As with all investing, your capital is at risk. The value of your portfolio with Moneyfarm can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance. If you are unsure investing is the right choice for you, please seek financial advice.

In the unpredictable ups and downs of financial markets, the decision to invest is often seen as intricate navigation through uncertainty. Some argue you should wait for the markets to fall in order to buy, whereas others advocate for caution during bearish periods. The key to long-term financial success lies not in market timing but in the steadfast commitment to a timeless principle: the power of consistent and diversified investment, regardless of market conditions.

It’s completely normal for an investor to think that markets have rallied and therefore they should wait for them to come down again before investing more, or to stop investing as markets will fall further and result in a loss. However, history tells us that a long-term investment strategy rewards even the unluckiest investors.

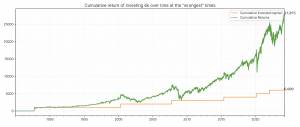

Source: Moneyfarm research, Refinitiv data (Total return index of the MSCI World in $); Timeline: 1985-01-02 to 2024-03-18

Performance figures are gross in dollars and don’t consider taxes, costs and commissions and the actual returns could be lower due to the costs and charges of investing in these instruments.

Imagine you’re an unfortunate investor who invested $1,000 in the MSCI World at the peak of each market cycle since 1985, just before significant downturns such as Black Monday in 1987, the 2000 Tech Bubble, the 2008/09 Global Financial Crisis, the notable sell-off in 2015/16 and the Covid-19 boom.

This entails a total of six lump sums of $1,000 over a span of 38 years. Now, refer to the graph above to observe how your portfolio would have fared despite these major downturns.

By holding onto your investments and strategy through all those major market crashes, the $6,000 you initially put in would have blossomed into a handsome $27,875 by 18 March 2024. That’s almost triple the total amount you invested.

This shows that even if luck isn’t on your side initially, sticking with your investments can pay off compared to just keeping your money in cash.

Timing the market perfectly is an almost impossible task, even for the most seasoned traders. The most successful investors emphasise the importance of discipline over timing. By adhering to a consistent investment strategy and maintaining a long-term perspective, investors can avoid the pitfalls of emotional decision-making that often accompany market fluctuations.

History tells us that missing even a few of the best days of the markets will significantly cut down your gains. The graph below illustrates that if you missed the best 10 days of the market since December 2022, you would have missed almost 90% of the growth. The best way to tackle this is by being invested throughout the period rather than waiting for the market to fall or recover.

Source: Moneyfarm research, Refinitiv data (Total return index of the MSCI World in $), Refinitiv data; Timeline: 2012-01-13 to 2024-03-19

Performance figures are gross in dollars and don’t consider taxes, costs and commissions and the actual returns could be lower due to costs and charges of investing in these instruments.

Markets can be volatile, and the chance of facing a downturn within a year or two is not insignificant. However, over longer investment periods, the actual return tends to align more closely with the expected return. Throughout history, markets have generally shown a tendency to grow, and I anticipate this trend will continue.

The key ‘trick’ that often makes investing a winner is that the longer you stay invested, the less likely you are to experience a loss. In the chart below, we’ve simulated the likelihood of experiencing a loss after various years of investment, cross-referencing the simulation with real data from the past 40 years. As depicted, the longer your investment horizon, the closer the probability of loss approaches zero.

Source: Moneyfarm research, Refinitiv data (Total return index of the MSCI World in $); Timeline: 2012-01-13 to 2024-03-19; Methodology: Calculated on rolling returns using business days from 2004-04-27

Performance figures are gross in dollars and don’t consider taxes, costs and commissions and the actual returns could be lower due to costs and charges of investing in these instruments.

So, if you’re jittery over your portfolio’s ups and downs or the market’s unpredictability, hopefully, this puts things in perspective. Always remember, successful investing isn’t about timing the market perfectly, but rather, spending time in the market.

If you are investing consistently and for the long term, you will benefit from compounding in the long run as the longer the time frame, the better the compounding, and the discipline of investing regularly will allow you to build up your investment pot. Over time, the compounding effect can significantly amplify the initial investment, allowing investors to benefit from both capital appreciation and reinvested dividends.

Investing isn’t solely about chasing immediate gains; it’s about building wealth over time. Regular contributions, known as pound-cost averaging, help spread investments across market conditions and mitigate fluctuations.

At Moneyfarm, we aim to help those of you who invest regularly by ensuring your emotions don’t triumph regardless of market movements, up or down. We help each of our clients create a bespoke long-term strategy that focuses on a diversified approach. We review it on an ongoing basis to make sure we are seizing any potential opportunities or hedging off any possible risk in the near term. Moreover, our low-cost, low-turnover strategy ensures we are not solely chasing immediate gains but focusing on building wealth over time.

In the overall financial market landscape, the path to prosperity is paved with consistent, disciplined investing. Markets will inevitably rise and fall, but the intelligent investor understands that these fluctuations are mere ripples in the broader context of wealth accumulation. So, whether the markets are up or down, the wisdom of investing endures as a guiding light to those who understand that time and consistent investing are powerful allies in the journey toward financial prosperity.

If you are unsure and not confident about current markets, our consultants can help you understand your financial goals and time horizon, empowering you to make an informed decision for yourself.

Prashik Dhepe: Prashik is an Investment Advisor at Moneyfarm, with a background in entrepreneurship and trading. He joined Moneyfarm in 2022 as a Junior Investment Consultant after founding two startups and holding various client-facing roles. Prashik holds an MSc in Management and Finance from the University of Sussex, with prior studies in Computer Science. He is also a holder of the Investment Advice Diploma from CISI. With a blend of market expertise and entrepreneurial spirit, Prashik is dedicated to helping clients achieve their financial goals at Moneyfarm.

Prashik Dhepe: Prashik is an Investment Advisor at Moneyfarm, with a background in entrepreneurship and trading. He joined Moneyfarm in 2022 as a Junior Investment Consultant after founding two startups and holding various client-facing roles. Prashik holds an MSc in Management and Finance from the University of Sussex, with prior studies in Computer Science. He is also a holder of the Investment Advice Diploma from CISI. With a blend of market expertise and entrepreneurial spirit, Prashik is dedicated to helping clients achieve their financial goals at Moneyfarm.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.