The annual symposium hosted by the Federal Reserve Bank of Kansas City in Jackson Hole, Wyoming has become a fixture in the financial markets calendar. Each year, the rest of us stare enviously at pictures of the beautiful scenery while waiting for market-moving comments from the Federal Reserve Chair Jerome Powell.

The 2024 event went true to form. The foliage looked great, and Powell delivered some important messages. Most importantly, he highlighted that the US labour market was weakening and that “the time has come for policy to adjust”. Central bankers rarely deliver such a clear message on interest rates. In fairness, it was probably what most investors had predicted, but the clarity was perhaps sharper than we might have expected.

As Powell highlighted, if the direction of travel was clear, the pace was not. He didn’t say a lot about how much interest rates would come down and at what pace – stressing that the Central Bank would be driven by macro numbers.

Investors are split on whether the Fed will, or should, lower rates by 25 bps or 50 bps in September. At the start of August, concerns were rife about an impending recession, but the data released since then suggests that the US economy is still holding up ok.

Still, Powell did stress that the labour market had cooled and that the Fed was mindful that it has to focus on employment as well as price stability, unlike the European Central Bank (Ecb) or the Bank of England (Boe).

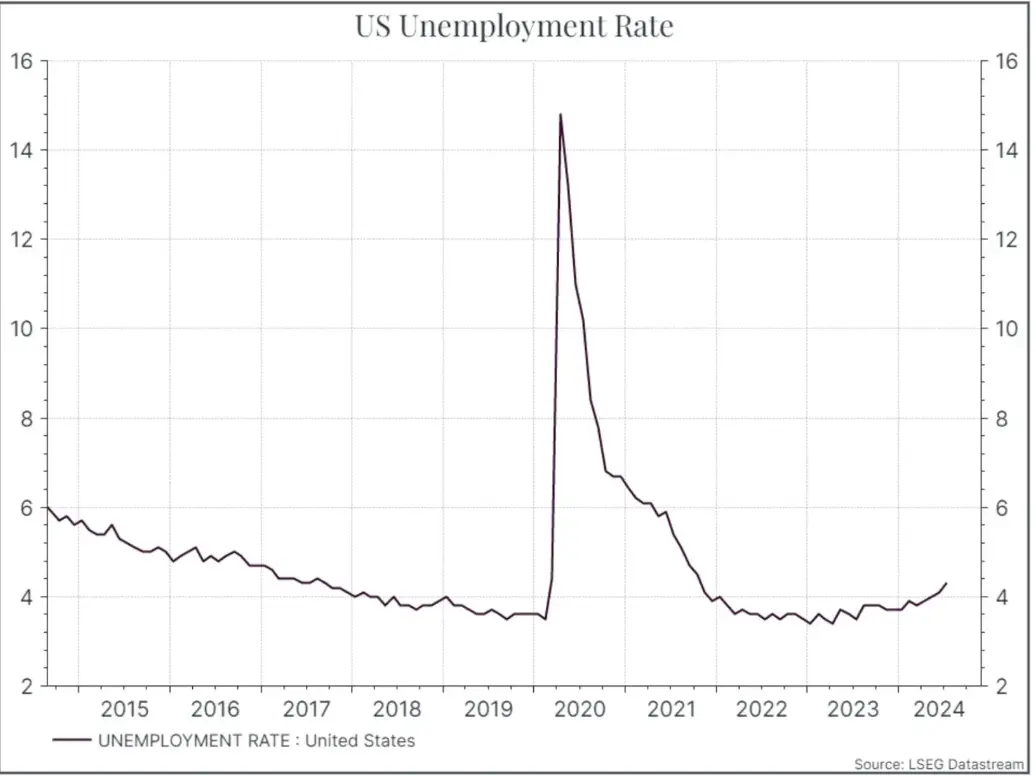

A few charts illustrate the point. First, as you can see in the graph below, the unemployment rate has risen over the past year as we’ve noted before. It may be low by historical standards, but the rise in joblessness has left some commentators concerned that a recession is imminent.

