Please remember that when investing, your capital is at risk. The value of your portfolio with Moneyfarm can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance. The views expressed here should not be taken as a recommendation, advice or forecast. If you are unsure investing is the right choice for you, please seek financial advice.

Interest in Artificial Intelligence has exploded over the past couple of years, as advances in technology suggest that we are at the cusp of something remarkable. We wanted to share a few thoughts on the market implications of this.

The first point is to highlight the early winners. Nvidia stands head and shoulders above the rest. The performance of the business, and the share price, has been extremely strong as demand for its products has exploded. Its performance, along with a handful of other large tech companies, helped to drive the US equity market.

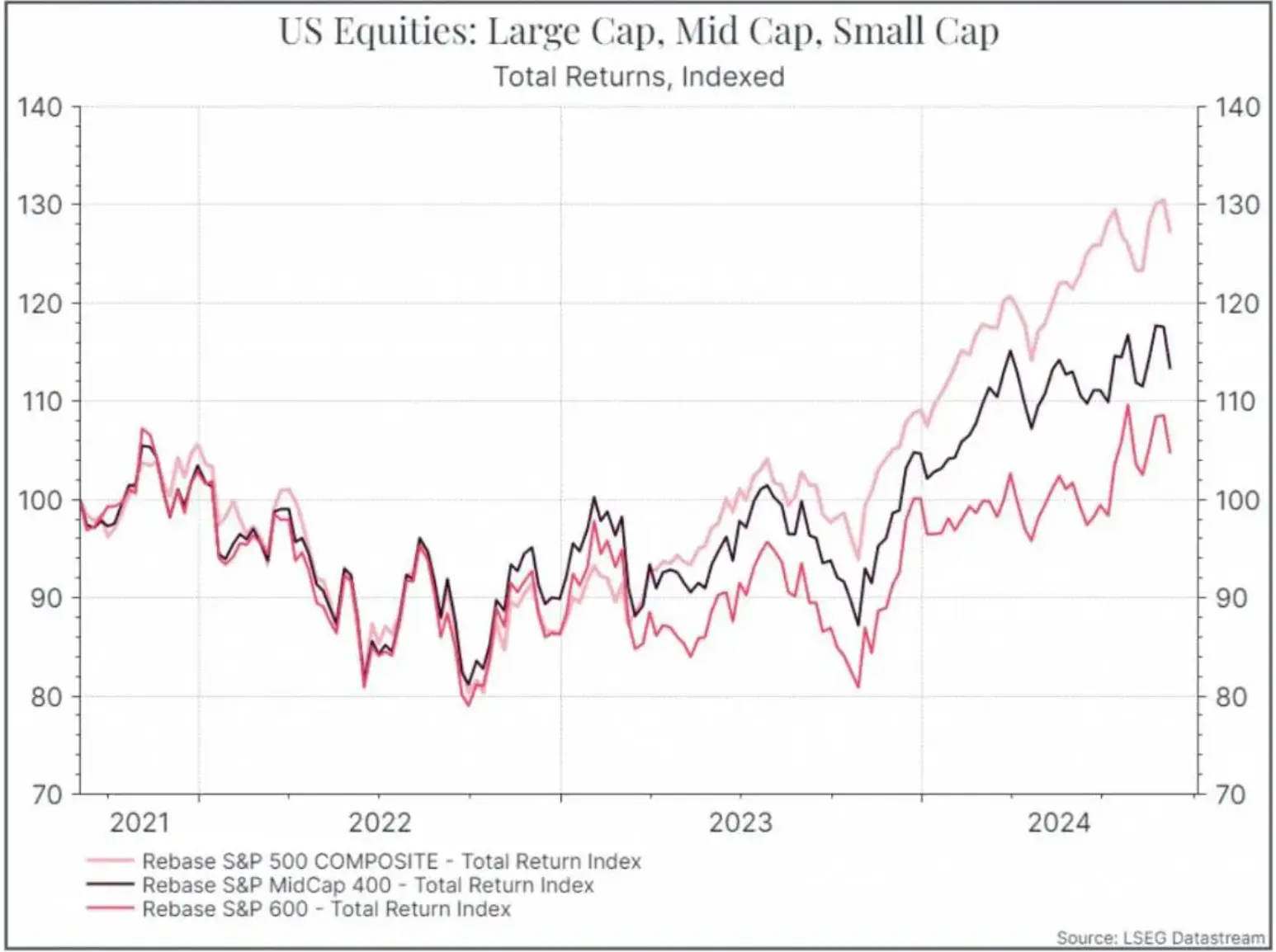

The chart below shows the performance of US large-cap, mid-cap and small-cap companies over the past three years. Large-cap companies have been the clear winners.

