You’re looking to grow your money for the future, but recent market movements have made you question whether now is the right time to invest. Correctly timing the market is a huge challenge for even the most experienced investors, which is why you should aim to maximise your returns through pound cost averaging (don’t worry, it sounds more complicated than it actually is).

Can you time the market?

Correctly timing the market is one of the biggest challenges that investors face. To generate meaningful investment returns you would ideally invest when the market is at its lowest and sell when it is at its highest.

But timing trades isn’t easy; it requires a constant monitoring of financial markets, the skill to promptly respond to fluctuations, and enough spare cash to cover the high cost of regular trading.

Even the best-known fund managers and investors believe it’s almost impossible to time markets perfectly. Warren Buffett once famously said: “We continue to make more money when snoring than when active.”

Investors are left asking themselves two questions: how do we avoid putting our long-term investment goal at risk, and what can we do to improve our chances of entering the markets at the right opportunity?

Pound cost averaging

One way to work around market timing is to invest smaller amounts often, rather than a lump sum in one go. This strategy can be particularly beneficial during a time ofhttps://blog.moneyfarm.com/en/financial-planning/how-to-invest-1000-the-best-ways-to-invest-your-first-1000/ turbulence and uncertainty.

Pound cost averaging is a technique where you make investments on a regular basis and therefore average the price you pay for the total investment over time.

Most investment instruments, such as single name equities, exchange-traded funds (ETFs) or open-ended mutual funds, are available for purchase through regular savings plans (such as ISA schemes) allowing investors to invest on a regular basis (e.g. monthly).

The key benefit of regular investing by setting up a direct debit is that you can avoid market speculation whilst also ironing out the fluctuation of an asset’s price over time, therefore, completely removing the trouble of finding the right time to invest.

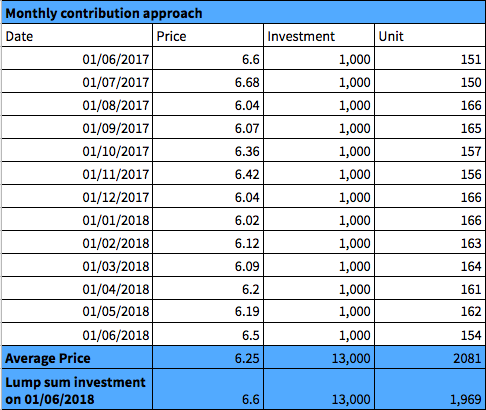

To illustrate this strategy, we have simulated the result of a monthly contribution investment approach in comparison to a lump sum approach when making the same investment.

Let’s assume that an investor wants to increase their exposure to the UK equity market by investing £13,000 in a UK stock ETF from June 2017. The investor can either invest the lump sum at the start of the period, or choose to make monthly contributions in equal tranches at the start of each month over the next year to average out the purchasing cost.

By making monthly contributions whilst investing in a volatile and falling market, such as in the early start of 2018, the investor buys more shares at a lower price (£6.25 per share and 2,081 shares in total).

If the individual had invested the total amount at the start they would pay £6.60 per share and 1,969 shares in total. This is equivalent to a discount of 5.4% in price terms and will ultimately boost performance of the portfolio when markets recover.

However, making regular investments over time in a rising market can also lead to a higher average cost of purchase compared to investing the lump sum at the start.

Building a strong portfolio

Building an investment portfolio that reflects your investor profile, appetite for risk and time horizon puts you in the best position to protect or grow your money during times of uncertainty. If your goals are in the near future, you’ll prioritise protecting the value of your money, whilst if you have longer-term goals like retirement you will focus on growing it.

By reflecting these needs in the mix of investments in your portfolio, you can make sure you’re in the best position to reach your goals.

This can be quite difficult to do yourself, which is why we’re committed to providing cost-effective investment advice to all our investors. We’ll match you to an investment portfolio that reflects you, your financial background and your financial goals. Our experienced fund managers will continue to manage your portfolio for as long as you invest with us.

This means the hardest decision you have to make is how much and how often you want to invest. You can make the process even easier by setting up a direct debit.

In general, a pound cost averaging strategy provides more flexibility as you can avoid committing a large sum of cash at the start of the investment period. Investors can build a strong portfolio by investing little and often.

Establishing a disciplined and regular investment pattern is a great habit for people who want to put some money aside at any time. In doing this, you take the emotion and speculation out of the investment process and returns will be smoother amid market volatility.

When it comes to investing, slow and steady wins the race.

Photo by Patrick Fore on Unsplash

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.