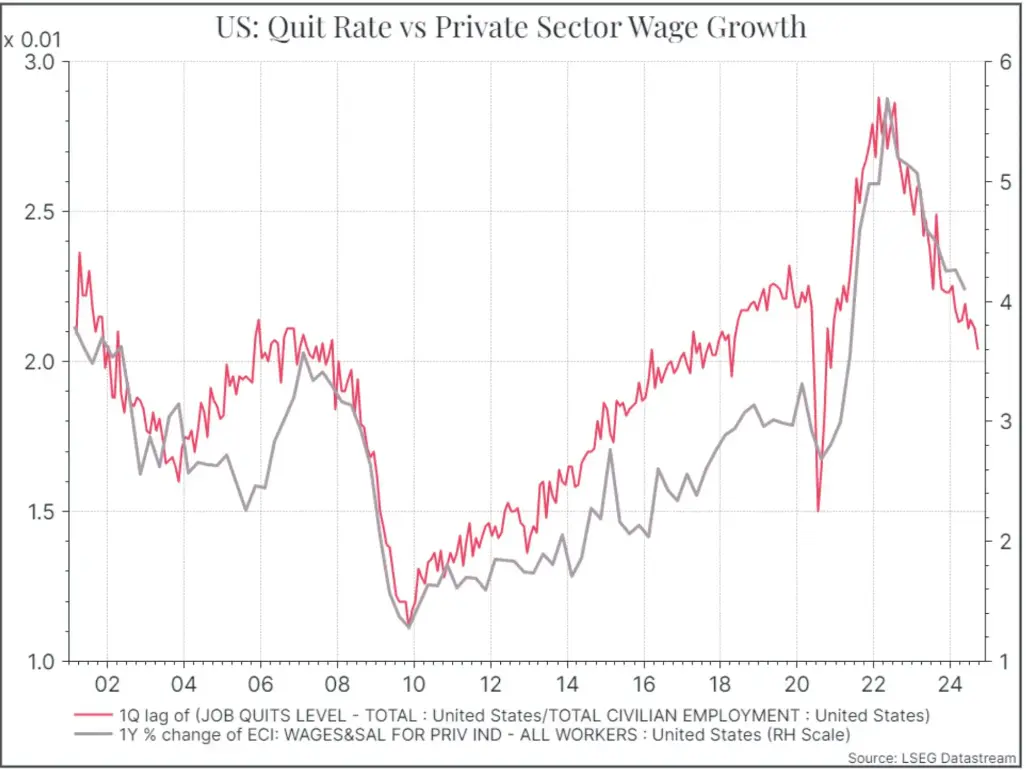

Other metrics tell a similar story. The chart below shows wage growth and “quit rates” (how frequently workers are quitting their jobs). Both these metrics have slowed sharply, suggesting that the job market isn’t as hot as it once was.

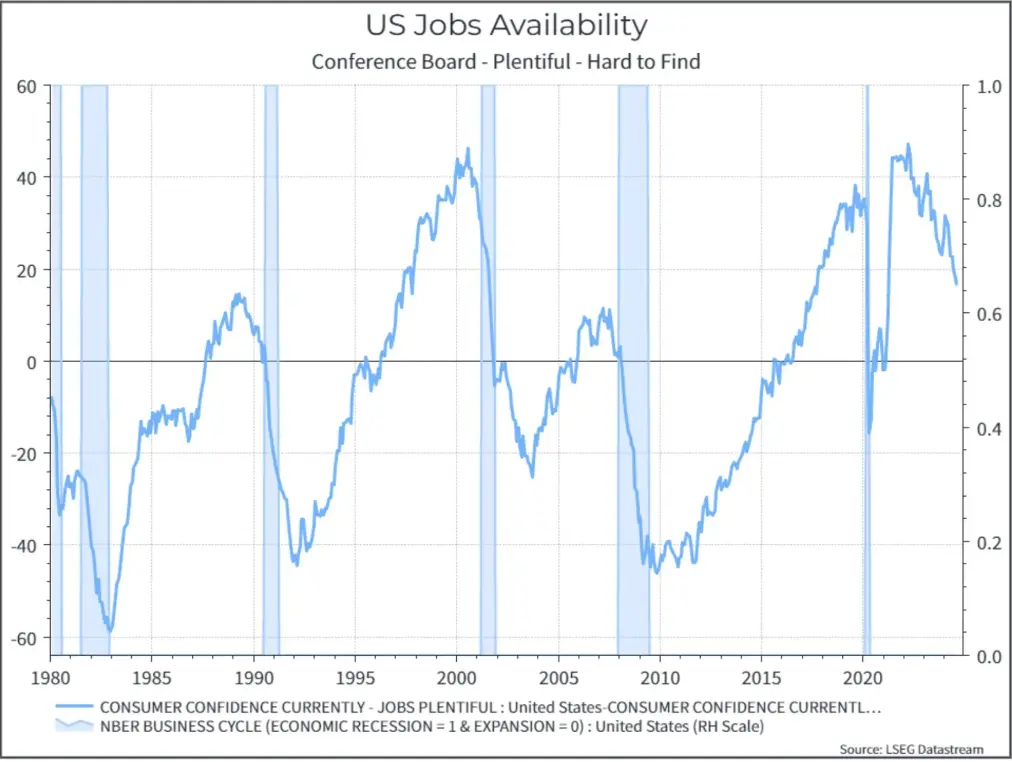

The final chart shows the results of a survey among consumers asking if jobs in the US are plentiful. The light blue bars show periods of past recessions. Again, we can see that US consumers think jobs aren’t as plentiful as they were coming out of the pandemic, even if the survey isn’t yet consistent with a recession.

So where does that get us? Central Bankers are supposed to move ahead of the economic cycle, easing policy before a recession arrives and “taking away the punch bowl just as the party gets started”.

These days it’s not so easy. After such a sharp inflation spike in the wake of the pandemic, Central Bankers have become more “data-driven”, even if that increases the risk that they will wait too long before they act. Some argue that the US Central Bank has already delayed too long to cut rates. So far, however, the current macro data suggest that the Fed may still be in time to reduce rates and avoid a recession.

But that picture can change quickly. For now, the so-called “soft landing” still looks like the base case scenario, and that’s probably positive for financial assets.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.