When you’re making big decisions, it’s nice to get a second opinion. And when those decisions involve your hard-earned money and a changing economic climate, you could benefit from a broader overview of the investment world.

On interest rates and inflation

The rapid run of interest rate hikes aimed at bringing some ultra-hot inflation back to low and stable levels is widely assumed to have ended, with consumer price increases having dropped fairly convincingly toward the 2% target.

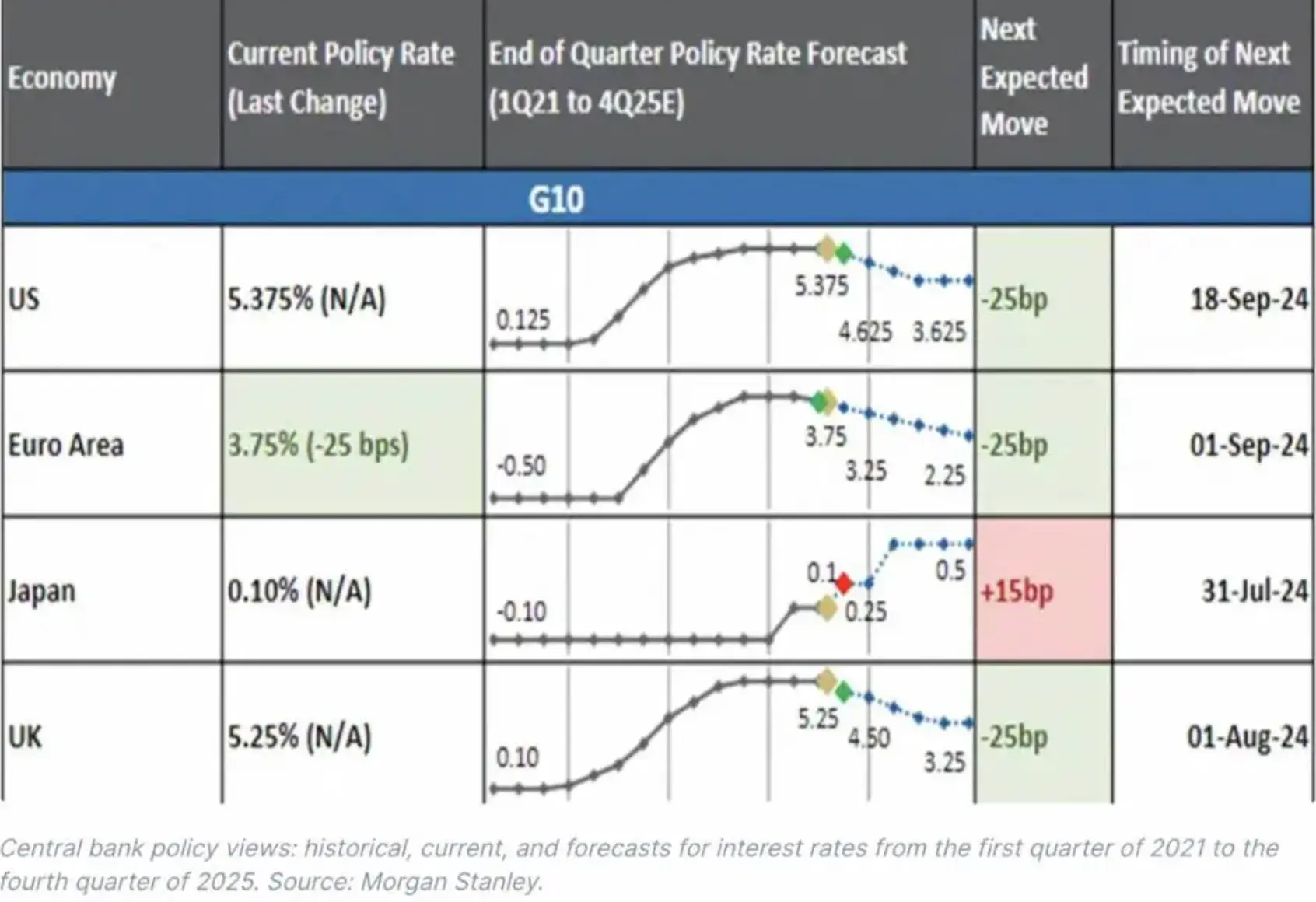

Markets are now fully expecting, or “pricing in”, a series of interest rate cuts from the Federal Reserve (Fed), European Central Bank (Ecb), and the Bank of England (BoE). The Ecb has already lowered its key rate, to 3.75%, from 4%. The BoE is expected to follow suit in August, the Fed in September.

The chart shows the expected timing of interest rate changes planned through the end of 2025. The Bank of Japan is the exception here, with small rate hikes expected, instead of cuts.

Lower interest rates are known to give a gentle boost to the economy and are generally good for riskier assets like stocks and crypto. But there’s a lingering concern about the potential damage that’s been inflicted on the consumer, with prices rising roughly 20% in total over the past two years and eating away at folks’ spending power. Across the US, UK, and Europe, essentials like food are now much less affordable.

