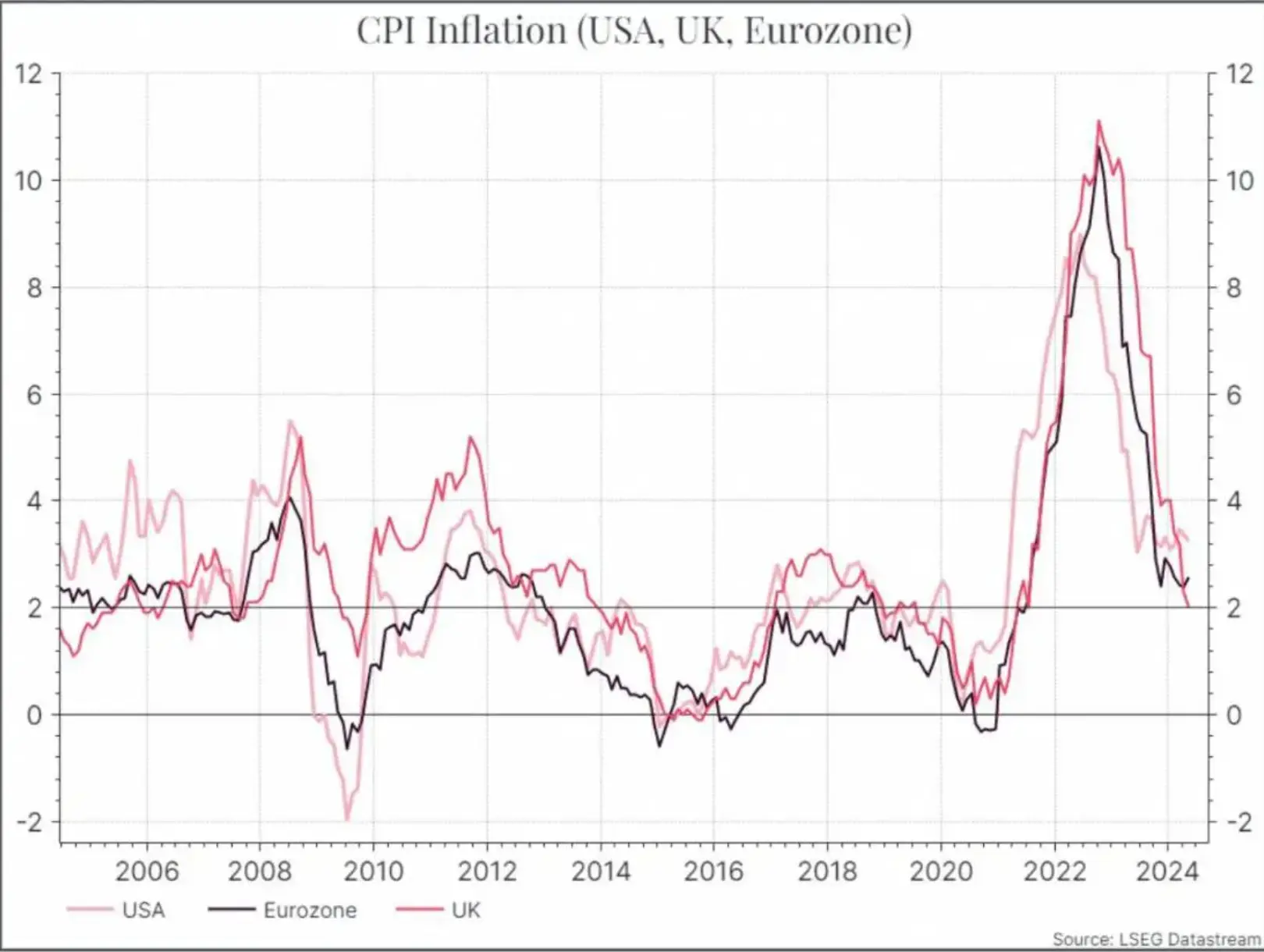

It might not be much of a victory but this week the UK won something. In this case, it was the race to get back to 2% annual consumer price inflation – the target for most Developed Market Central Banks. The chart below compares the UK, the US and the Eurozone. Eurozone inflation is still hovering at around 2.5%, while the US remains above 3% year-on-year.

