When will inflation slow?

Our brief look into the future can only begin with an analysis of the direction of inflation. Despite price dynamics being brought under control in the United States and Europe, inflation remains the key variable upon which all others depend to some extent. If the direction seems right, the question is how long it will take for inflation to return to the 2% target set.

To answer this question, focusing solely on the headline number doesn’t help us much. Inflation is composed of different components and can be measured in various ways. In the first half of this year, the decrease in energy prices largely contributed to the overall decrease in inflation.

This is also true in the USA, where inflation is on a clear downward trajectory: from 4.9% to 4% in June. However, the core measure, which excludes energy prices, is lagging behind, slowing down from 4,8% compared to the previous month’s 5,3%. Although the number remains high, there are reasons for optimism. The component related to housing (such as rents and bills), a major driver of overall inflation, has shown the first signs of normalisation. There are good reasons, including the dynamics of the property market and rental prices, to believe that it will continue in that direction.

Even less volatile inflation measures, often used by central bankers to make their decisions regarding interest rates, such as supercore inflation (which excludes housing costs), have returned to growth in line with historical trends (around 0.3% month-on-month).

Even in Europe, inflation continues to decline, although the progress is slightly behind compared to the United States. Currently, the markets expect at least two more interest rate increases in the Eurozone, but it’s unclear if more will be needed. In the UK, unfortunately inflation is more resistant and the Bank of England has still some work to do

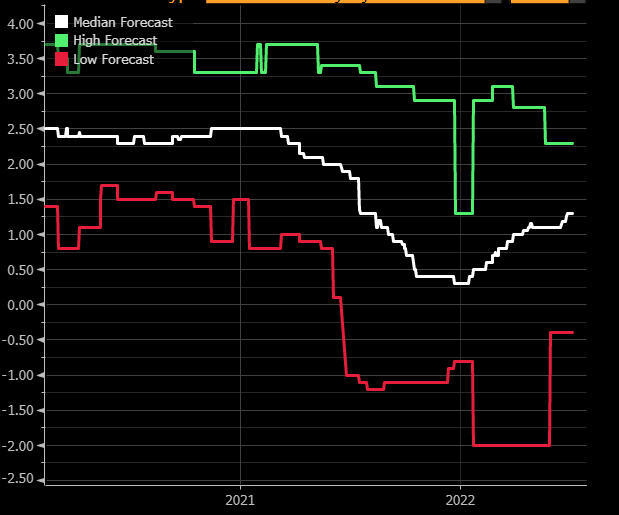

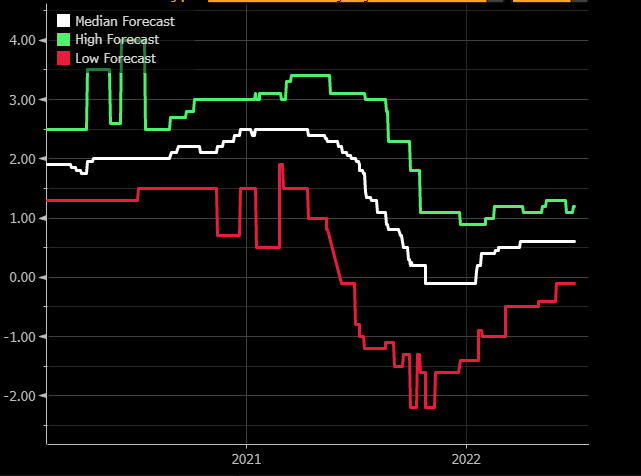

Looking at analysts’ forecasts, inflation levels are expected to continue to normalise in both the United States and Europe in the coming months, approaching the 2% target by the end of the year.

Increase in interest rates: when will it end?

The answer is obviously linked to the previous question, as the reversal of rate dynamics is directly correlated to the decrease in inflation. There are, therefore, two questions that we need to answer: have we reached the peak of the rate hikes, and how long will the rates remain supported?

