It has been quite a month for the global banking system. The crises of Silicon Valley Bank (SVB) and Credit Suisse have put the markets on edge, and many fear the problem could spread to other banks that lack strong capital or robust risk management plans. Memories of the global financial crisis are certainly colouring how many observers perceive this latest event. The key, however, is not to panic.

It should be noted that the problems of SVB are quite specific. They do not apply even to smaller US banks, while the European banking system has proven strong, with the central banks responding quickly. The Fed, the Bank of England and the ECB released a joint announcement to increase dollar liquidity and stabilise the markets. And the Fed and the Swiss National Bank acted promptly when the SVB went bankrupt and Credit Suisse started to falter.

US regulators also extended protection to all deposits (even unsecured ones above $250,000), and provided ample liquidity and credit lines to the most troubled institutions, effectively stifling the crisis. In Switzerland, the reaction was even more impressive: the historic deal leading to the acquisition of Credit Suisse by UBS was backed by a large credit facility and very well received by the markets.

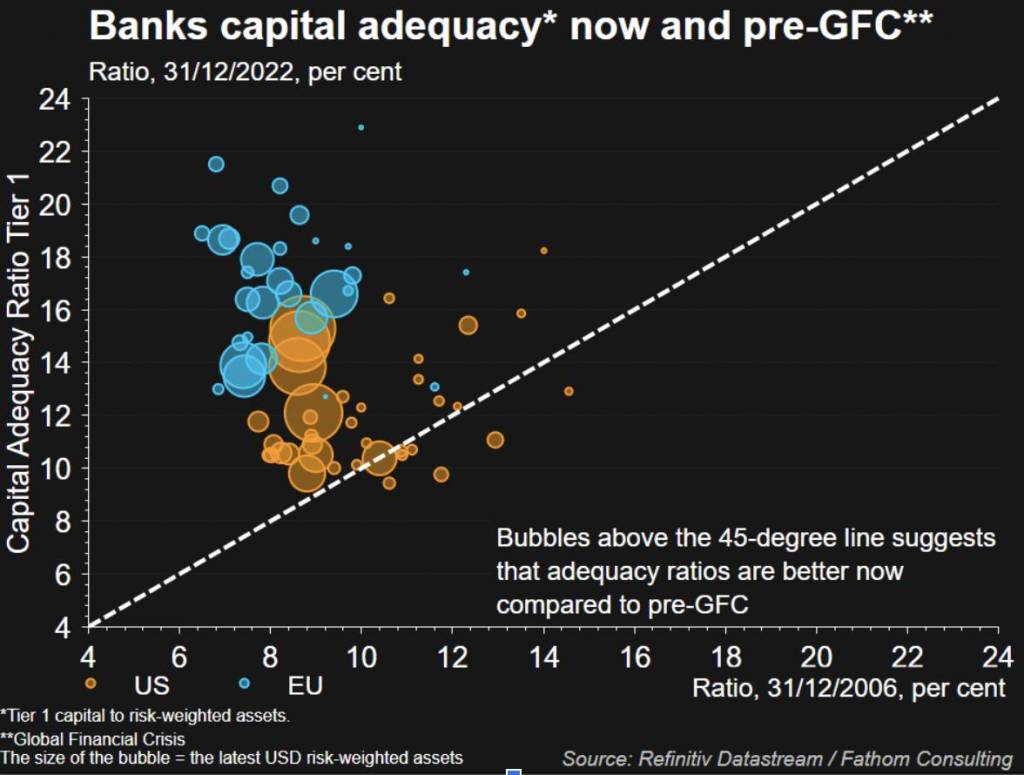

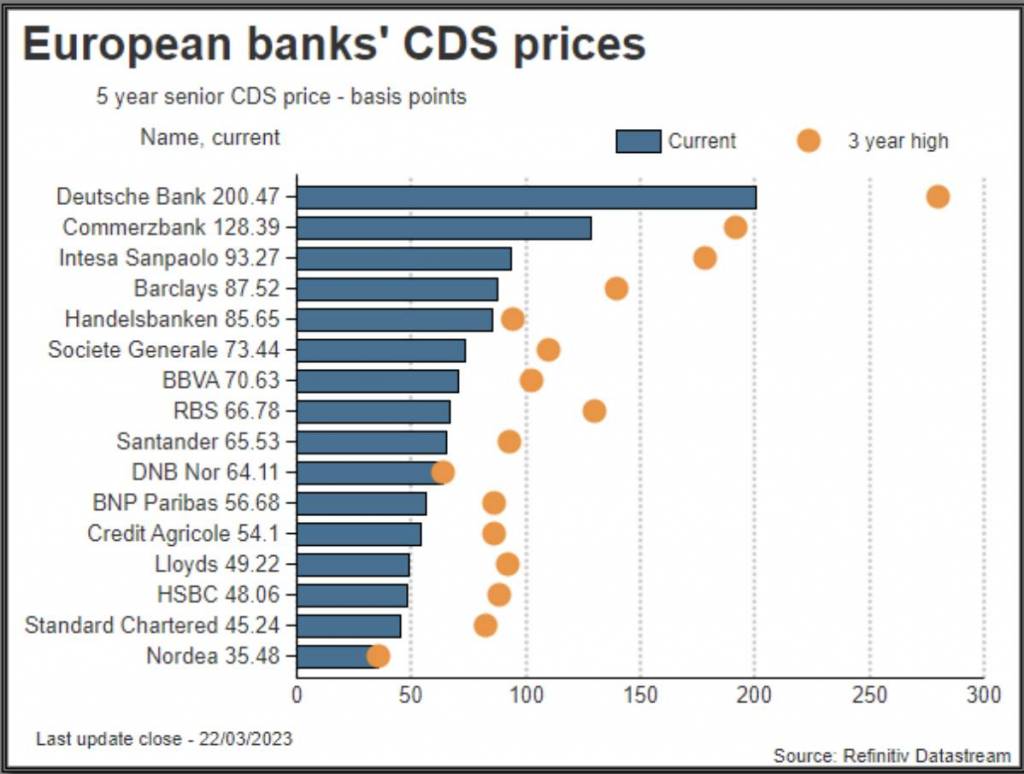

Taking a wider view, it’s also worth remembering that banks in the US and Europe are in better shape than they were at the time of the financial crisis, as these charts show (though that’s no guarantee that the weakest will survive). The Tier 1 ratio shows the degree of capitalization of each bank in relation to its assets (weighted by risk). In response to regulatory pressure, this ratio has