This week, three topics caught our attention. The first is US inflation and monetary policy. The second is the European elections, specifically France. The third is the UK elections, and the party manifestos in particular.

Overall, it was a good week on the inflation front in the US. Consumer prices rose by less than expected, with headline inflation flat month on month. Inflation is still running above 3% on an annual basis, but it’s a step in the right direction. In a similar vein, producer prices came in lower than expected, declining by 0.2% compared to last month and rising only 2.2% versus last year. At the same time, the Federal Reserve kept its policy rate unchanged and signalled that it expected, overall, to cut rates by only 25 bps in 2024. Today, that doesn’t seem too conservative, with inflation still well above the 2% target, but if we see a couple of months of better-than-expected inflation figures then the Central Bank may need to re-evaluate its stance.

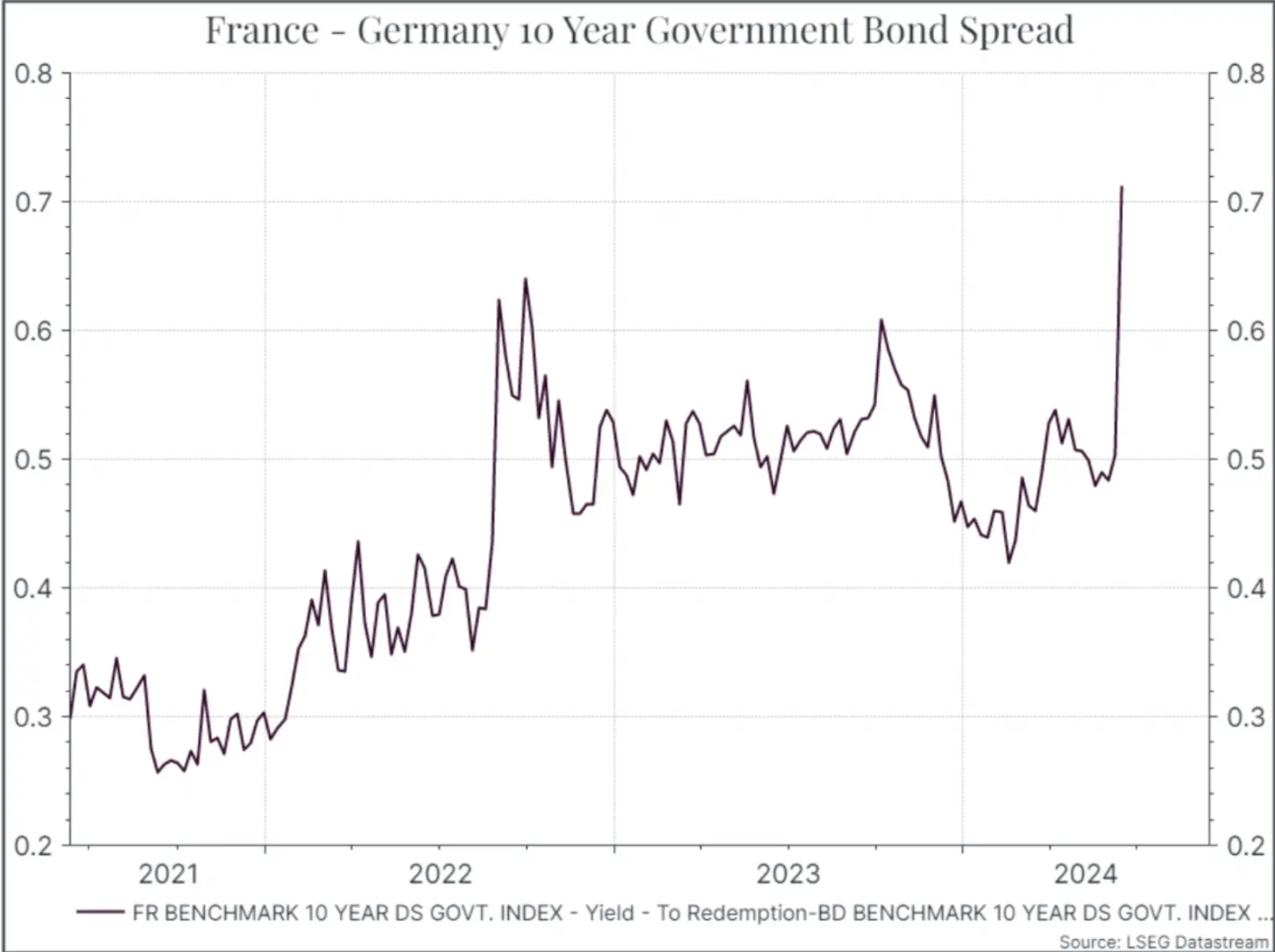

The European elections proved more exciting than we might have hoped. A strong performance by the right-wing Rassemblement National (RN) had been largely anticipated by the polls, but the reaction of President Macron to call a snap parliamentary election came as a surprise. The elections will take place over two rounds starting at the end of June. Financial markets reacted negatively to the news. The chart below shows the spread between French and German ten-year government bonds. The spike in the wake of Macron’s decision highlights investor concerns that an RN victory could prompt increased fiscal spending. This comes after S&P, the credit rating agency, had downgraded its outlook for French government debt in May (before the elections). The current spread between French and German bonds is still far below the peak it reached during the Eurozone crisis in 2012, and we don’t expect anything like that sort of volatility, but French politics is likely to be a focus of attention for investors over the coming weeks.

As we’ve noted before, recent election results around the world have prompted a bit of local market volatility. But with polling data so overwhelmingly in favour of the Labour Party, you’d think that there might be less scope for a surprise in the UK. Certainly, Labour leader Keir Starmer has been working hard to be as sober and centrist as possible, as he lays the groundwork for a multi-term Labour government. The Labour manifesto, released this week, gave little away. Ending the non-dom tax regime and putting VAT on private school fees were the main tax increases, which had already been well-flagged. So, the focus has been on what the manifesto didn’t say, specifically about where further government revenue might come from. The Labour argument is that it will come from faster economic growth (Liz Truss, anyone?), which is fair enough. How to achieve that is, sadly, less clear. Most commentators suspect that there’ll be more tax increases to come. Starmer and his shadow chancellor, Rachel Reeves, haven’t said anything about potential increases in capital gains tax, for instance. But if you’re 20 points ahead in the polls, you don’t need to say too much – at least for now.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.