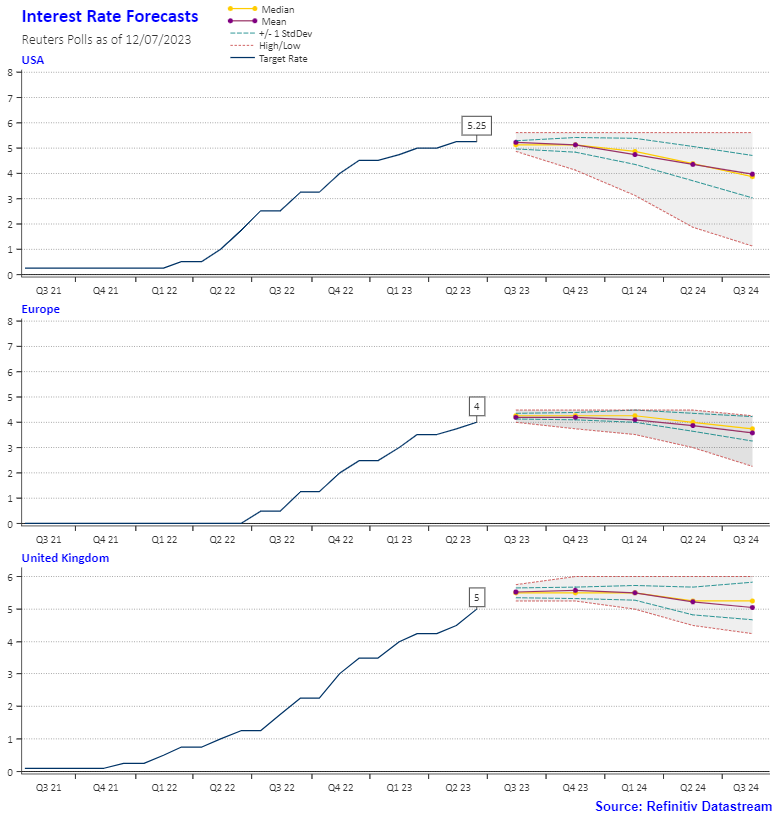

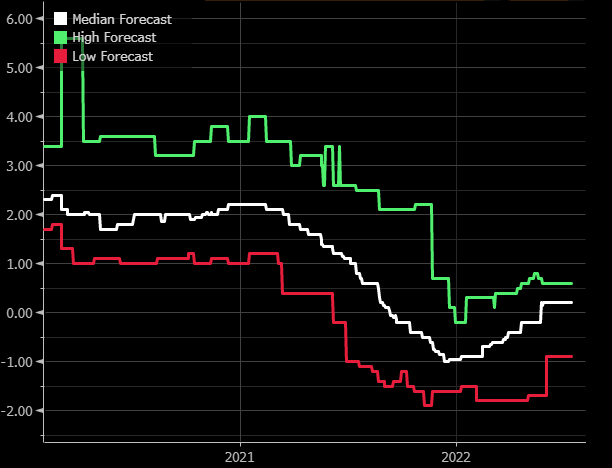

On the first point, there seems to be enough agreement among the majority of analysts. We expect a maximum of two rate hikes in the United States, while in the Eurozone a couple of rate hikes should be expected, with the possibility of more. Regarding the reversal, as can be seen from the chart, the various forecasts differ quite significantly.

The first thing that stands out is that interest rate cuts are not expected this year, according to the vast majority of forecasts. This is partially good news because it reflects better-than-expected economic results. The second noteworthy evidence is that the reversal of monetary policy is expected to begin in the first half of 2024. Central banks, buoyed by a continuously surprising economy, are trying to support this narrative by conveying resolve in the fight against inflation.

But what could be the effect of interest rates at these levels for a longer period? According to theory, raising interest rates generally tends to slow down the economy, but not always, as the depth of the negative effect depends on inflation and the strength of the underlying economy. If inflation expectations surpass nominal rates, the actual cost of borrowing remains low and attractive. Despite a significant increase in rates since 2022, there has not been a significant economic slowdown thus far. In 2023, despite real rates rising above 1%, macroeconomic data in the United States has exceeded expectations, indicating the possibility of a soft landing, with inflation under control and sustainably higher rates, but without a recession.

However, the rapid increase in interest rates could cause problems in the financial system, as evidenced by the mini-banking crisis in March 2023. The main concern for investors is that this could result in a tightening of the credit available to individuals and businesses. Nevertheless, the most recent data suggests an improvement in credit conditions in the United States and Europe.

In a context of higher rates and uncertainty, investors should consider two key points: fixed income finally offers interesting yields, even for short-term government bonds. Even in such a challenging environment, the equity component has shown the potential to perform well. In such a scenario, opting for a well-diversified multi-asset portfolio should be a good choice.

When will growth arrive?