Did the Bank of England celebrate? It did not. The Bank of England left rates unchanged this week, seemingly unmoved by the progress on inflation. The decision was 7-2 in favour of keeping rates unchanged; the same voting pattern we saw last month. Policymakers did suggest that we could see a cut as early as August, but they remain cautious about declaring victory prematurely. It’s easy to see why – inflation may have come down, but wage growth remains high. The chart below shows a measure of wage growth that’s still likely well above where the Bank might want it to be.

In fairness, UK workers are still struggling to get back to where they were pre-pandemic. The chart below shows wage growth adjusted for inflation (in this case the retail price index). Wages are currently growing in real terms, and that’s good news. However, the sharp drop in purchasing power over the past couple of years is still impacting households.

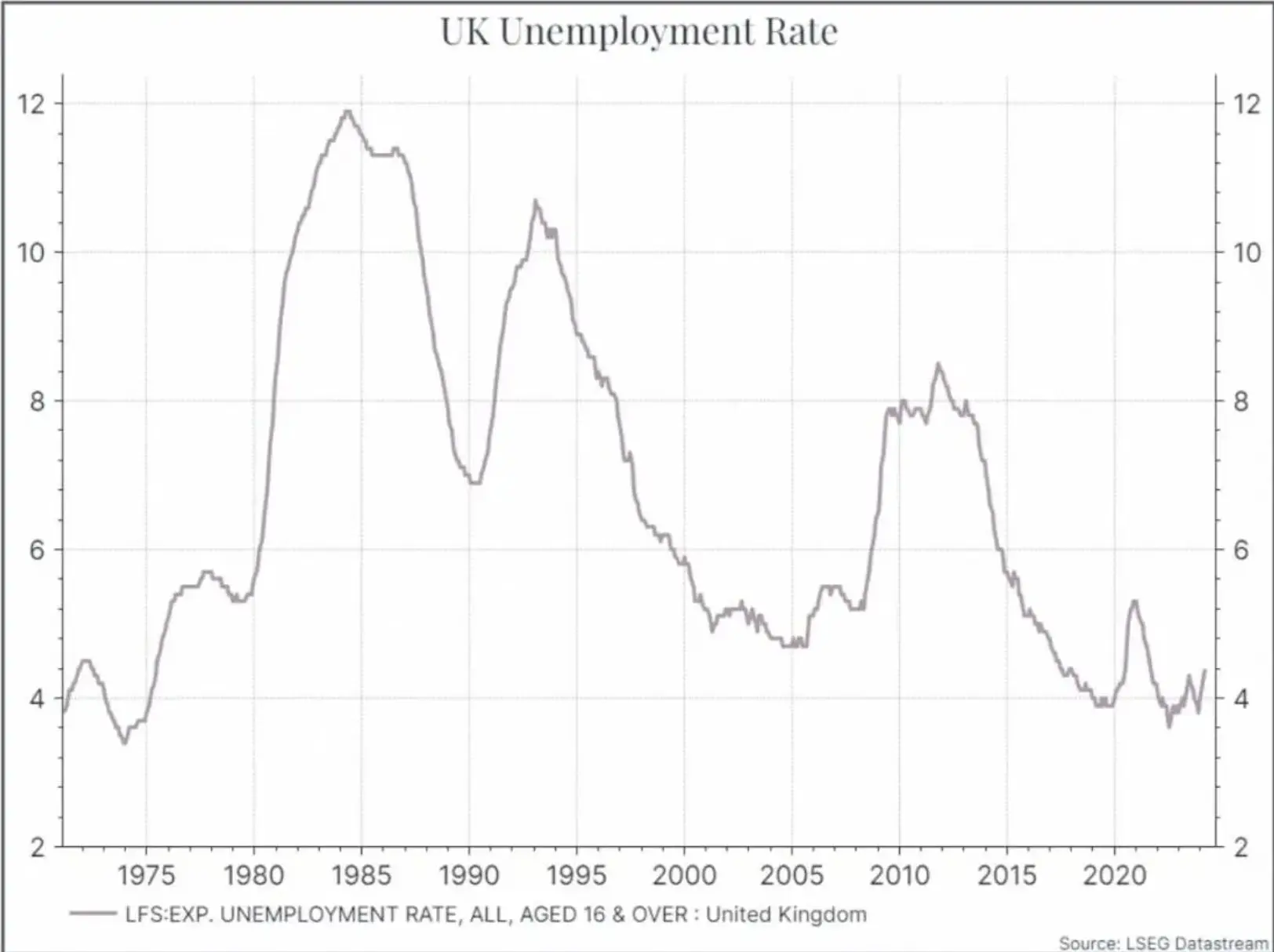

The labour market is softening a bit, but it’s still in decent shape. The chart below shows the unemployment rate. It’s picked up a bit over the past couple of months, but still well below the long-term average.