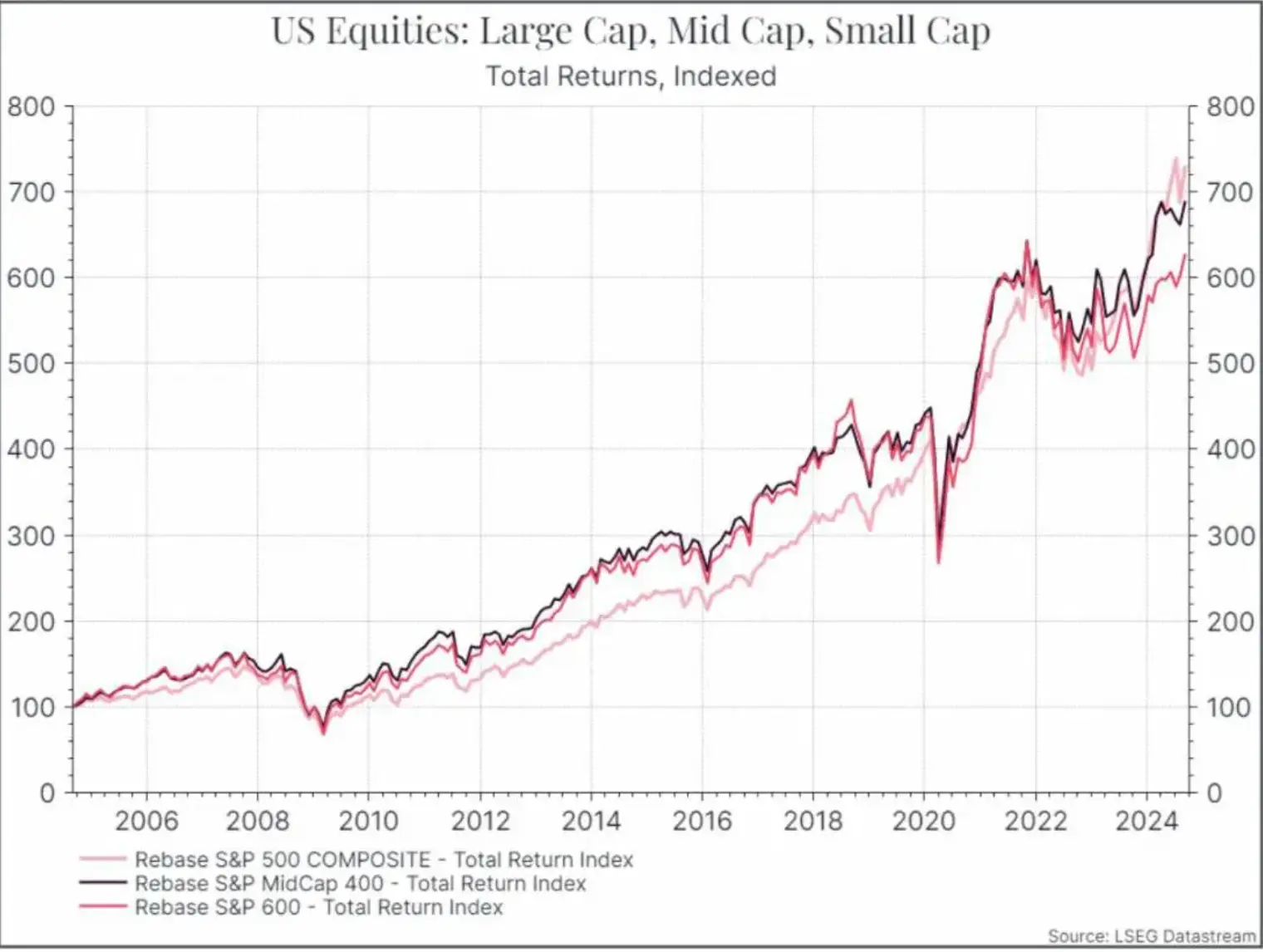

That hasn’t always been the case. This is the same chart over the past twenty years. We can see that in the years after the Global Financial Crisis, mid- and small-cap indices in the US performed better.