On global growth and the Magnificent Seven

Global economic growth is expected to remain on an even keel, just above 3%. Among the world’s developed markets, the US is going to flex the most muscle, with a slower tempo of expansion this year and next that will nonetheless outpace what’s seen in the EU, UK, and Japan. And that forecast means the world’s biggest economy is likely to avoid the recession that had been predicted by some at the turn of the year.

Far zippier growth is expected in emerging market economies, with China and India near the top of the pack.

It’s worthy of a sigh of relief from investors, because slower but still positive growth, lower inflation, and cuts in interest rates are typically a good cocktail mix for a stock market rally.

The US stock market has outperformed its overseas peers in dollar terms since the global financial crisis. And, look, that may be partly thanks to the strength of the greenback. But it’s mostly because America’s got a dynamic economy that’s helped produce many of the world’s leading tech companies.

In the past couple of years, earnings at the so-called Magnificent Seven group of US companies have shot the lights out. These giants – Microsoft, Meta, Apple, Amazon, Alphabet, Tesla, and Nvidia – have left the rest of the companies in the S&P 500 (i.e., the other 493) in their dust.

The “Mag 7” are expected to continue to post strong growth for the second and third quarters, but at milder levels. The “other 493” are expected to post minimal profit growth in the same period, but by the fourth quarter, analysts expect their growth will match those glittery behemoths.

Overall, the Magnificent Seven’s disproportionate strength in recent years has pushed their collective weighting in the S&P 500 index to extreme levels – the kind not seen since 1929.

Now, comparisons to the stock market era that preceded the Wall Street Crash of 1929 and the start of the Great Depression are never comfortable ones – I’ll give you that. But this high concentration isn’t necessarily a problem, and that’s because the earnings from these seven companies largely justify their share price gains. Still, in a healthier market, you’d expect to see wider contributions from far more companies and sectors.

Less of an issue here is the fact that the high concentration makes it tough for active fund managers to do well in their jobs, since it’s hard to outperform an index that’s dominated by just a handful of companies.

In the first half of 2024, only 18% of active fund managers who benchmark their work against the S&P 500 Index managed to come out ahead. By the same token, it’s been tougher for retail investors to stock-pick their way to better-than-index gains.

What’s the opportunity here?

A lot of assets look attractive just now, including shares, bonds, cash, and alternatives (think: commodities, real estate, private credit). And though stock valuations look stretched in the US, it’s hard not to want to be invested in AI as it drives game-changing innovations. And, besides, if you exclude Big Tech, those stock valuations look expensive, but not massively so.

Elsewhere, Indian stocks look attractive for investors who favour growth stocks – i.e. the kind that may come with a bit more risk now, but that are seen as having the potential to outperform the overall market over time.

For investors who favour value stocks – i.e. those that appear to be trading at a lower price, relative to the company’s books – the UK stock market is worth a look. It appears to be the cheapest on a 12-month forward price-to-earnings ratio, and with a new, stable government in place and promising to implement a growth agenda, the risk and reward balance looks pretty attractive.

Cash accounts and bonds also look good. Earning a risk-free return of more than 5% on your cash when consumer price increases are fluttering around 2% or 3% means you’ll easily make more than inflation. It’s no surprise, then, that there have been massive inflows into money market funds over the past two years.

And then there are bonds: right now, they come with pretty decent returns. What’s more, if the economy slows more than expected, and more interest rate cuts follow, bonds would get an added boost higher.

And, finally, what’s the risk here?

Some finance folks are always whispering about the potential for a “black swan”, or totally unforeseen, event. And, sure, those things happen. But right now, the main threat to the otherwise generally rosy outlook is a brand-new jump in inflation. That’s one reason why the Fed is taking a go-slow approach to that first interest rate cut. It’s been using higher interest rates to bring inflation back to its low-and-stable target, so the last thing it wants to do is drop them too far, too fast, and undo all that hard work.

But the reality is that loftier bond yields could result from a new pop-up in inflation. What’s more, recent research from Bank of America shows that the S&P 500 now tends to fall when bond yields rise.

Interested in investing in High Dividend Yield?

Explore our High Dividend Yield collection, which aims to enhance portfolio income with dividend-focused ETFs.

Our Asset Allocation team has selected these ETFs based on key factors such as their high dividend distribution capacity and because they have favourable spreads, meaning generally lower transaction costs for investors. They were also chosen because they have large market capitalisation, lower fund costs and high trading volume.

Important Information

This publication has been produced with Finimize. As with all investing, your capital is at risk. Forecasts are never a perfect predictor of future performance, and are intended as an aid to decision- making, not as a guarantee. This publication does not contain and should not be taken as containing, investment advice, personal recommendation, or an offer of or solicitation to buy or sell any financial instruments. Prospective investors should seek independent financial, tax, legal and other advice before making an investment decision.

Your capital is at risk. If you choose to invest, the price and value of any investments and any income from them can fluctuate and may fall. So you may get back less than the amount you invested. Past performance is not a guide to future performance.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.