Central banks have been steering the global economy out of the financial crisis for almost a decade. But investors’ faith in their powers now seems to be fading. Following the use of measures such as quantitative easing, low interest rates, forward guidance etc. many investors are concerned that central banks are running out of ammunition to help with global growth and generate inflation.

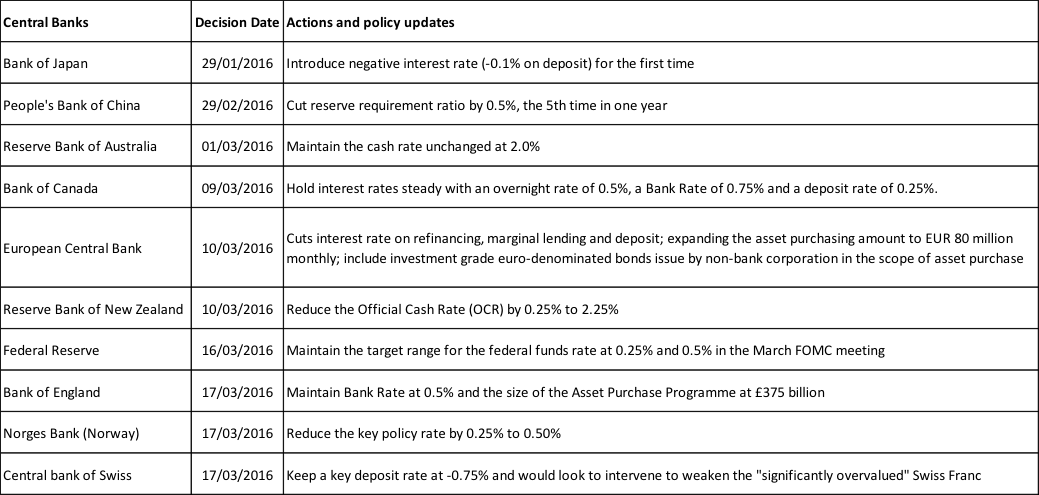

With slowing global economic growth, deflationary pressure and external risks, monetary policymakers are on the defensive. Over the past two months we have seen many central bank monetary policy meetings come and go. Amongst these policy updates, The European Central Bank (ECB) and Bank of Japan (BoJ) seem be to the most aggressive institutions, they have fought back against sceptics and showed determination to defeat deflation and revive healthy economic growth.

The ECB’s package included further cuts in key interest rates, expansion of – not only the size but also the scope of – the quantitative easing programme to riskier assets and made new loans available for the banks to encourage lending. Arguably, an even bigger surprise came in January, when the BoJ announced it would cut its base rate to negative, whilst insisting that it was possible to go further. These measures have shown that there is still plenty of scope for central banks to encourage banks to increase lending to support the real economy.

Even in the US, where the economy has shown relative strength when compared to other developed nations, there was a similar concern about global growth and external uncertainty. The Federal Reserve kept the base rate unchanged and expectations for tightening scaled back in the Federal Open Market Committee (FOMC) meeting on 16 March, despite a 0.25% increase in the December 2015 meeting. Across the global list of central bank actions in 2016 we can see a similar theme emerging; central banks are either loosening monetary policy, or keeping their base rates at a record low level, but are prepared to ease further later in the year.

Market reactions

There is no doubt that these dovish central bank policies will also boost financial markets; they tend to help to restore investors’ confidence, particularly in risky assets. Equity and credit market volatility in recent years have a strong correlation with the tune of central banks. The ECB announcement in March had a big impact on European credit markets given the news of potential corporate-bond buying from the ECB.

It is important to note that much of the central banks’ power rests in managing the market’s expectations. Markets will typically react to what they foresee happening in the future. That is why Mr Draghi’s comments following the ECB meeting caused a reverse effect to that of the ECB policy update. An initial drop in the Euro (as expected due to rate cut announcement) was quickly followed by a sharp rise once Mr Draghi said he did not expect further rate cuts to be necessary. In the days following the ECB meeting, the Euro was in fact trading above its level prior to the announcement. This was very similar to the market response to the BoJ negative interest rate announcement in late January. The policy, which was designed to lower the currency, strengthened the Yen. It is now at about Y112 against the dollar, compared with Y118 before the BoJ rate cut. These market reactions can be interpreted as the limits of strategies approaching.

Painkillers wearing off

In the view of many economists and investors, accommodating central bank policies can be seen as a “painkiller” to the real economy. They help the real economy to tick along in times of stress; providing liquidities and buying time for the government to construct and introduce some well-thought out fiscal policies and structural reforms to correct the fundamental issues of the underlying economy. However, over the past few years we have seen accommodating central bank policies being introduced around the developed world which have evolved into many different, often bolder forms. As central banks venture further into uncharted territories in terms of loosening monetary policies, the risks of unintended consequences are also increasing.

There is still a real lack of effective structural reforms by governments to restore market order. On this account, it is not surprising to see that central banks are reaching the limits of their power. More structural, long-term solutions need to be put into place by the government, this needs to be done before the effect of the “painkillers” wears off.