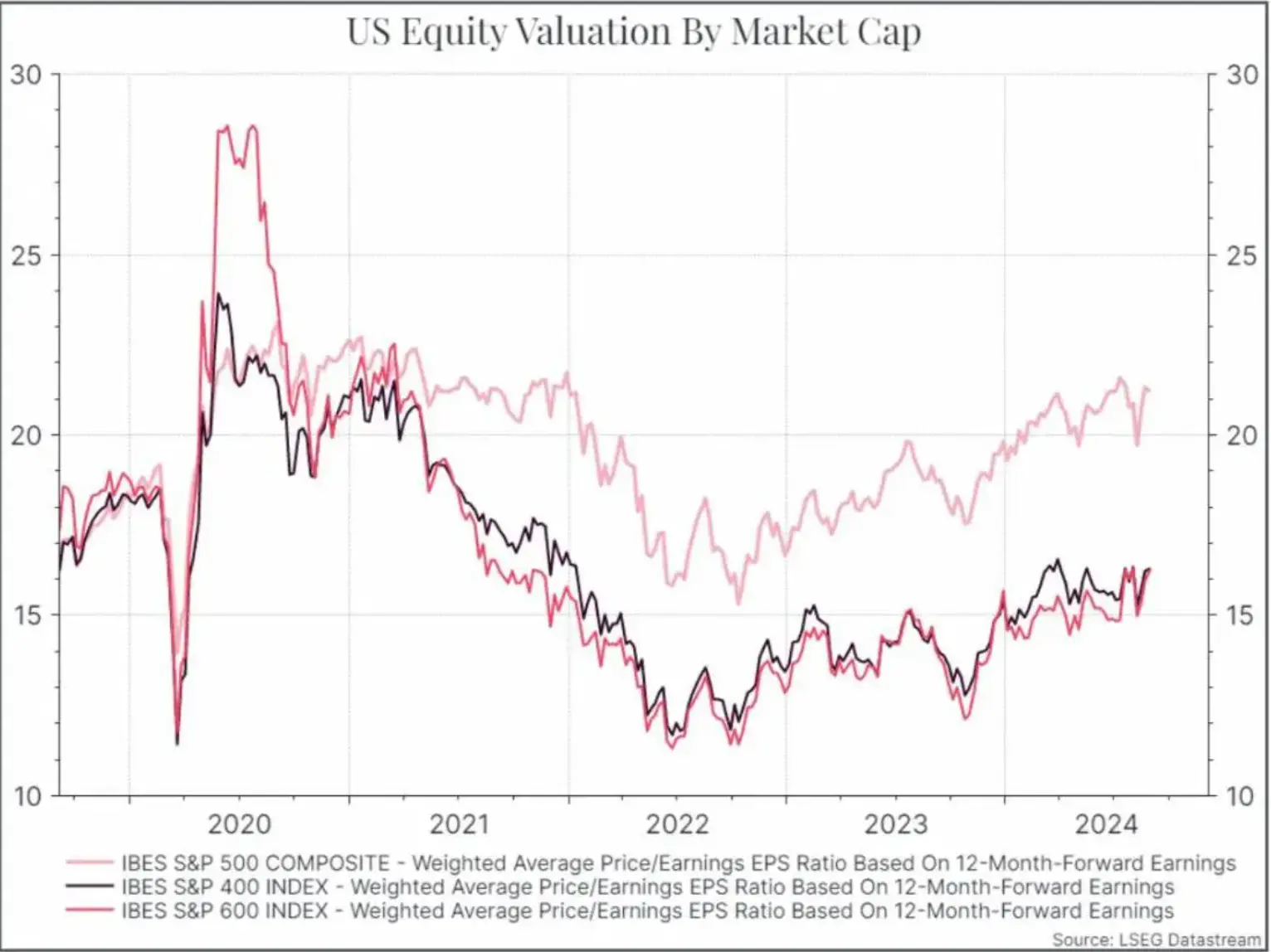

The same is broadly true for valuations. The chart below shows the forward Price/Earnings ratio for US large-cap, mid-cap and small-cap indices. Large-cap companies overall have been trading at a premium over the past five years.