risen considerably. The numbers are very robust and we can expect them to be strengthened further in the wake of recent events. Indeed, as this second graph shows, while credit risk in the euro area has increased, it remains lower than in previous crises, such as the outbreak of war between Russia and Ukraine in 2022.

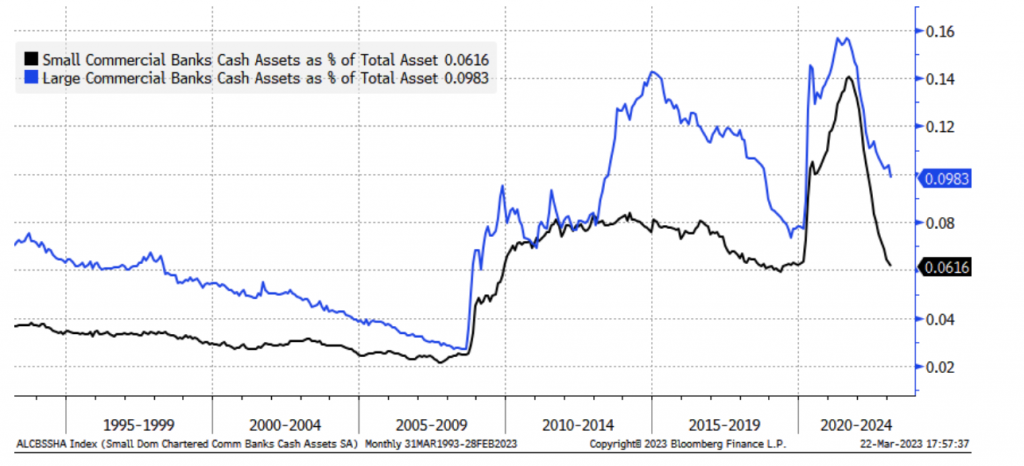

Moving on to the AmericanMedia market, bank reserves are well above pre-2008 levels. This is especially true of large credit institutions; while small and medium-sized ones are more exposed to risk – they quickly fell to 2019 levels – they pose little threat to the system and the global economy. The most important lenders are still in a stable situation, better than that of the smaller ones, despite the volatility of 2022.\

Source: Lyn Alden Investment Research.

Another important indicator is the difference between the interbank rate, i.e. the rate at which banks lend money to each other (a measure of trust in the system) and the Fed deposit rate, which is very low. In 2008 this indicator skyrocketed; not now.

All this leads us to two conclusions. On the one hand, the banking system, partly thanks to the peremptory action of the central banks, remains sufficiently resilient to avoid a systemic crisis. On the other hand, there is no doubt that there will be effects on the real economy, with a slowdown likely. We expect to see credit conditions tighten as banks become increasingly conservative, which will probably have medium-term effects for households and businesses. The likelihood of a recession in the next twelve months has certainly increased, but the probable credit crunch and slowdown of economies will at least have a positive impact on inflation.