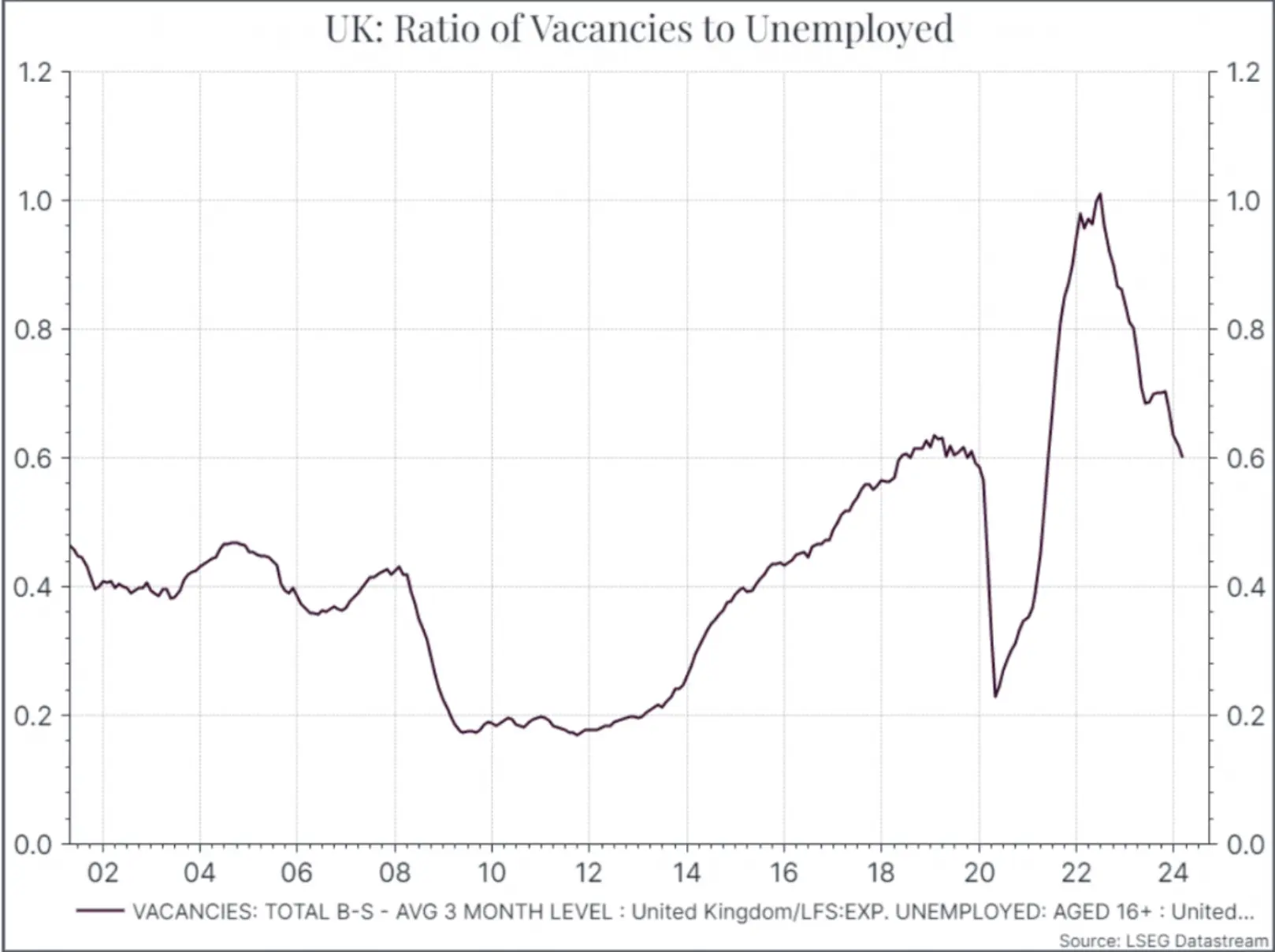

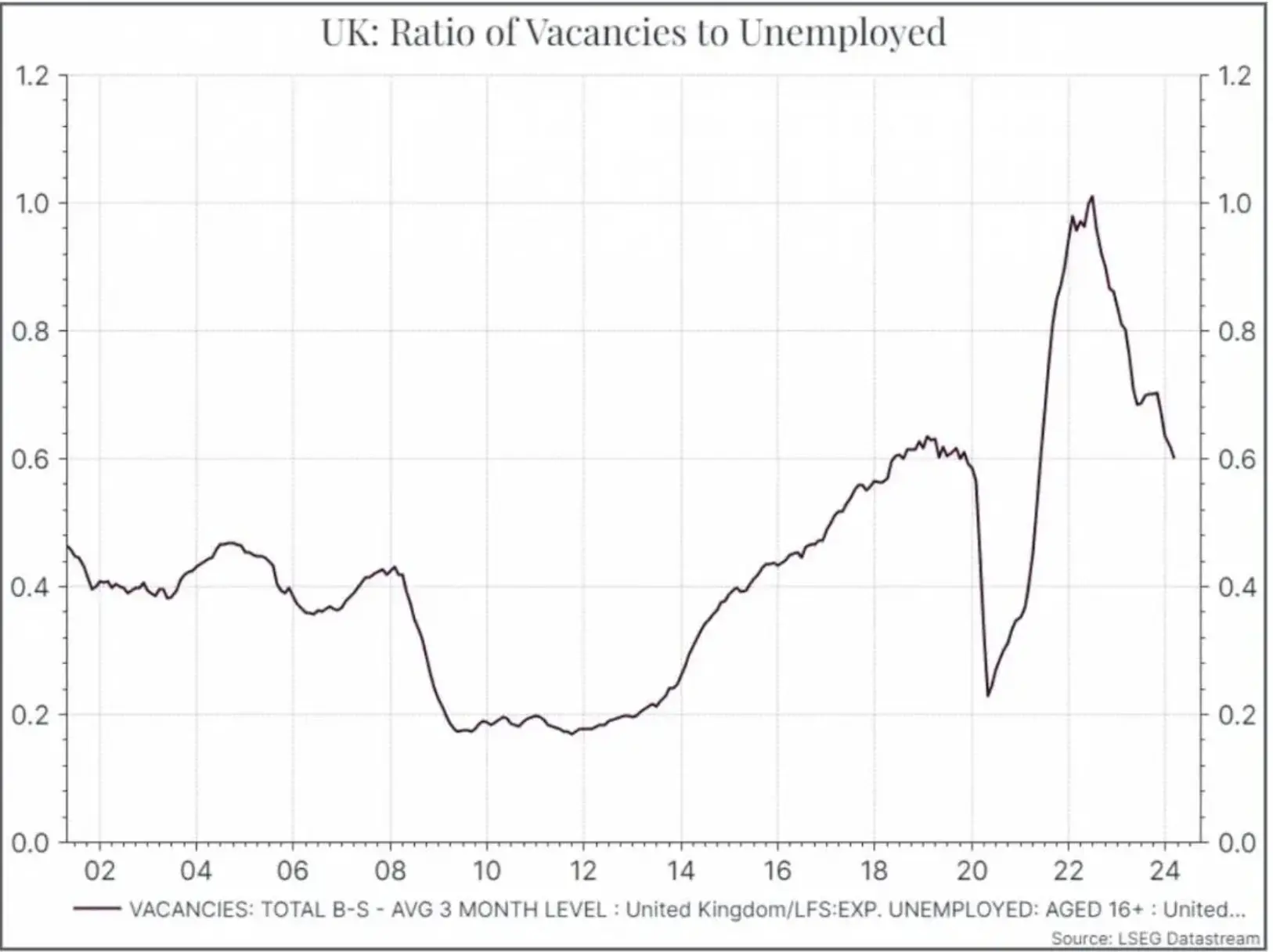

If we compare the number of vacancies to the number of unemployed, we still see a fairly healthy picture. On this metric, the demand for workers isn’t as strong as it was in 2023, and it’s coming down quite quickly, but it’s still above the average of the past twenty years.

