China’s “third plenum” came to a close last week. The Third Plenum is a series of meetings that occur roughly every five years and usually result in a long list of policy initiatives. The communique at the end of this session highlighted, among other things, the government’s focus on “high-quality development” – likely focused on domestic technology innovation – and structural reforms, while at the same time looking to defuse the risks in real estate and local government debt.

Policymakers were also conscious of the more immediate challenges that the economy faces. Domestic demand looks quite weak at present, and this prompted the Peoples Bank of China (PBOC) to cut rates this week.

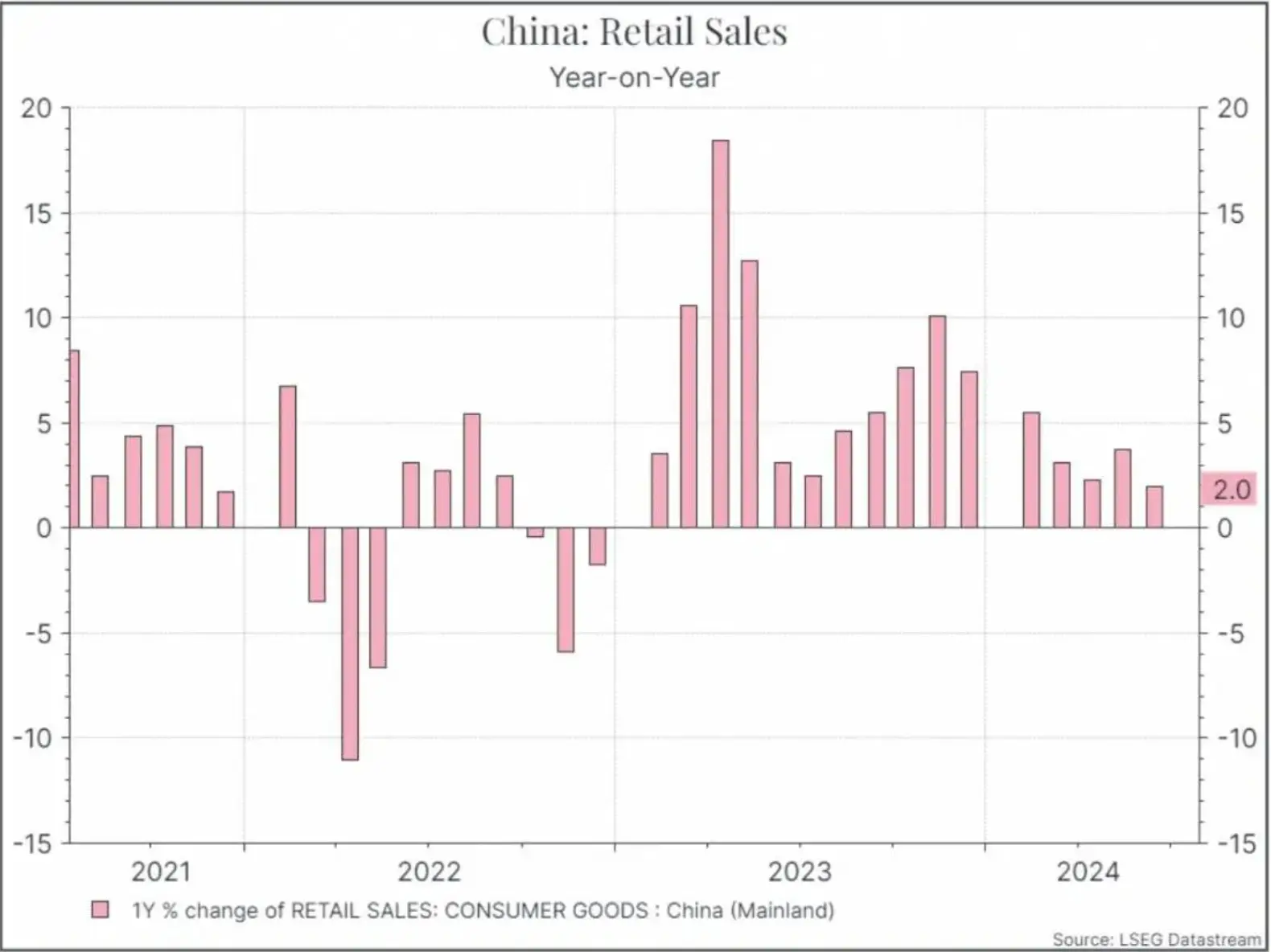

Retail sales growth looks pretty anaemic, registering below 2% year-on-year in June (see chart below).