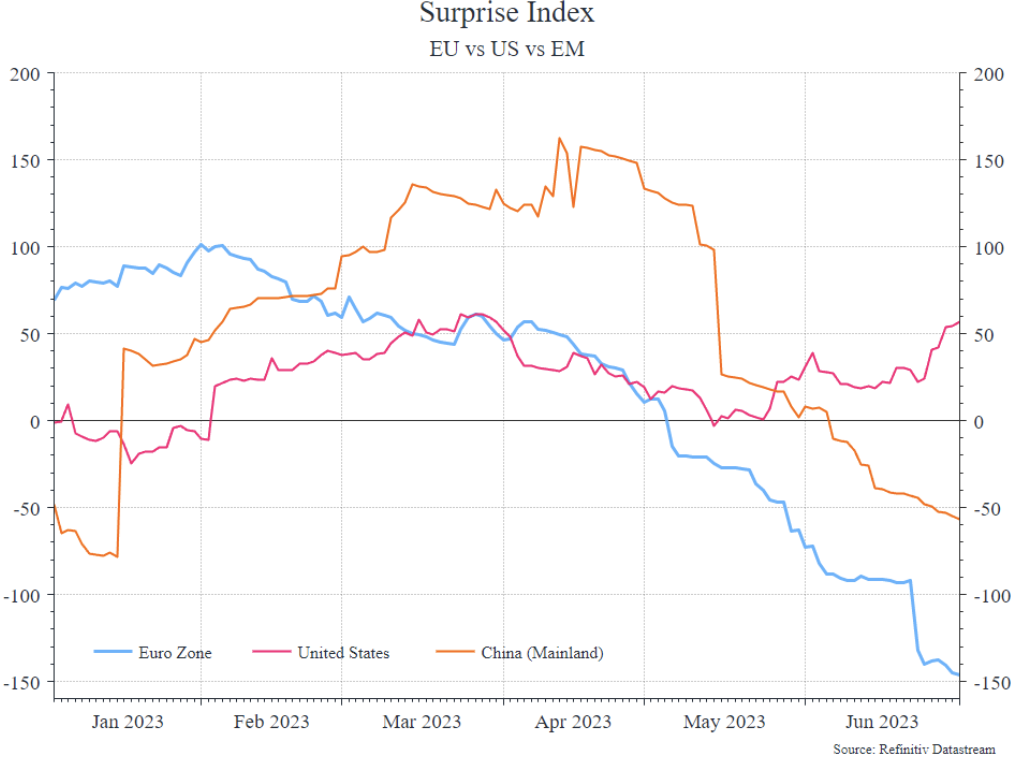

And the recession? As we explained in the second question, an increase in interest rates should be accompanied by a deterioration in the economic situation, to the point that the possibility of a recession was almost taken for granted this year. In reality, surprising many analysts’ expectations, economic performance continued to be impressive throughout the year. The chart shows the surprise indices (a measure of economic performance vs expectations) for Europe, the USA, and China. China and Europe have disappointed, while the United States has recovered after a slow start to the year.

The story is similar: the manufacturing sector is slowing down, while the services sector is driving growth. Even the labour market, both in Europe and in the US, has shown surprisingly positive signs of recovery. In short, the American economy is surprising us in a positive way and remains strong, once again pushing the possibility of a recession further down the road.

Looking ahead to the coming months, it might be useful to evaluate the sentiment data and expectations regarding GDP dynamics. In the USA, the latest aggregated PMI indices, which measure the sentiment of purchasing managers in companies, have stopped at 53 points, in expansion territory, driven by the services sector. The GDP growth data for the first quarter has been positive and above expectations (2% versus 1.1%), while the expectations from now until the end of the year have increased from about 0.5% to almost 1.5%, according to Bloomberg.

Even in Europe, aggregate PMIs remain above 50 points, indicating positive growth in June. However, signs of slowdown are more evident, especially in certain core regions such as Germany. Below, we can see the forecasts for economic growth in both Europe and the United States. As you can see, growth forecasts have been revised upwards throughout the year, to the extent that the likelihood of a recession in 2023 is only considered by the most pessimistic of analysts (which was simply not the case just a few months ago). In short, while we believe that the possibility of some economic slowdown in the first part of the year remains probable, we do not think that it necessarily has to result in a recession.

USA

UK

EUROPE

Giorgio Broggi: Giorgio joined Moneyfarm as a Quantitative Analyst in December 2021 and he is a member of the Investment Committee. Prior to joining the company, he worked at Barclays Wealth Management and S&P Market Intelligence, gaining expertise in Funds Research and ESG Investing. Before starting his professional life, he successfully completed a double-degree at Eada and EDHEC Business School, obtaining two Masters in Finance and specialising in factor investing and portfolio construction. He is a CFA charterholder.

Giorgio Broggi: Giorgio joined Moneyfarm as a Quantitative Analyst in December 2021 and he is a member of the Investment Committee. Prior to joining the company, he worked at Barclays Wealth Management and S&P Market Intelligence, gaining expertise in Funds Research and ESG Investing. Before starting his professional life, he successfully completed a double-degree at Eada and EDHEC Business School, obtaining two Masters in Finance and specialising in factor investing and portfolio construction. He is a CFA charterholder.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.