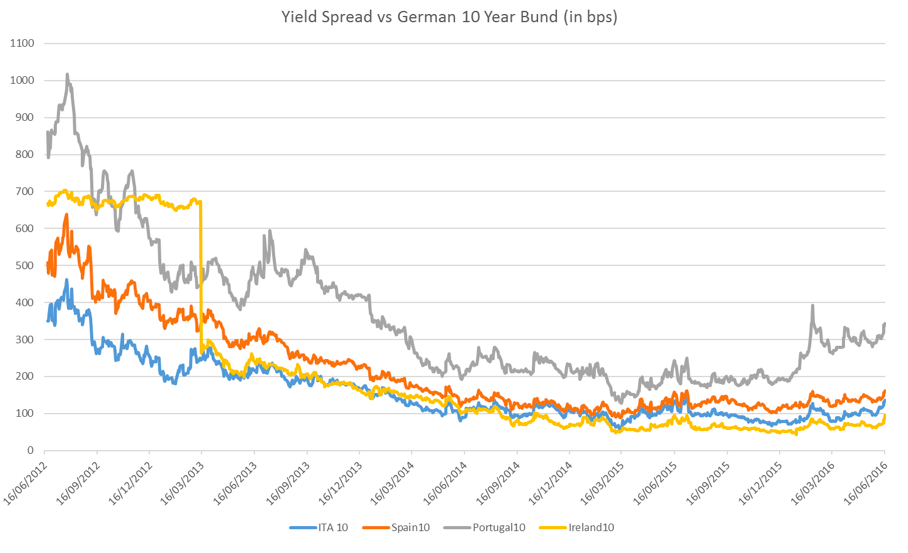

Relative to the ultra-low yield (therefore high valuation) on German bund of comparable maturities, the potential risk adjusted reward for investing peripheral bonds certainly appears to be more attractive. The growing demand in peripheral bonds is reflected in the gradually tightening yield spread, which is the difference in yield terms between the peripherals and the bund, recently as the prices raise due to increasing demand, bond yield declines.

In addition to the income/yield seeking investment strategy, many insurance institutions who need the steady incomes that bonds provide and have obligations to their policyholders can no longer only hold the safer government bonds which now generate negative yielding, these institutions are forced to look at the peripheral debt space for higher yielding assets for their portfolios.

More recently at the height of global market volatility in mid-February, the yield spread between the peripheral bonds and German bund rebounded to reflect the risk off mood, for instance the spread between Italian 10-year BTPs and German Bunds was at around 150 basis points (1.5%), this spread dropped to around 100 basis points early June. A consistent pattern of behaviour can be observed in other peripheral bonds.

Risk of Brexit has caused the peripheral yield to rise

Over the recent weeks, peripheral bonds seem to be bearing the brunt of the potential risk of the UK leaving the EU. With opinion polls suggesting a tight split between the Leave and Remain camps, risk averse investors have showed that there is continuous demand for safe assets, sending German 10-year Bund yields to below zero for the first time. The worries of the potential consequence of Brexit on the single currency has also put pressures on the peripheral bonds, sending bond yields in these countries to sharply increase and the yield spread versus German bund is at a four month high. Clearly the market is worried Brexit would cause a domino effect and cause the European project to unravel, it would not be difficult to image that, if Brexit becomes a reality tomorrow, the ECB may quite possibly need to step in and calm the market nerves.