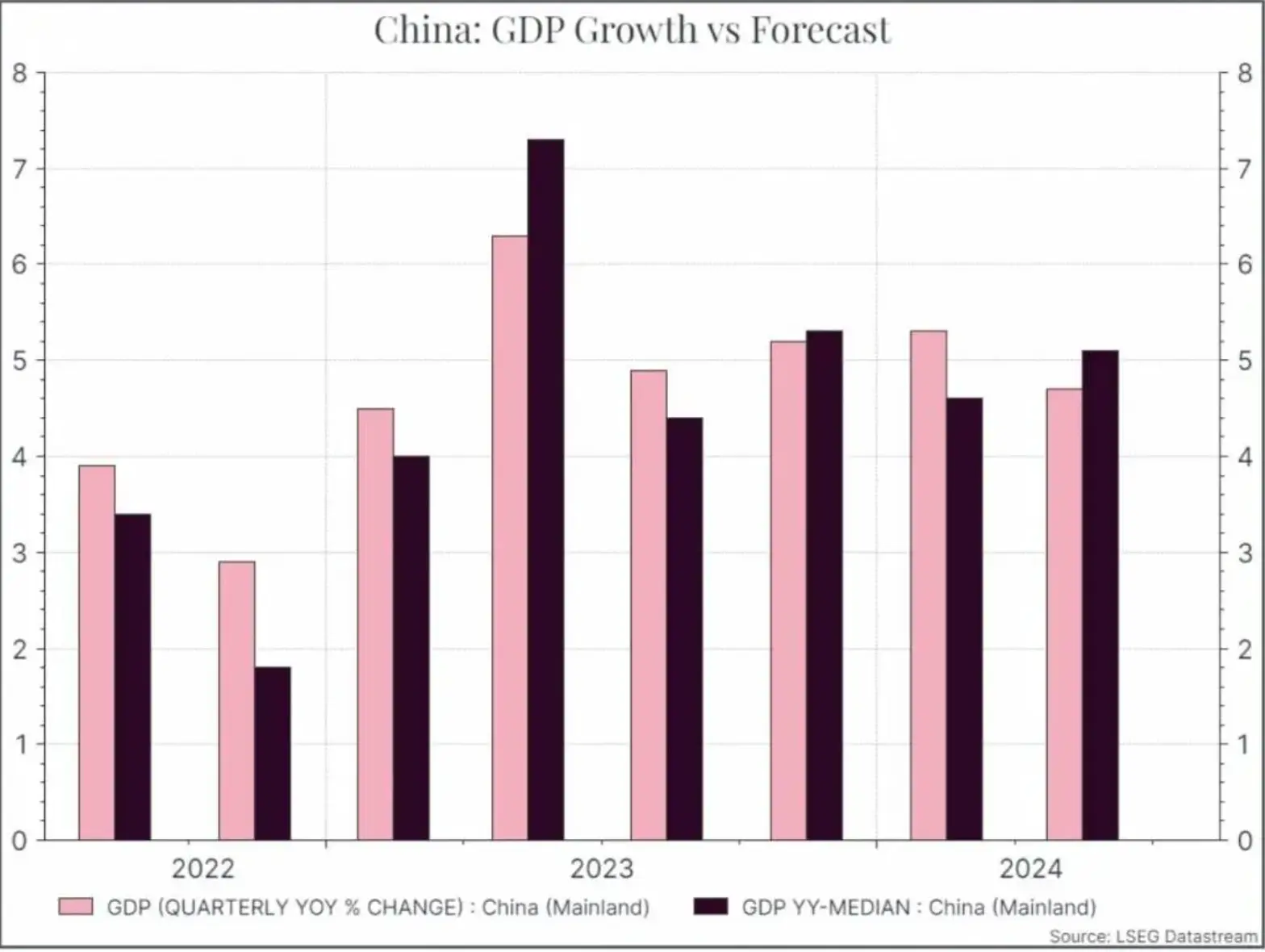

Second quarter GDP growth also came in below expectations at 4.7% (see chart below). Officials continue to believe that the economy can grow at around 5% this year, but we may see some more policy stimulus to achieve that.