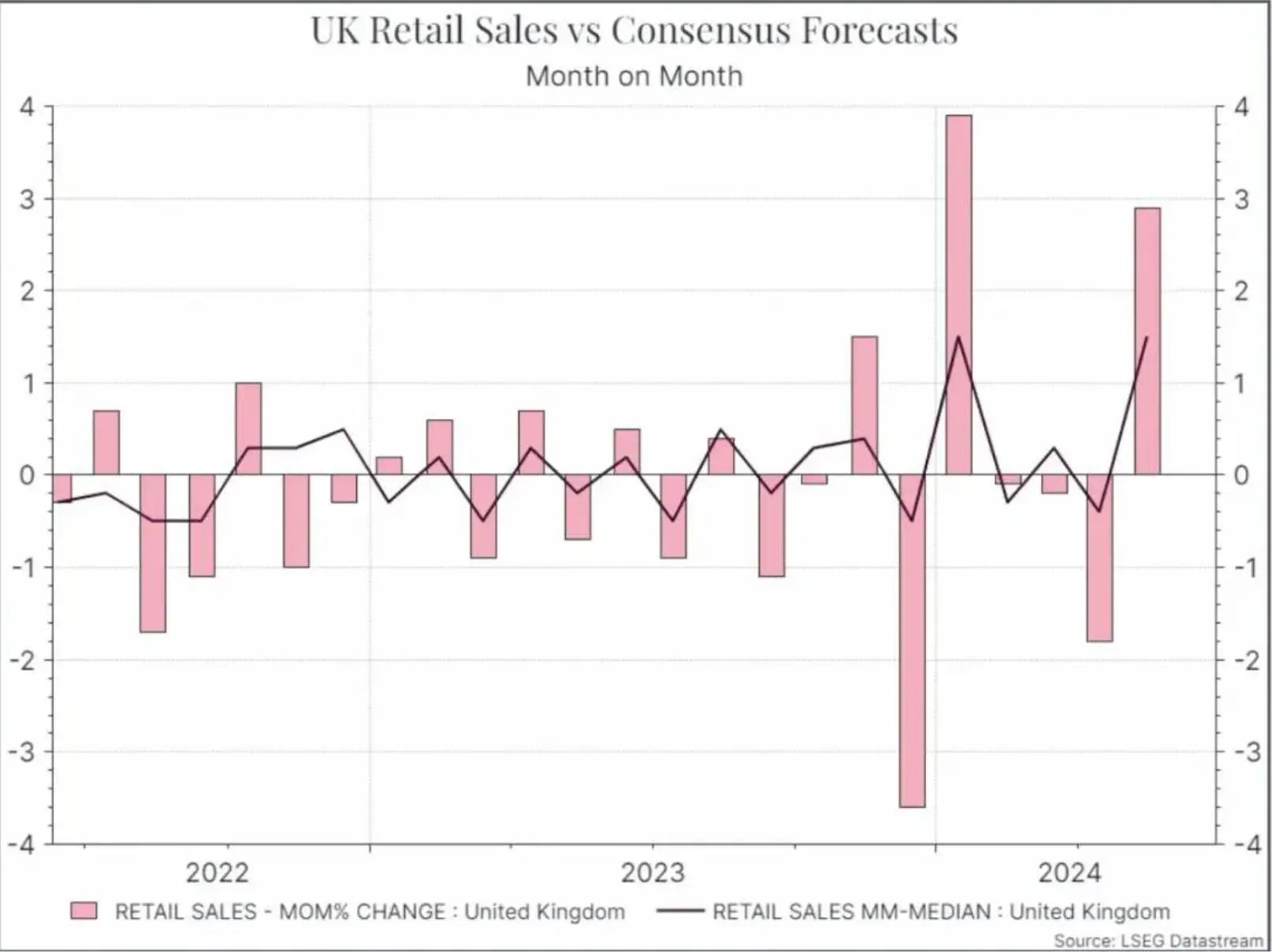

Finally, we also saw a strong retail sales figure for May in the UK – much better than expected. That might suggest a robust improvement in the economy, but we’re wary of making too much of it. The chart below shows monthly retail sales growth compared to economists’ forecasts. The forecasts are quite subdued, while the actual results are much more volatile. Part of that, we suspect, is the weather – which can have quite an impact on short-term sales numbers. If we smooth that out, the picture for retail demand isn’t quite so robust.

Where does this leave us? It’s good news on the inflation front in the UK, even if wage growth still looks higher than the Bank of England might want. That probably gives policy-makers scope to cut rates in the coming months, but they’ll likely remain cautious. The easing cycle will probably be quite shallow compared to history.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.