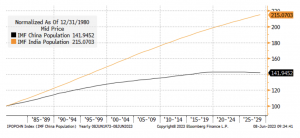

According to World Bank data, the annual population growth rate for India in 2021 was 0.8%, compared to 0.1% for both China and the United States. This trend is also confirmed by the latest estimates from the United Nations on the world population, which highlight that China will relinquish its status as the most populous country in the world to India this year. In April, the population of India reached 1,425,775,850 people, equaling and then surpassing the population of mainland China. The Dragon, as China is often referred to, reached its peak size of 1.426 billion in 2022 and has since started to decline. Projections indicate that the size of the Chinese population could fall below one billion before the end of the century. In contrast, the Indian population is expected to continue growing for several decades.

India overtaking China in terms of human capital growth is not the only advantage for the country: the Dragon will also have to manage a larger number of elderly people compared to its younger population. According to the United Nations Department of Economic and Social Affairs, between 2023 and 2050, it is projected that the number of people aged 65 or older will double in China. It will also increase in India, but, when compared to the total population and therefore the birth rate, the growth of the elderly population in India will be much slower than in China. A crucial point is that the country, led by Narendra Damodardas Modi, predicts that the number of working-age adults will continue to increase until 2050, offering opportunities for faster economic growth in the coming decades. The young population (those under 25 years old) accounts for almost half of the country’s population, and experts estimate that India will not reach its peak until 2065 before stabilising.

An increase in population does not always lead to greater growth, however.

The demographic growth of India is not an anomaly. Since 1980, the demographic trend in India has consistently outperformed that of China, although this has not translated into significantly higher economic growth.

Despite the intuitive relationship between population growth and economic growth, academic research has not been able to find a clear-cut answer. Certainly, having a larger working-age population can support economic growth, just as having a country with a strong component of people over 65 can depress economic growth levels. However, labour force participation, which refers to the rate of participation in the labour market, must also be considered, as it can weaken the demographic effect on the population. This aspect represents a weakness for India.

Poverty and high inequality continue to be a daily reality for many Indians, and experts say that while it is true that the country has a significant portion of young people eager to contribute to India’s economic growth, there are not enough jobs for everyone. The greatest problem is found particularly in the northern regions, which still heavily rely on agriculture. For example, Uttar Pradesh is home to 17% of the Indian population but only accounts for 9% of industrial jobs.

There is, therefore, a strong possibility that, if not guided by far-sighted economic policies, it may not materialise in the best way possible.

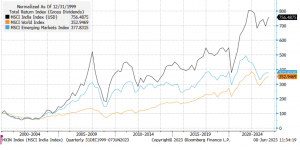

Another important point of reflection for investors comes from the relationship between economic growth and stock market performance. Even in this case, empirical evidence is at best mixed; looking at history, it is not possible to trace a clear relationship between the two measures. A glaring example of this is China, where the extraordinary economic performance did not translate into particularly brilliant stock market performance.

Stock market performance is mainly driven by factors such as the profitability of the stocks included in the index, the evolution of the sectoral composition, the regulatory and competitive landscape both nationally and internationally, and last but not least, investor sentiment towards that particular geographical and sectoral area.

The major Indian stock index has performed very well, reflecting, in our view, the following dynamics:

- Opening up to investors and a market economy.

- Strong emphasis on IT services, which has gained renewed momentum in remote work adoption for such sectors post-COVID.

- A more neutral geopolitical position, likely less polarised and thus ready to seize international opportunities outside the block logic.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.