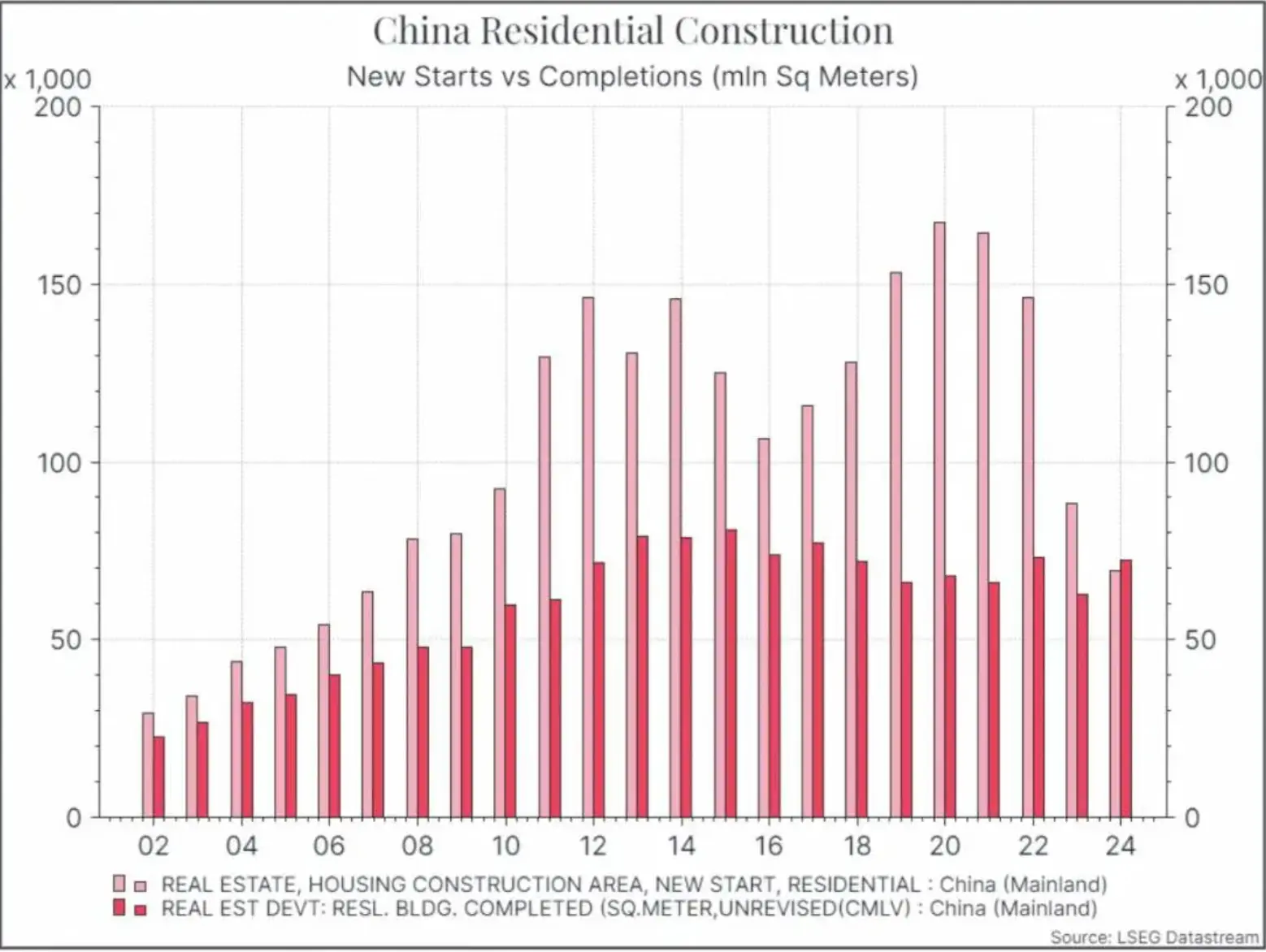

The challenges facing Chinese property developers have been well-publicised for some time. The chart below shows the number of new starts and completions (in square meters) in residential construction. The new starts in 2023 and 2024, in particular, are fair below the levels we saw previously as developers have struggled to manage their debt burdens.