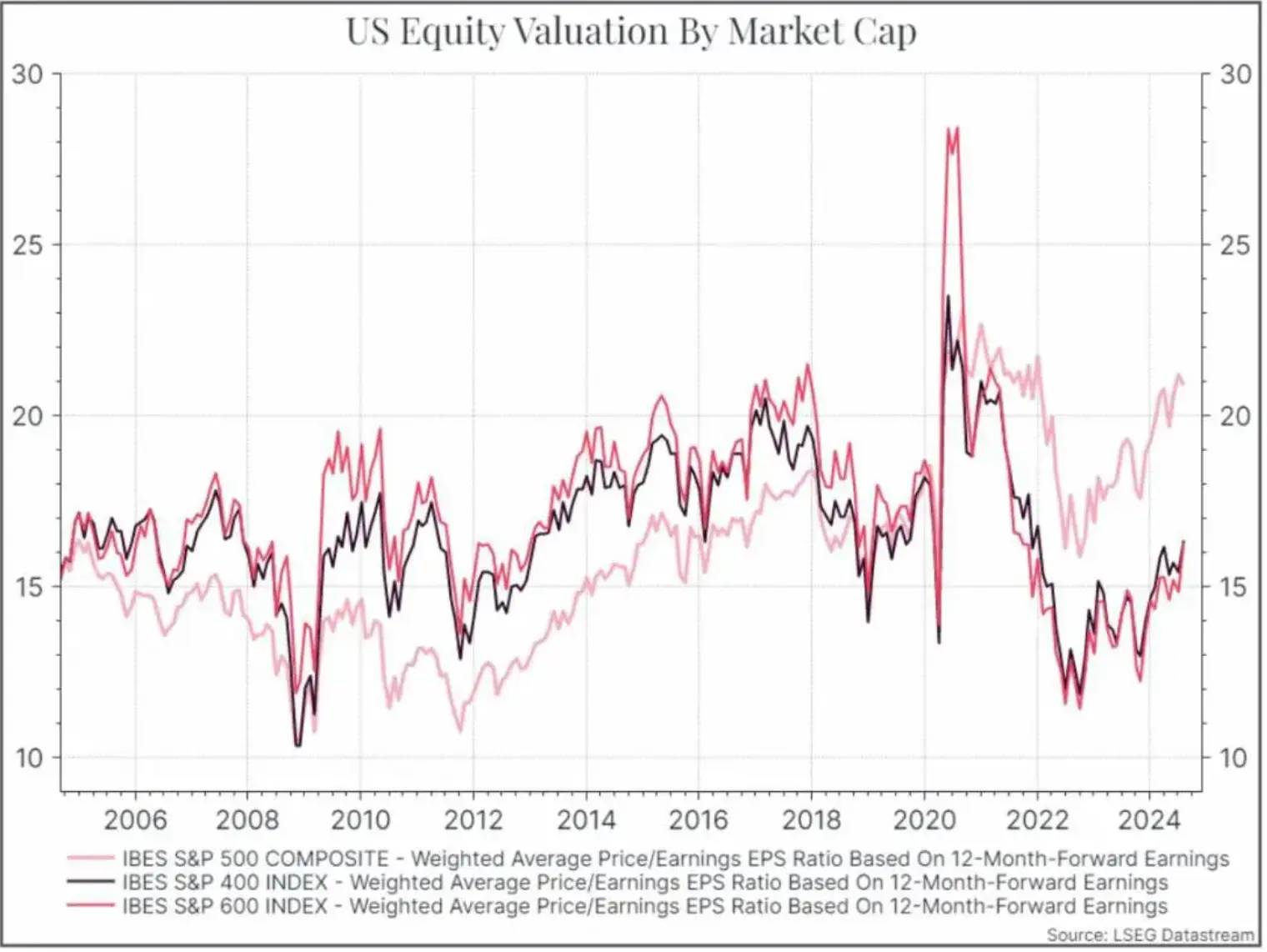

If we extend that chart back over twenty years, again, we see that this hasn’t always been the case. For much of the past twenty years, large-cap companies have traded at a discount to their smaller peers.

We’d argue that expectations for large technology companies, and for AI more specifically, are behind a lot of these changes. Investors think that these businesses will see strong and sustained profit growth as a result of innovations in Artificial intelligence.

There are a few interesting points to come from this. As we’ve already noted, investors have already identified Nvidia as a big winner, and we can clearly see that reflected in its operating performance. Demand for its high-performance chips has accelerated sharply. One important question is whether this demand is really sustainable. It’s worth noting, for instance, that Nvidia’s customer base is quite concentrated. According to some estimates, its top five customers might account for 40% of its total sales currently. At first glance, that seems like a risk, but it might not be a big issue. Nvidia might be supply-constrained and those customers are large partners who can make a long-term commitment. Maybe there are lots of other potential customers who simply can’t get their products. The second point is that expectations for Nvidia are very high. As we saw after the latest earnings release, the stock sold off even after very strong profit growth. A lot of commentators have highlighted Cisco Systems, a network equipment business that was a key enabler of the internet revolution and darling of the internet boom in the early 2000s, but whose stock has still not returned to its 2000 peak. Whether the comparisons are fair or not, it is a reminder that high expectations can limit your returns. Starting valuations matter in the long term.

The other interesting question is when will start to see the benefits of AI investments really appear for other companies and what could they look like? It’s an important question – after all Nvidia customers are investing a lot in its products, and some investors are concerned that it might take time for the benefits to really show up. Publicly available information like financial accounts won’t give you a lot of detail. But in some ways that helps to clarify the answer. As an investor, you’d hope to see any investment a company makes show up either in higher sales or relatively lower costs. The good news is that some companies are beginning to at least talk about the impact of AI on their businesses – in terms of reducing the number of people in their call centres or making their online ad business more effective. We’d expect to see more of that in the months and years to come.

It’s also important to consider who the losers might be. Yes, the overall pie might grow, and economic activity could increase, but you’d guess that the rising tide won’t lift all boats. This brings us back to the market cap question – how accessible will AI be for mid or small-cap companies? Will bigger companies have a sustainable advantage, or will AI create a more level playing field and actually cancel out some of the advantages that the first movers could enjoy? In the long term, we’d guess that AI will become increasingly accessible, but companies that are making an early investment should see the benefits sooner.

Artificial intelligence has already been driving equity markets and that looks set to continue for now. But it’s also not certain how quickly that optimism will show up in corporate profitability. It’s something we’ll continue to monitor in the coming months.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.