It is also important to highlight that the banking crisis should not affect the rate hike path. The ECB reiterated last week the importance of not confusing financial stability and price stability. The bank believes its fiscal tools can manage the financial stability of the Eurozone, while interest rates take care of inflation.

Overall, therefore, the banking crisis appears to be under control. The real test of economies will be a probable tightening of available credit, with central banks remaining focused on the battle against inflation. On the bright side, inflation is likely to come down faster, giving more breathing space to institutions and consumers in the medium term.

For now, we believe our portfolios are well positioned. Obviously we don’t have a crystal ball but it is reassuring to see that diversification has continued to work, with positions in sovereign bonds performing well and offsetting some of the riskier parts of the portfolios. Our exposure to both SVB and US regional banks, as well as Credit Suisse, is very limited, so the crisis has not materially impacted the performance of our portfolios.

Credit Suisse vs SVB: Comparing the two crises

The first thing to note is that SVB mainly served start-ups and has had a very specific recent history. In 2021, with the post-Covid explosion of tech, it attracted deposits from various companies in that world who decided to open current accounts at the bank. The problem was that SVB failed to turn these deposits into loans. To remedy this, it invested a large proportion in broad-maturity Mortgage Backed Securities (MBS), financial instruments that use mortgages as collateral. This was not a very forward-looking choice, given that in 2022, rates were raised to fight inflation, so the value realized by these products fell considerably. When the bank realised it was in such a fragile situation, it had to ask for more capital, but with the market rightly judging SVB’s risk management poor and its risk of bankruptcy high, none was forthcoming. So when depositors started requesting their deposits back, SVB went bankrupt.

The three weaknesses of SVB

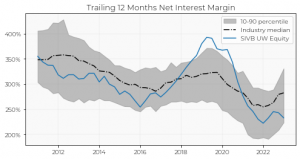

1.SVB was not a particularly profitable bank. In the graph you can see the orange line representing the best banks of the S&P, the worst in blue and the SVB in green, close to the worst 10%.

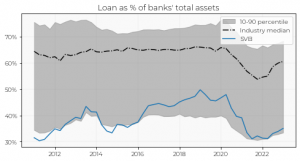

2. SVB had little diversification. It bought a package of high maturity MBS without knowing how to manage the interest rate risk. This weakness can be seen in the chart, showing the ratio of loans to total asset quantity. The more successful banks instead maintained a much greater proportion of loans, operating more in line with a “traditional” banking business model.

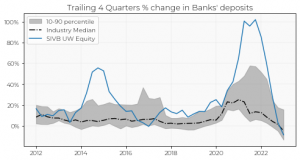

3. SVB’s deposit situation was very volatile. The blue line soars in 2021 and then plummets in 2022. Such volatile deposits create the perfect crunch for a liquidity crisis.

Credit Suisse struggling for confindence

Credit Suisse, like SVB, had a large number of depositors requesting their money back because they were afraid the bank might fail; 110 billion in the last quarter of 2022. And here the similarities end. In fact, the two banks were completely different in terms of strategy, capital and business. Credit Suisse’s Core Tier 1 Ratio was 14.1% (among the best in the world), its Leverage Ratio at 7.7% was the highest globally and its Liquidity Coverage Ratio was 144%. This meant Credit Suisse could have met a disbursement of 144% of its short-term liabilities in 30 days. Furthermore, from a strategic point of view, the Swiss bank showed signs of heading in the right direction after a series of scandals in 2022.

So what went wrong? Very simple: the chairman of the Saudi National Bank, one of Credit Suisse’s biggest shareholders, told Bloomberg his institution had no intention of adding to its stake. The timing of this triggered panic, given that a few days earlier SVB had gone bankrupt. The intervention of the Swiss regulator calmed the situation momentarily, but did not erase investors’ fears regarding the withdrawal of capital from the bank. The situation evolved until the Swiss Central Bank requested a marriage between Credit Suisse and UBS. And the resulting agreement certainly has some points worthy of note.

The first is that UBS has agreed to pay (only) three billion Swiss francs to buy its competitor. That represents only a small fraction of Credit Suisse’s book value, which raises a few questions: should we be concerned about the book value (which was approximately 49 billion Swiss francs)? What did UBS see to make it offer just three billion (and initially even less)? These questions are not easy to answer, but we imagine UBS acted less in response to the bank’s book value and more to that of its franchise. Another element that should not be underestimated is UBS’s lack of enthusiasm to make this marriage, and for good reason. There is a lot of overlap between the two businesses, which will result in layoffs and other disruption. Furthermore, mergers in financial services are notoriously difficult to do well, so UBS had to worry, at least a little, about its shareholders, who may not have been willing to accept such a large integration project at anything but a knockdown price.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.