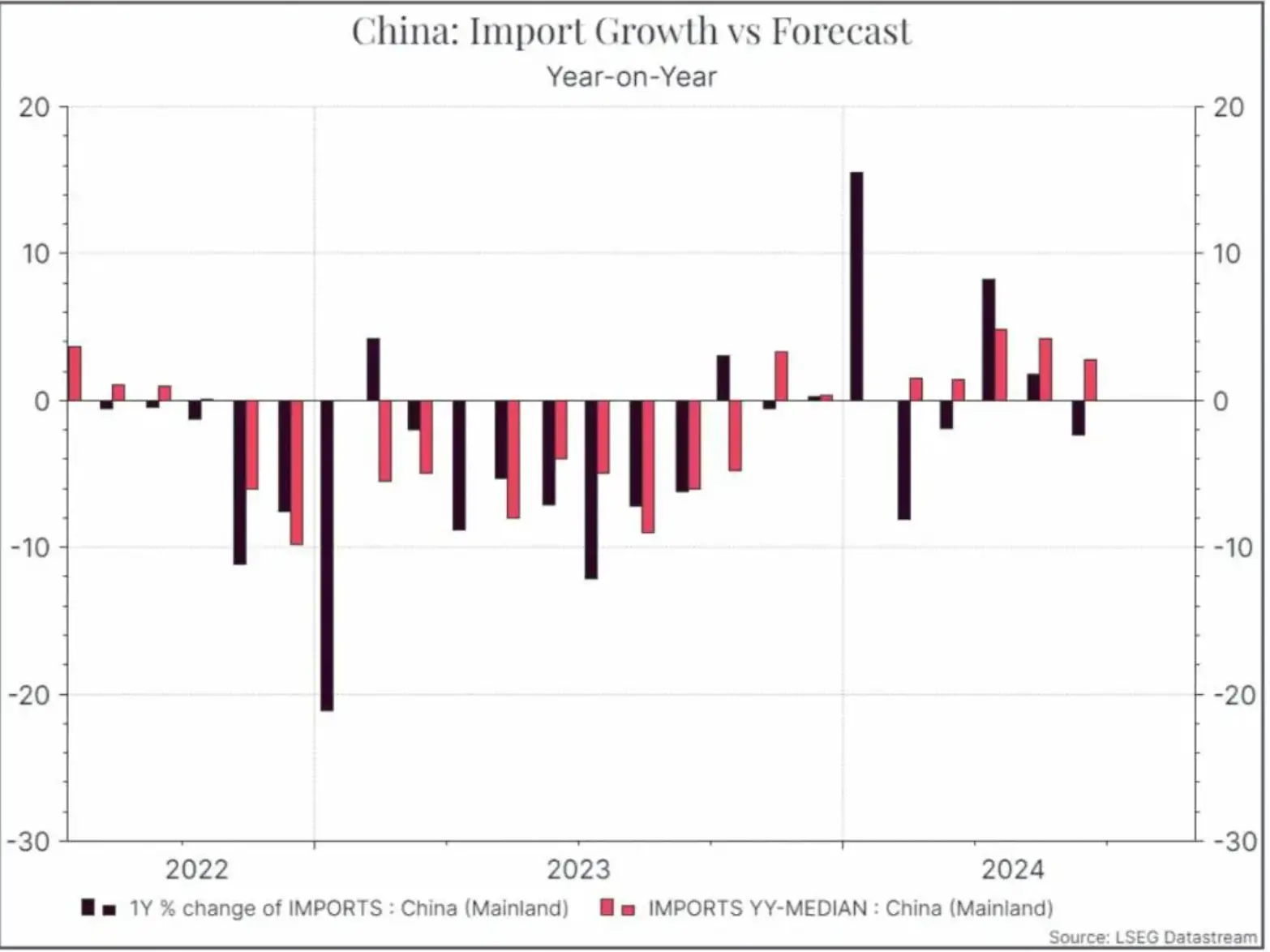

Trade data also points to a slowdown. The chart below shows import growth compared to forecasts. Import demand has proven weaker than expected over the past few months.

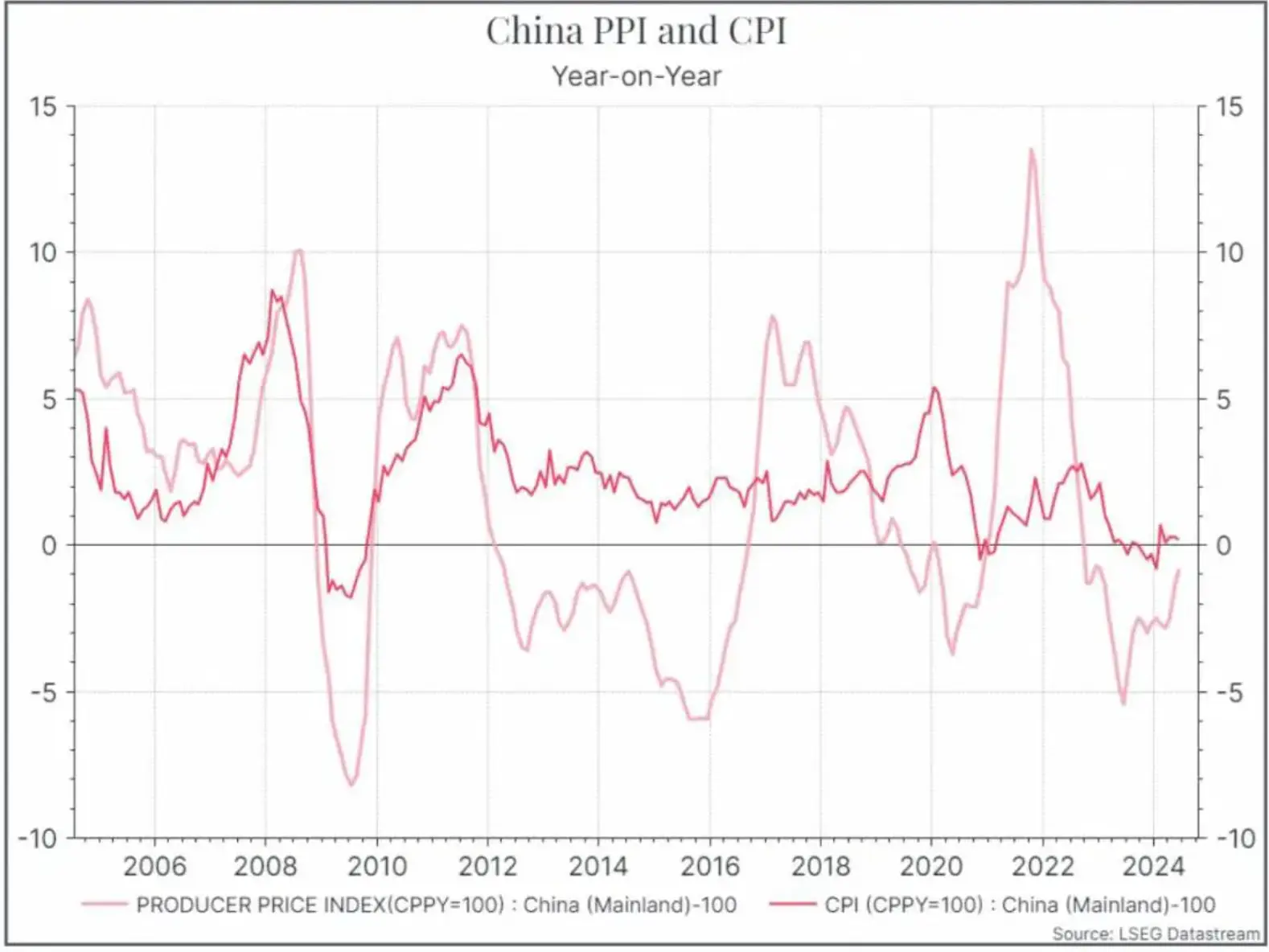

One silver lining is that China isn’t facing inflation pressure – rather that inflation is if anything too low. The chart below shows consumer and producer inflation at or below zero year-on-year.

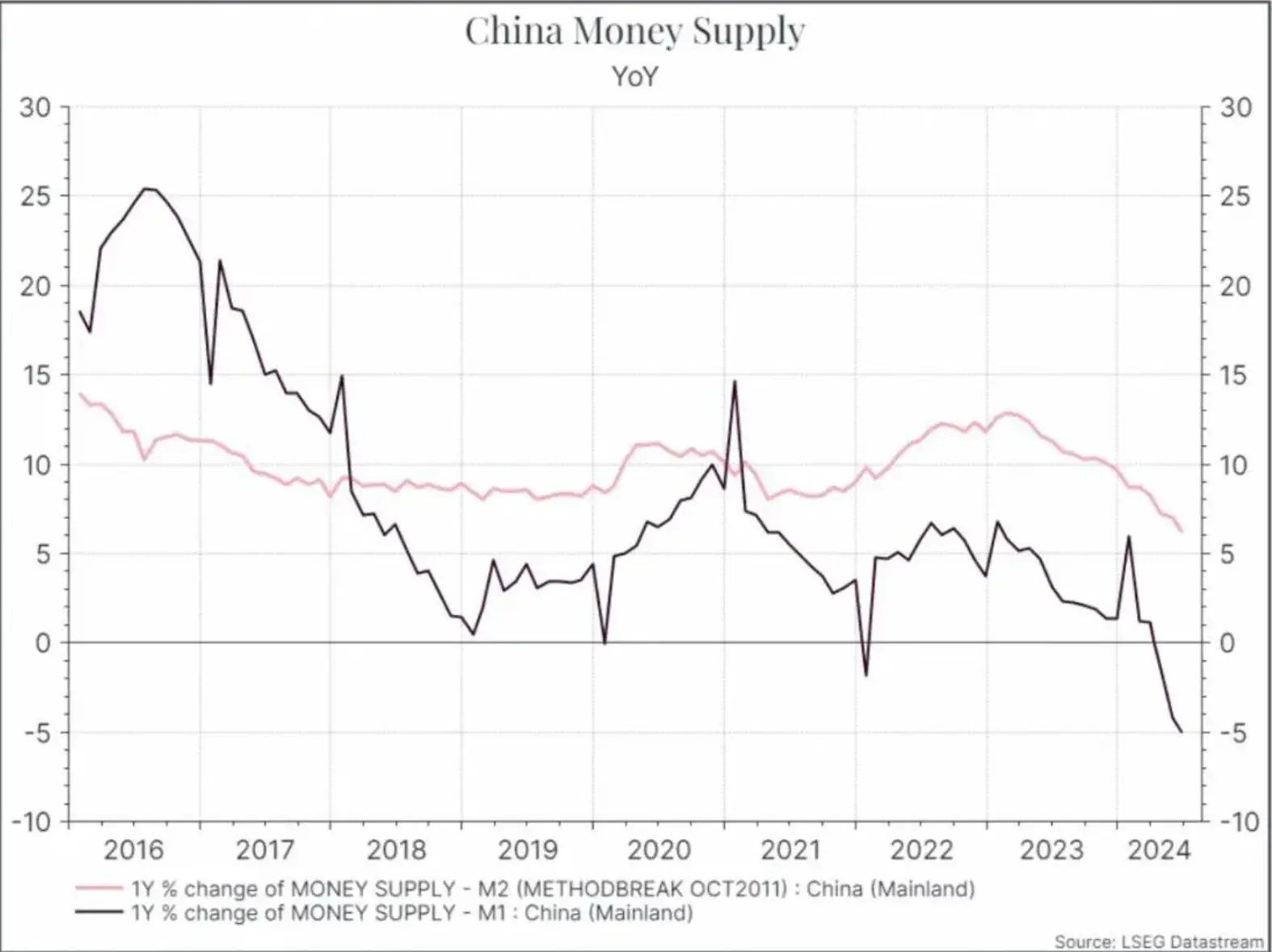

Weak inflation is consistent with the slowing, or declining, money supply growth. The chart below shows narrow money (M1) declining year-on-year, while the growth in broader money (M2) is decelerating.

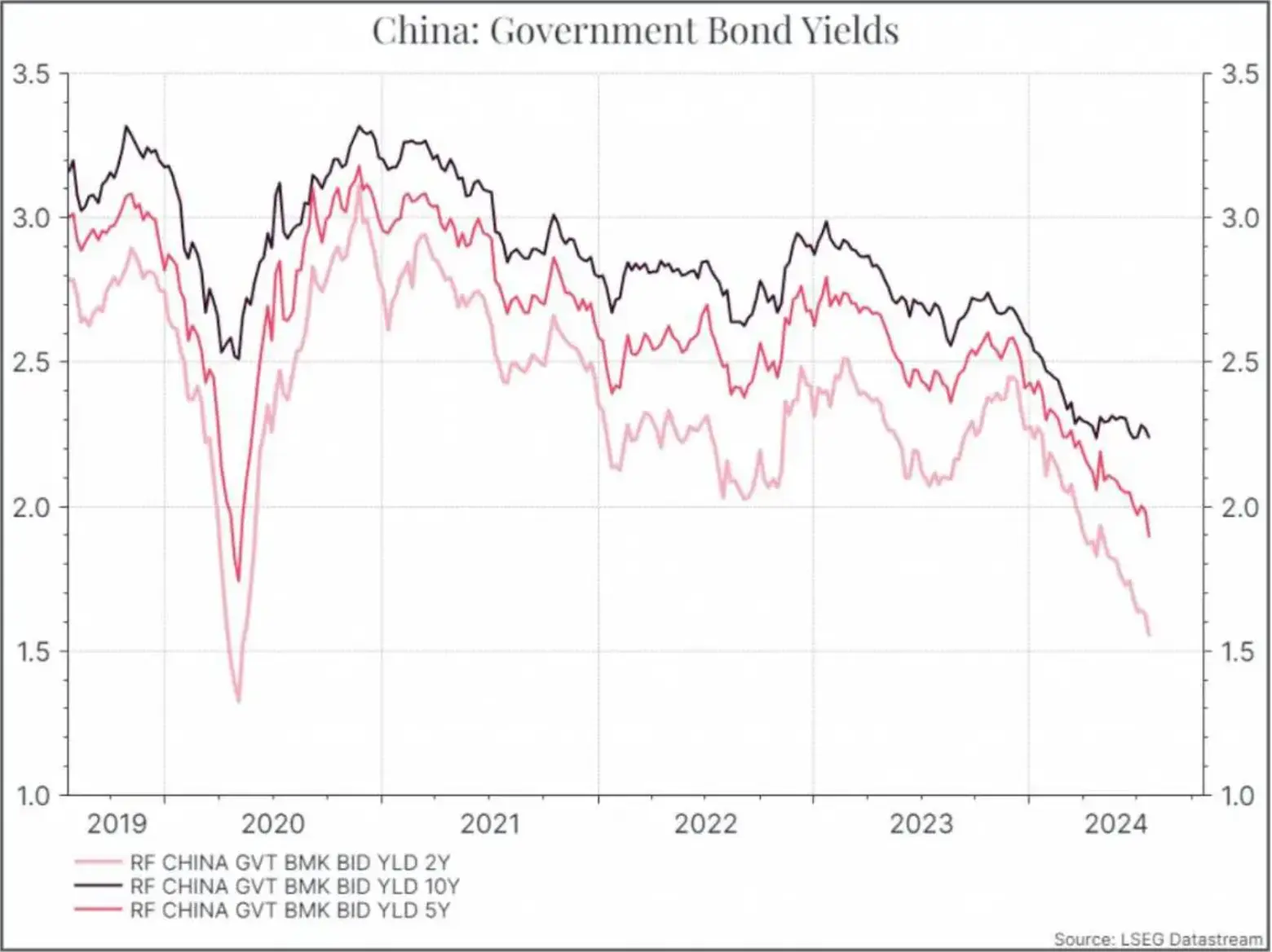

All this has brought down Chinese government bond yields. The 2-year yield is approaching the most recent low in 2020. At the moment, Chinese government borrowing costs are some way below the US, the UK and Germany.

Where does this get us? Chinese demand looks to be weaker than we might have expected, and that has implications for global demand. We’ve seen the Central Bank cut rates and you might expect to see further fiscal stimulus. The government has been reluctant to spend too aggressively, perhaps mindful of the challenges it still faces in the residential sector. Despite that, we’d still expect to see more support in the coming months.

At the same time, we can see that Chinese export growth is picking up steam, perhaps because companies are looking to export their excess supply of goods. Chinese export prices have come down a long way from their recent peak in 2022. That might be a helpful tailwind for inflation in developed markets, but it has also led to concerns that Chinese manufacturers are dumping products on their trading partners. As we head into a noisy US election season, we’d expect to see China trade get a lot of focus from the candidates.

In terms of global equities, weaker Chinese demand could be a bit of a headwind for the open economies of the Eurozone, while the US market, which is more domestically-focused, could see a more limited impact. If we did see a reacceleration of Chinese demand, then we could see European companies benefit.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.